It’s on… 2016 is the year that will separate the service dinosaurs from the savvy cannibalizers, as revenue growth slides towards negative territory and the onus shifts from selling more buttocks on seats to maintaining sexy profit margins.

Cutting to the chase, the technology and business services industry is becoming a very different place, and those of us failing to adapt, should start considering alternative career plans. I hear massage therapy is in high demand these days…

So what will really happen as we embark on our negative revenue growth journey? Here are five scenarios detailing how this will play out…

1) Big sucks – especially for providers… so get smaller and smarter. You’re still huge, clunky, siloed and political, constantly looking at “new” ways to reduce the workforce, while only being allowed to bid on big legacy deals, where the advisor is (still) squeezing everyone for price and your marketing team is still pretending you’re delivering nextgen solutions to clients (which you really aren’t). Under all the swirl of nonsense, you’re strategy is still really all about carting in even cheaper, younger kids from even cheaper, more remote places, and quietly ushering your burned out middle-management the exit. Meanwhile, as the allure of big provider life fades, many of the stars you want to keep are getting enticed by the thriving start up scene. Yes, people, being big and clunky is an increasingly crappy place to be, and many people reading this will be nodding violently that this is where they, quite frankly, are.

2) The mid-tier BPOs and up-and-coming As-a-Service providers have a great opportunity to steal the show. You either need to find sole source clients prepared to co-invest with you in their futures, or start to cater for new-gen deals that force you to build out your multitenant delivery

infrastructure to entice future clients. Believe it or not, these are interesting times for the mid-tier BPOs which can scale down for smaller deals and build out BPaaS capability for the future. Watch out for the likes of EXL, WNS and Sutherland which have all been active with the smaller stuff this year (while growing their business at a healthy clip). Other mid-size providers worth keeping an As-a-Service eye on are OneSource Virtual, which recently expanded its Workday-based HRO offering to accommodate FAO, Aassonn’s focused play around SAP Successfactors and Equiniti, a UK-based services firms very focus on BPO services tied to finance and banking technology. Also keep tabs on the ambitious contact center providers, such as Concentrix and HGS, which are verticalizing their offerings and leveraging new technologies and talent strategies to take on higher value work with much more scalable models. We are truly witnessing the convergence of BPO across the horizontal and vertical domains.

3) Disrupt your competitors’ business upon rebid. This is where things are going to get really interesting. It’s hard enough making revenue sacrifices (a.k.a. cannibalization) to keep ambitious clients happy, but – surely – it’s more rewarding (and P&L additive) to go after your competitors legacy clients with a much more robotically-automated offering with nice savings incentives? It’s not really cannibalizing when it’s acquiring new business, is it? Expect to see a lot of nastiness where providers just go and rape their competitors with all their new fancy robotic stuff and promises of cost impact taken straight from the Gartner scare-manual…

4) Sell your legacy stuff while you can get a good price for it and “re-emerge” in the future. There are several providers out there who simply cannot figure out how to compete in the “new” market while maintaining a legacy portfolio of clients, which are increasingly less profitable and almost impossible to do anything with beyond beg them to renew and cheaper rates. So why not get the hell out while you can? Sell that legacy stuff while you can still get a half-decent price for it… reinvest that money in building true BPaaS offerings with native RPA and real cognitive capabilities… invest in the F500 of 2020, not the F500 of 2016….

5) Just milk the legacy model and play the old game. Yes, there is enough legacy business out there so that you can still survive, if you pick the right deals and go after them in the right way. There are several service providers successfully operating in this fashion, and they are very happy to keep picking off the detritus of the labor arbitrage model, as that is what many legacy enterprises want – “just do it cheaper with minimum fuss, let us dictate what we want and we’re happy with the short-term savings”. And there is a lot of legacy business on offer in the upper-middle market which has yet to be infiltrated by the Tier 1s. There is a room for the unsexy body shops to play, and I see many of them sticking around for some time to come…

