Month: March 2008

March madness: little advisors, Starbucks redux, F&A is bubbling back… and EDS gets active

So what was the month of March all about? Read More

Blog-culture is ripping up the rule book for the outsourcing services and technology media industry

The rapid maturing of blog-culture is radically changing the way media is being delivered to people in the hi-tech, services and outsourcing industry. Suddenly, opinionated experts (I do use this term lightly) have access to the industry which they never had previously. Read More

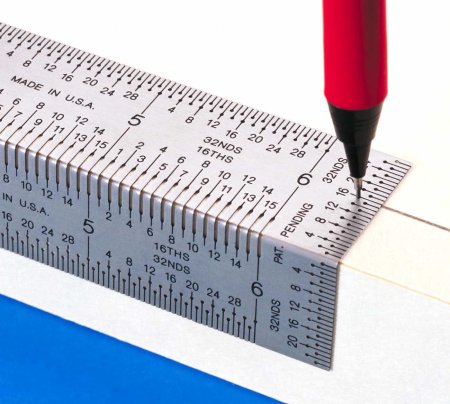

What to look for in a sourcing advisor

I am getting questions almost daily from buyers asking who/how they should approach selecting a third-party. It's becoming almost as important as which vendor to select. Read More