2025 saw savvy enterprises despair of the insipid deluge of flashy boardroom presentations and finally move beyond AI fantasy to the reality of execution.

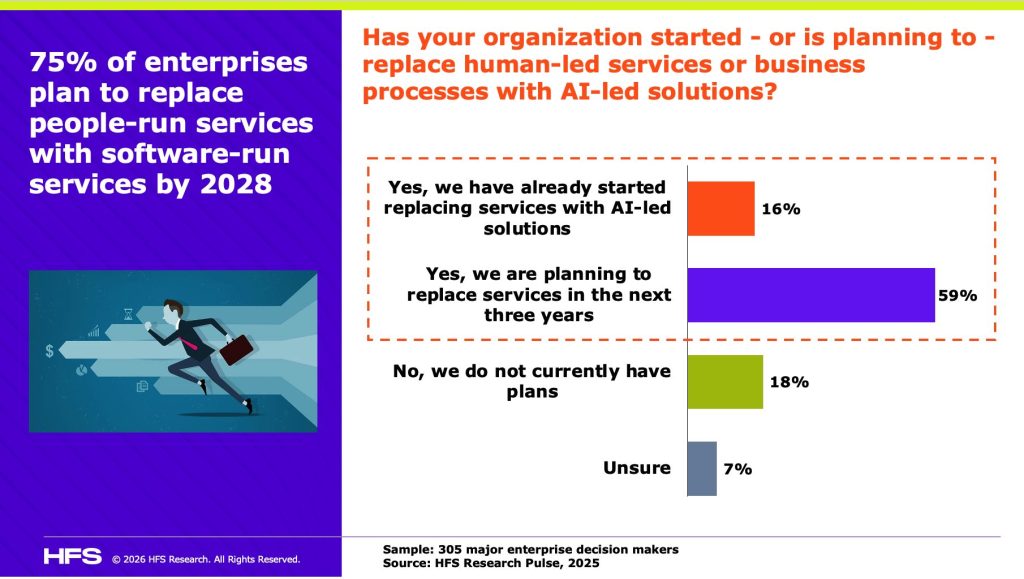

It’s a pivot that has created an inflection point for the services industry. Legacy delivery models focused on bums-on-seats aren’t relevant anymore, and services firms must reinvent themselves to survive. Those who don’t will quickly find themselves obsolete, as 75% of the Global 2000 recently declared in our Pulse Study:

Here, we reflect on what we believe will shape the next 18 months with a brutal review of the current state of place in IT and BPO services…

Why will 2025 serve as the inflection point of global services?

The AI honeymoon period ended. The conversation finally moved on from endless possibilities to what actually works at scale. Savvy enterprises are looking beyond copilots to early agentic systems embedded in real workflows, hoping to ditch traditional labour-led delivery models in the process. They are also demanding more from their service providers; they want better outcomes, faster, with greater accountability. It’s exposed leadership debt, process debt, and data debt that services firms can no longer hide behind through headcount growth.

Structural stress drove real action. Margin pressure, slowing discretionary spend, and geopolitical uncertainty killed complacency and forced most firms to rethink their operating models. Everything, from pricing and talent models to capital allocation, was reimagined. Inorganic growth became more strategic, as they looked to bolt on software, data, and AI capabilities. Mid-tier providers became increasingly relevant as their nimble model helped navigate structural stress.

Product velocity became the real GCC litmus test. Cost advantage is table stakes. Scale is less relevant. The strong GCCs are embedding expertise and AI capabilities, integrating themselves tightly with global business teams, and defining measurable accountability. They discuss outcomes, not activities. Product velocity is the metric that matters; how quickly can your GCC transform an idea into real capability? That separates GCCs that can anchor AI-led growth from those that are just another rebadged delivery center, posing future delivery risk.

BPO collided with IT Services. The wall between “managing technology” and “managing processes” shatters when AI automates entire workflows across both domains. Capgemini’s acquisition of WNS is living proof of it. BPO providers’ labour-intensive delivery models (such as contact centers, finance and accounting (F&A) processing, and HR administration) are prime targets for agent-based automation. BPO players that don’t pivot, swapping FTE models for outcome-centric ones, will see their value proposition erode. Meanwhile, winners will own what fuels agents: domain expertise, process intelligence, and enterprise data.

What will be the big technology impact shaping global services in 2026?