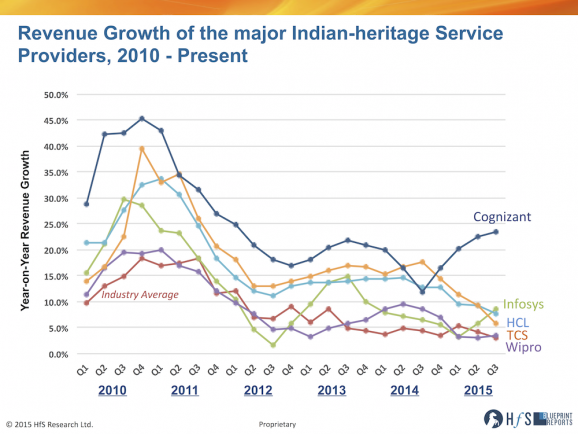

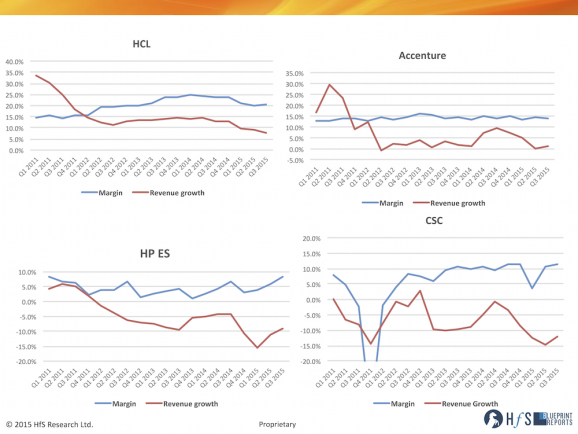

However which way we look at this, 2016 is the year many providers will be hitting negative revenue growth, and sustaining those nice profit margins will be nigh-on impossible, without driving major changes to the way they operate, hiring capable talent, making smart acquisitions and rethinking their own cultures. The numbers, quite simply, tell a stark, frightening story of where this is all going:

The Bottom-line: The major service providers need to be laser-focused on a three-pronged strategy to survive

i) Target core existing clients to develop co-investment strategies for future survival. Buyers will need to make new investments in automation technology (both robotic and IT) and people expertise to make it work, while their service providers will ultimately have to concede they may need to reduce the FTE provision on their side, as automation takes effect. The real challenge here is for the service provider to encourage their clients to have them redeploy the freed-up FTEs on their clients’ higher value processes. So these two motivations should go hand-in-hand: decreasing labor effort on automatable tasks and increasing it on the higher-value work the clients would like to outsource in the future. So… if buyers and their providers can get this right, intelligent robotic process and IT automation will be a long term play for both parties, where higher value work gets done and delivery staff are kept busy because of the closer collaborative relationship and greater volume of work being parsed out.

ii) Target your legacy competitors clients with solutions that drive that next wave of value. The likes of HCL, TCS and Cognizant have feasted off HP, CSC and IBM clients for two decades now as they could offer real cost-impact through smart global delivery capability. Now we’re in a rat-race to develop the right blend of robotic automation platforms, cognitive capability, combined with global delivery talent, to offer clients those next waves of delights. And this isn’t going to all be the same cast of characters as before – and will require a lot more risk-taking than before, as driving savings and value through other means, and not just cheaper labor, is challenging. Those providers with these capabilities can break this cycle by building multi-tenant solutions for the future – and will be the winners. I believe this could happen in barely a couple of years, when you look at the current pace of change and mood in the market. The key is to pick off the next 15-20 deals they can win at lower margins in order to invest in common automation, robotic processing platforms, common analytics, common SaaS underpinnings and common service skills – hence a more competitive, more scalable multi-tenant As-a-Service delivery model.

iii) Bring in new leadership blood which truly understands the As-a-Service Economy and what it takes to get there. It’s easy to point fingers at certain service providers for preserving the legacy FTE labor model, but the stark reality is that many of them simply don’t have leadership prepared to invest in the depth of talent, or technology capability to drive genuine advancements. So – let’s face facts here – 2016 is presenting an impasse of seismic proportions out industry had yet to experience. There are tremendous opportunities to create genuine productivity advancements through robotic process automation, smarter analytics and the onset of cognitive computing, but much of the present service provider bunch are not going to be the ones to take true advantage of them. I predict a few will break out, but the next winners will be from a new breed of As-a-Service provider, many of whom many not even have been formed yet.

