I took a rather embarrassed peek at the very first post I wrote on the Horses and, having been revived from the camembert fumes of consultant-speak from yesteryear (did we really write like that?), I realized that we were actually onto something back then.

I took a rather embarrassed peek at the very first post I wrote on the Horses and, having been revived from the camembert fumes of consultant-speak from yesteryear (did we really write like that?), I realized that we were actually onto something back then.

The only major difference today is that this is no longer a game for the glitzy F100, when clients could demand their vendors take their existing processes, and simply run them at lower cost, with very little change to the actual way they did things. And if the resulting savings weren’t quite as good as originally promised, and the books weren’t getting closed promptly, the vendor always bore the full brunt of the blame.

The big difference today, is that more clients are tending (though not always) to take more responsibility for the success of their BPO engagement. If clients take flawed processes and run them offshore, it’s only going to expose how flawed they were in the first place. Plus, if you’re put in charge of managing a BPO engagement today, you’re charged with making it work, not coming up with reasons for failure. If you can prove you can do this successfully in one firm, many other firms will want to hire you to do it for them too. I’m trying to convince a good friend of mine to guest here and talk about how he’s managed to oversee two major F&A BPO transitions for two companies, because it’s truly becoming a lucrative – and scarce – expertise for customers today.

Like anything else, we have to learn through trial and error, and F&A BPO is certainly no exception. Once clients realized they weren’t making anything near the savings they initially thought, it forced them back to the table to work with their vendors to understand why it was the case. In nearly every instance, it wasn’t the fault of the vendor for supplying inadequate personnel, but more the inability of the client to use the BPO as an opportunity to iron out those flaws, examine some better process flows for getting things done more effectively, and to work more collaboratively with their vendor to implement them. In the case of F&A BPO, most the work today is relatively transactional, so the argument not to look at more standard ways of doing things doesn’t wash anymore. How many ways can you “transform” an accounts payable workflow?

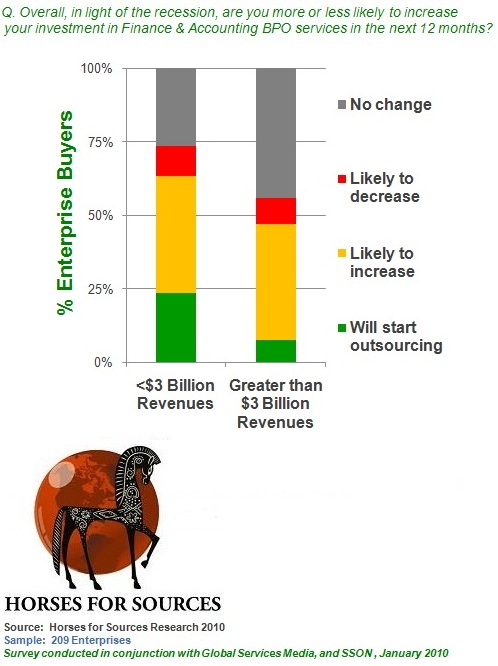

As we discussed in Part I of this series, many customers, especially in the mid-market ($750m-$3000m revs), now view outsourcing an a change agent to go beyond simply driving out cost. They want to exploit the opportunity to globalize processes and become more effective in the way they do things. And as the supplier based has matured and started to move into smaller-scale engagements, the impact on customer demand, emerging from the economic crisis, is eye-opening:

Figure 1: Mid-sized customers are ready to exploit Finance and Accounting BPO

So, what does this mean for the BPO industry?

No turning back for the large customers. Our study clearly signifies that many large-scale customers have now outsourced some elements of the F&A, with only 7% moving in for the first time in 2010 (see Figure 1). However, 40% of current F&A BPO customers are going to increase their engagement scope this year. This is a strong endorsement that once customers take the plunge, they are seeking to enhance their engagements. And when you drill deeper into the numbers, it’s clear that customers are seeking to add more capability to support management reporting and analytics.

Once you’re using a BPO to do our work for you, why hire new staff? Another reason why so many customers are looking to increase scope is the simple fact it’s easier, cheaper and more flexible to have your vendor provide the staff, as opposed to hiring it yourself. Moreover, the process many firms have to go through these days to have staff requisitions approved is often so prohibitive, that it’s a lot less hassle to contact your outsourcing PMO to ramp up a few FTEs on an engagement.

As the high-end saturates, attention turns to the mid-market. When you consider that close to a quarter of mid-market customers will seek their first forays into F&A BPO this year, you know where this industry is headed. Vendors have got much more organized with how they push more standard processes at the mid-tier, and they are becoming more adept at taking on smaller-scale employee transitions and still turning a healthy profit. While just a couple of years ago, most the top tier service providers would only look at engagements with a minimum of 50 FTEs involved, most will now dabble in must smaller affairs, especially where there is strong future upside to increase scope and cross-sell other services. Moreover, some customers are bundling F&A BPO with IT systems development work (see Part IV of this series), which allows for vendors to take on smaller-scale BPO engagements as part of a larger contract.

The Bottom-line: F&A BPO has opened up to the broader market, but the tough transitions for clients really start

With the industry-at-large widely looking at F&A BPO, it’s clear that the main difference today is customers being more prepared to change their existing processes to move onto a more standard delivery model. Those services vendors that adopt the old “lift and shift” mentality when taking on smaller engagement in this space will quickly fall-short – there simply isn’t the same wiggle-room in the mid-market to throw bodies at the problem.

The core to success with smaller-scale engagements stems from encouraging customers to standardize much of their workflows onto process maps vendors can understand, and have the vendor staff-up quickly to service them. The transition for clients will often be painful, but at least the realization is there that they have to do things differently and take more responsibility for their own outcomes.

Posted in : hfs-industry-2010, the-industry-speaks

What is amazing in the F&A BPO segment is the lack of attentive opportunity seeking to evolve a F&a KPO analytic segment. With all of the chest pounding that is going on about economic recovery very little is being done in companies to strategically analyze market positioning. While I might consider it to be a case of not know how, I tend to think its because he models have change so dramatically. Hope to see some of my favorite KPOs start to make visible strides in this arena.

Phil – excellent analysis (as always). It’s going to be tough for providers to maintain anything like the margins with these smaller F&A deals, compared to those of many large contracts. How do you think investors are going to react to this changing landscape?

Shankar

@Jerry: seeing some KPO uptick in the mid-tier, but it’s mainly specific analytics for industry processes, as opposed to specific for F&A. As F&A gets more traction in the mid-tier, we’ll start to see more customers add on KPO work. As I mentioned earlier, once in the BPO model, customers use it to scale when needed, as opposed to hiring internally

@Shankar: articulating anything to Wall Street beyond margins is tough, so you do have a great point!

Many of the current vendors are able to offset lower BPO margins by driving consistently strong ITO ones. Moreover, as deals become more blended with IT-BPO components, we won’t see a “shock” effect with falling margins, more a gradual decrease, which is bound to happen in any case with increased wages, competition etc. I would hope even Wall St knows the spectacular consistency in 20%+ outsourcing profit margins is going to slow at some point…

PF

Indeed, vendors have got much more organized with how they push more standard processes – case in point is Capgemini’s GPM (Global Process Model) that aims to bring best-in-class, benchmarked processes with all the productivity gains that clients expect.