Oh and Merry Xmas all =)

Posted in : Business Process Outsourcing (BPO), Cognitive Computing, Contact Center and Omni-Channel, CRM and Marketing, Digital Transformation, Finance and Accounting, HR Outsourcing, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, Security and Risk, smac-and-big-data, sourcing-change, Talent in Sourcing, The As-a-Service Economy

Great piece and an honest appraisal of state of play as service providers struggle to stay relevant.

Adding a view of the same issues from a different angle, clients are completely baffled and overwhelmed about digital – is it all marketing fluff? Which parts are relevant to their business? How does it intersect with keeping their industrial age legacy technologies running and amortizing/

If you are a service company marketing person reading this, your marketing is a disaster and is muddying this picture for everyone including yourselves. Pretentious third hand posturing about ‘digital transformation’ by old line suppliers whose marketing people are clearly on a different planet in comparison to what their employer actually offers doesn’t work. It’s compounded by past behaviors, deliverables and cost overruns that make clients do that ‘won’t get fooled again’ hollow laugh.

I work with large firms looking for cost effective solutions to define and achieve business goals and solve problems in our fast changing digital world, and there would be more work for large scale service companies if they didn’t keep painting ridiculous pictures of themselves as something they aren’t. I’ve seen this happen several times this year, and I actually reached out to one of the companies in the charts above to discuss but was met with marketing smarm…

Happy holidays and best wishes for 2016 to all reading this

Phil – Do we *really* believe that these companies are going to innovate? TCS, Wipro, Infosys, cognizant etc are all body shoppers without much imagination or differentiation. And their core business model is predicated on large numbers of cheap workers.

I think the outsourcing model is under major threat and these players will by and large fade I to oblivion over time. Cloud providers are driving down implementation costs. Automation is doing the same. Newer areas like digital transformation require skills and a culture that these body shoppers just don’t have. They talk about “design thinking” but sell butts on the seat.

It is like shuffling chairs on the deck of the titanic.

Brilliant insights and data, Phil.

I completely agree we’re on the precipice of some very big changes – and also agree with point 5 that several will simply stumble along selling the same old model.

However, one thing is for sure – we’ll have a very different set of market leaders in 3 years from now!

Larry

@Oliver – the marketing from several of these firms has reached insufferable levels of bullsh*t to the point where I don’t even think the provider themselves even understand it. The “Digital” issue at our recent client summit was barely mentioned – it’s not a real topic for most buyers today. They get the basics of automation, analytics, event cognitive, but “Digital” alone is meaningless. What makes better sense, IMO, is to talk about “Digital” as a business model transformation enabled by new technology tools and platforms, as not just to the “tec” itself.

I think we’ll hit a reality armageddon in 2016 where a lot of this noise just falls away and we return to real conversations with clients about what they need to do to find renewed value,

PF

@Nimish – if they only focus on selling ITO offerings with a frosting of “Digital” and “Cognitive” they will likely die (or fall into Category 5 and fester while circling the drain). How can you compete with Watson and Amazon if you don’t have any real domain strength or consultative expertise? I see the providers which can truly embrace “As-a-Service” as those which will carve our new niches for themselves – those that can offer solution platforms with analytical/creative talent and process expertise, can take clients through the Ideals of As-a-Service, where they can write off legacy, embrace intelligent automation and reorient their people to perform much more creative, value-add tasks.

Only some will make the shift, others will get hoovered up, a few might even break up and die, while some will find solace in Category 5…

PF

@phil So for 2016 I’m going with the reality that the catchall word ‘digital’ is too marketing toxified to be used anymore. It’s a shame any word or phrase of any value quickly gets mauled by marketing and loses any focus or value.

Ultimately the story never changes: evolve business models that work, and move with the times…this is as true for my clients as it is for tech firms and their implementers, but amazingly the latter two are now often more leaden footed than their customers, making selection of those still relevant to execute plans easier… for now…

@oliver – as long as “Digital” is defined correctly and specifically, it could survive. However, I see it being so generalized for new gen tech and social, it could end up being a very generic phrase like “cloud”… Which has many meanings today… There’s been such an obsession with the latest buzz term in our industry intend to ignore much of it…

PF

Hi Phil, Data driven factual read and pretty much predictive in terms of change that is knocking the door……this is exactly in line with a disruptive discontinuity my organization has been calling ‘The Watermelon Effect’ – which is symbolic and symptomatic of the relationship between outsourcing service providers and their customers, like a water melon, it is green from outside but a deep red inside. Customer delight is lost, innovation is forbidden, client attention is distant and decades old pyramid strategy is falling apart with the advent of automation/As-a-Service models . As you pointed out appropriately RPO, cognitive strength and differentiated delivery capabilities with crowd sourced inventions combined with best talent would drive change while determine the industry future. The value beyond contract quotient in legacy and non-legacy deals combined with investments in accelerators, business process harmonization that players bring to the table would be key to success. Customer delight if prioritized can do wonders….

Here’s the detailed thought process by my CEO:

http://raconteur.net/business/current-state-of-outsourcing-relationships-the-watermelon-effect

Merry Christmas and Happy Holidays!

Sincere Regards,

Piyush Dube

@Piyush – I like your quote: “Customer delight if prioritized can do wonders”

Happy holidays

PF

@Oliver – I think we’ll see the term “Intelligent” being used more, such as “Intelligent Operations”. Intelligent Operations is the evolution of traditional Business Process Services that creates additional value for enterprises by bringing the capabilities of the As-a-Service Economy into process delivery. The ultimate end-state for Intelligent Operations is when enterprise clients can access “Plug-and-Play Digital Business Services”, which are “ready to go” business-outcome focused, people, process and technology solutions with security measures, however clients need to take their capabilities through these eight phased “Ideals” of As-a-Service in order to get to this ultimate destination of operational service value (see the link).

The role of service providers in process delivery is changing and the old models of labor arbitrage based manually-created value delivered on inflexible, legacy applications with limited business insight are no longer suitable for leading enterprises. Instead operations need to be brought closer into the IT and Business Units with service providers that understand enterprises’ business objectives and can convert those objectives through the application of Design Thinking into new more flexible process structures (see link). Given the current B2C focus of most design thinking, the corollary impact and change that Intelligent Operations will have on middle-office, industry specific processes and operating models will be profound. As a result, many Intelligent Operations processes will be platform based and increasingly “born digital”, and data rich.

In turn, these processes are delivered through Software-as-a-Service platforms that are becoming more and more comprehensive in the tasks that are automated and which produce vast repositories of data on the processes and the business. The years of quarterly business reviews between the enterprise and service provider to review static, labor based performance management reports are over, replaced now by service providers focused on Intelligent Operations can then convert those data repositories into actionable process changes and business insights for the enterprise in a continuous and agile manner.

In HfS’ view, the services market will soon belong to those service providers, which build all of their capabilities around Intelligent Operations, placing it at the core of what they do. Moreover, ambitious enterprises are increasingly recognizing that the scope of what they can source is changing, and so too are the types of commercial and governance relationships required to create value in the As–Service Economy.

Happy Holidays!

PF

Great piece and good discussion Phil.

From my perspective, I see the automation software companies partnering directly with the specialised system integrators such as Genfour, Symphony and Virtual Operations to steal a march on Category 1 (and even Category 2) providers. And, I’m prepared to put my money where my mouth is as you will find out in the next few days…

Guy

Vertically focused, customer-experience oriented, cloud-based transformations and integrations using PaaS, SaaS and BPaaS offerings are going to be the key differentiators.

The interesting thing is that there still is going to be lots of need for coexistence models b/w on-prem and cloud-based tech and similarly in-house ops. and BPO for the next 5 yrs.

The providers that have the insights and the agilty to offer such coexistence and integration services b/w the 2 paradigms are going to ride this wave!

Phil, remember how in 2008/2009 we were predicting these times and now they’re finally here!

@guy – how will these micro consultancies scale up fast enough? Surely this is all greenfield for KPMG, EY etc who have the process depth and relationships?

PF

@Ali – Indeed – it’s been a slow evolution, but market forces are finally forcing the shift…

PF

@phil There’s a chicken and egg issue with some clients around ‘intelligence’ – so many western companies run on making the numbers every 90 days with little regard for concepts such as ideation or design thinking. I appreciate all the great work HfS does and think your ‘as a service’ predictions have to come to pass for service industries.

In a previous career incarnation I was a creative in the advertising world. In that era last century most firms looked to their formal advertising partner for design thinking and advertising that would move products. Today firms are all over the map, both bringing advertising in house and being increasingly fragmented due to the complexities of the modern digitally evolving world we live in.

The same is arguably true for technology resources: old style industrial IT is in the rear view mirror now, and monolithic IT service providers are going the way of advertising agencies of record as costs are shaved and value models change.

‘Client’ and collective ‘intelligence’ can be an oxymoron, particulary if morons are in charge at the top of the company…. historically there are plenty of brilliant people and ideas in advertising agencies, but they often have to deliver against a formal client creative brief which sets everyone up for failure.

That key decision making and parameters from the client for advertising is akin to the situation many IT service providers find themselves in today: plenty of smart people in the firm, well versed in design thinking concepts etc, briefed to put band aids on some creaky old IT environment to keep the old machinery working.

More seriously, most IT service providers are still living in a world of ‘answer the mail’ rfp responses and are largely kept in that role by the client. (‘Don’t call us, we’ll call you…).

Like advertising creatives, IT service people don’t merely have to demonstrate being ahead of the curve (preferably without using of the moment third hand buzzwords) – they also have to shine a light on the path to client profits and a simpler future. It’s a tough place to be right now and those still talking about workflow swim lanes on slides and erp systems are not only going to struggle to survive, they also paint a very unflattering picture of service firms in 2016 that drags the entire industry down…

The fall of BPO will coincide with SaaS solutions.

I remember Unilever’s HR leader on the stage at IAOP’s keynote to get their award for whatever massive 100+ country implementation of HR they did. I’m sure it was many years, tens of millions, and centered on something like Oracle/SAP.

Didn’t CEMEX do something huge at another IAOP. Some massive, multitower deal led by some consultants who got the vendors to dress in soccer jerseys if I remember.

There is no point nowadays. These deals only created a virtually unbreakable contract for services that couldn’t possibly be returned to their clients.

Workday and Salesforce are ridiculous technology solutions. You don’t need $10m to implement in 20 countries. You can be up and running in 9 months for far less… And then you don’t need that huge anchor of IT to support the tech (including the offshore guys) and the integrations are so solid you can nerf your HR staff that used to spend time doing it (business processes and analytics) the hard way.

However, it will take tech adoption to kill the IT services industry.

Two good solutions won’t do it, but the world will be so different in 3-5 years when the industry vendors jump into the cloud.

@Tony – I recall some of these 10-20 year legacy BPO deals where the client has lost complete control of their operations, and are still rumbling along with zero hope of salvation.

But you are semi-correct – technology will massively change the services industry, but it won’t kill it – it will commoditize it and turn it into an experience industry… you pay for a great experience to achieve whatever outcomes are important to your organization. But big is no longer beautiful for these providers as they go through this change… it’s about delivering skill, knowledge and capability tailored to clients (around the tech platform) at the size they need it…profitably. And the smart providers can grow their profitability as clients will pay for quality of experience. Growing revenues simply through scale is dying and the data proves it…

PF

@Oliver – the SPs will go through some major management talent change in the coming months. Marketing in the services industry has become a joke and leadership knows it. We will look back at this time as the “era of meaninless bullsh*t”. To put it simply, sellers need to sell what the buyers need to buy…

PF

Brilliant Insights. A lot depends on how the business of End Customers in segments like BFSI, Retail etc is disrupted by FinTech and Startup’s.

Like your post Phil.

What do you think will be the state of Analytics which still has a growing demand… This will be a key area to invest into and develop the capability. Big data analysis has to be the driving force behind business needs.

What is it that stands out in any of the companies mentioned…. virtually the same working model.

@Murali – in most cases they are either put out of business by very disruptive “born in the cloud” competitors, or they can survive by radically overhauling their cost structures. And this means really working with a provider to figure out how to offload higher value work, while at the same time eliminate as much cost as possible from transactional processes through smarter automation. But whether some of today’s providers are structured in the right way to offer integrated solutions that incorporate automation, business processing, application modernization is a major, major problem for some of them. Most are still treating their offerings like “BPO” and “Apps” as horizontal solutions in siloes, as opposed to bringing them together as more industrialized, verticalized solutions. The service providers which have the talent and determination (and financial backing) to break away from the old mentality have a fighting chance. This that don’t are on the race to the base…

PF

@Vishal – “Analytics” as a standalone offering pretty much is a bust. Analytics needs to be embedded in industrialized solutions that can deliver specific business outcomes and provide data real-time insights, as opposed to adhoc queries and reactive data mining. I agree that some providers can do a much better job communicating their analytics prowess is specific areas of customer interest, such as healthcare, insurance, banking, supply chain and FP&A. I am also keen to see more cognitive capabilities being integrated with analytics to help clients make constant, ongoing improvements to their data quality and have more predictive capabilities. Very interesting to see some of the advancements of platforms like Amelia 2.0 (IPSoft) and Watson in this area, where customers can really start to create better process chains because of the constant self-learning and better data integration…

PF

[…] Get Started Now! $j=jQuery.noConflict(); jQuery( document ).ready(function($) { /*$( '.close').click(function() { $('#adblock').hide(); });*/ //this is the floating content var $floatingbox = $('#adblock'); if($('#main').length > 0){ var bodyY = parseInt($('#main').offset().top) – 20; var originalX = $floatingbox.css('margin-left'); $(window).scroll(function () { var scrollY = $(window).scrollTop(); var isfixed = $floatingbox.css('position') == 'fixed'; if($floatingbox.length > 0){ //$floatingbox.html(“srollY : ” + scrollY + “, bodyY : ” + bodyY + “, isfixed : ” + isfixed); if ( scrollY > bodyY && !isfixed ) { $floatingbox.stop().css({ position: 'fixed', left: '10', top: 200, marginLeft: 1010 }); } else if ( scrollY < bodyY && isfixed ) { $floatingbox.css({ position: 'fixed', left: '10', top: 200, marginLeft: 1010 }); } } }); } }); « Traumatic 2016… Survive the race to the bottom! […]

Phil

Thanks for talking out loud. These issues have been on the table at every strategy and boardroom discussion at IT service providers for more than 2 years. I have been a part of a few. However, there is not one solution. Paths range from -disrupting “what” e.g. Mirantis or “how” e.g. pivotal labs or “what as well as how” e.g Palantir.

On this premise, recently started my own Technology Services Startup, Lirik. Focus on three SaaS platforms and great customer experience are our drivers for first 2 years. May not be a recipe for large providers, however we will prove that it works @ $100M scale and then try to solve at larger level. Would love to collaborate with you as we progress.

Anand.

@phil . One more drain these companies have is that the have very senior (by age and by tenure of service) who are unable to unlearn and take risk to revamp their go to market strategy with new client Engagement model and services which are fused across verticals and Geos. @pritenb

Great post to end the year Phil. Like HFS, analyst community should also stop beating around the bush and call spade a spade – referring to the 5th scenario in your post. That’s a harsh reality unfortunately. Many big Indian service providers have been enjoying a good 25%~30% margin by just milking the old cow – which is still quite good from a shareholder perspective. Interesting thing to note is that Accenture (and other US based service providers) do the same at almost half the margin %. Of course one of the reasons is their high cost base and expensive sales budgets (Golf memberships, Tiger Woods and all) but what it tell me that overall industry margin is somewhere in between. So India based service providers have stills some buffers to sustain the legacy model.

Please share your views on this blog post:

Can this one change transform IT Services industry? http://bit.ly/1PcUpgg

[…] and cost is the ultimate arbiter of change, and it’s not until the providers really start to feel the squeeze on their profit margins, and the clients get tempted by disruptive rebids, will we really see much of the change described […]

I especially like the unpopular but necessary statement below. Having long term vision for growth while understanding the costs that come with it is true Business Agility. The street makes us forget this until our hand is forced. In Poker Parlance – That’s an “All-In” with a Jack-4 off suite

“The key is to pick off the next 15-20 deals they can win at lower margins in order to invest in common automation, robotic processing platforms, common analytics, common SaaS underpinnings and common service skills – hence a more competitive, more scalable multi-tenant As-a-Service delivery model. – See more at: http://www.horsesforsources.com/race-to-bottom_122415#sthash.YuejtJyy.dpuf:

Excellent analysis! Major enterprises are too sluggish for changing things at the rate at which the market is evolving. Things such as “Digital Transformation” etc., are really good to talk about from a strategic standpoint, the gross reality is that – large organization find it hard to drive the transformation agenda within. As long as the company’s don’t walk the talk large service providers would continue to thrive with their traditional “body shopping” with butt on the seat driving the business models. Cloud solutions are the growing “ilk” – so is the “tightening of the noose”in the BFSI sector with significant expectation around regulatory requirements and controls. CEO’s & CFO ‘s are faced with a conundrum of Cost Vs regulatory compliance. It is this space that startup’s could perhaps target to disrupt the existing market.

Interesting insight in the report. The factual data is quite revealing.

The service providers will really need to be

1) Nimble – ie. have the ability and willingness to adapt, to actually capitalize on the changes. Their leadership is on the test.

2) Sustain current ground and enhance value – by becoming proactive vs reactive. Companies outsource not only for cost reduction but operational efficiency, capacity, speed to market among other factors. Service providers must “listen” closely to their client’s problems, become proactive (beyond SLAs) and add value by partnering to solve them. Their partnership is on the test.

3) Expand domain/verticals/geographies – Service Providers will also need to invest heavily in their people who have brought them big margins over the years (talent/people management) to gain new skills and expertise catering to new domains (analytics…?), verticals (specific solutions?), etc. Cloud reduces costs but increases functionality generating new needs (do I hear integration problems ??).

[Couple of years ago HCL acquired UK SAP specialist Axon, Infosys acquired Switzerland-based SAP consultancy Lodestone to increase their continental footprint. Cognizant was in news recently where Etihad Airways has chosen them to support digital transformation…]

[…] is clearly the path most companies are going to take. This is great news for service providers geared up to deliver As-a-Service capability, which have the desire – and investment chops – to hijack legacy deals from legacy […]

[…] been the toning down of the rhetoric and hype, as most of the providers tackle the winds of change threatening a worrying decline of growth in the global services […]

Good discussion, all valid observations and insights.

So how will the response be during this current period of the BIG adjustment? For sure they will squeeze and squeeze and squeeze, will automate the most obvious bits, try hard to keep those fat margins and old deals (scenarios 1, 5), volume of acquisitions will go up markedly, the big fish will buy the smaller BPO/BPaaS/IT players, even startups? (scenario 2). It maybe worthwhile to start tracking total acq. spends by each – the nature of firm acquired/vertical in context and the associated revenue challenge (in verticals of Telecom/Oil/HLS being most obvious first), in 2015 and YoY?

Will competitive strategies become a vicious price game, each trying bite off revenue from the other with similar commoditized offerings (scenario 3), sure they will. Will any ditch their legacy core, doubt it…but a time could come when two large firms decide the scenario of merging with each other is really all that is left to try (or perhaps split the company).

Will they invest in advance to create plug n play IT or Business Services offerings, do that for the 15-20 deals proactively, canabalize, indulge in deep co-creation, build innovation, consulting and cognitive capabilities? …some will try, of course.

What else, Imagine more interesting deal making (cash plus stock, cross holdings etc.) as the PE supported firms also up the ante, a shrinking legacy business but a lot of new buys – could we see a scenario that under the hood some will emerge as holding firms with a bunch of acquired new independent, networked businesses – some growing faster than the industry?