Agentic AI will face increased scrutiny from enterprises. The focus will shift from building agents to governing them, which will be a pain point for enterprises. Multi-agent systems introduce accountability, complexity, and trust issues that traditional operating models weren’t designed to handle. As a result, demand will surge for orchestration, observability, and an Agent Operating System. Enterprises don’t need more agents; they need agents they can rely on.

Data becomes a boardroom issue. Enterprises finally understand that AI success isn’t about which model they use; it’s about the data sitting within their own organization. It’s about data quality, lineage, security, and regulatory readiness. Services firms that blend engineering depth with data governance and risk management will win in 2026.

Simplicity is the new success multiplier. The technology is ready, but many enterprises are not. They remain burdened with decades of enterprise debt, tangled systems, fragmented platforms, and overly customized cores. AI will never deliver tangible outcomes in that environment, just enhanced complexity. Enterprises that purposely simplify, standardize, and re-platform should expect to extract far more value from the same AI investment.

Revenue and headcount separation accelerates. Enterprises no longer want effort-based contracts. They will continue their push for outcome-based pricing, productivity assurances, and software-infused services. This favours services firms capable of productizing their IP, investing in the right platforms, and demonstrating the outcomes they deliver, rather than those that mistake scale for value.

What are the critical themes emerging in 2026?

Talent will be redefined. Technical hands-on capability will not be optional for leaders. They must be comfortable building agents and leading from the front, rather than delegating from the safety of their boardroom. Service firms will broaden their recruitment strategies, looking to product companies for go-to-market expertise, the entertainment industry for storytelling, and non-traditional sectors for commercializing outcomes. The time for hiring the same old people is long gone.

Investor success metrics are changing. Old scale metrics have been replaced by revenue and margin per FTE, and private equity firms are catching up. The question will shift from how many people to how much value each person creates. This will reshape how investors evaluate growth, profitability, and market position, which will impact how services firms operate as they paint a new story for investors.

Services firms become “last mile” value creators. Services firms have spent decades driving technology adoption behind the scenes. But as technology adoption becomes simpler, value shifts to the last mile, where systems are adopted, processes are changed, and outcomes become real. Smart providers will reposition themselves to own the connection between technology and outcomes in the last mile, and those that don’t will find themselves obsolete.

Budgets don’t live with IT anymore. Business leaders control a growing share of enterprise spend, and they evaluate services firms differently as a result. Growing emphasis is placed on multi-stakeholder deals and outcome ownership across functions, not siloed delivery. Services firms that target only IT leaders will see their influence shrink and revenue erode, while their competitors engage the wider business and capture more relevance and spend.

Mid-tier providers are set to succeed. Enterprises are losing patience with large incumbents. They are too slow, too protective of legacy revenue streams, and unwilling to cannibalize their existing business. Meanwhile, mid-tier firms strike a balance between credibility and agility. They combine proven delivery capability with a willingness to innovate and share risk. Large incumbents currently control less than half of the addressable market, and their grip is weakening, which means mid-tier firms have a significant opportunity in 2026 and beyond.

Creative commercial models explode. We’ve spent years talking about outcome-based pricing, but 2026 is the year of real growth for new commercial models. Think equity partnerships, gain-share arrangements, platform royalties. Ultimately, enterprises will favor deal structures that resemble SaaS businesses more closely than traditional services contracts. Firms uncomfortable with this pivot will remain stuck in a price-pressured, labour-intensive relationship.

Ecosystem orchestration overtakes monolithic delivery. Nobody can be everything to anyone, and that is especially true in the AI era. Winners will excel at bringing together specialist partners, ISVs, and niche technology providers to deliver a single, outcome-driven solution. In today’s market, the ability to act as a trusted ecosystem orchestrator is far more valuable than building everything in-house.

GCC-as-a-Service becomes the norm. GCCs are no longer considered fully captive delivery engines. Enterprises will make more purposeful choices about what must remain in-house and what can be flexed through partners, cutting fixed costs while maintaining control. The GCC-as-a-Service model keeps product ownership, AI orchestration, and domain expertise in the enterprise while using partners to provide specialist skills and execution capability when needed. It’s not about build vs buy anymore, it’s about what to own, what to borrow, and what to exit fully.

BPO must adapt to survive. BPO players have survived past waves of technology with incremental changes while preserving their core labour model. But that won’t work anymore. Agentic AI doesn’t automate tasks within processes; it eliminates the entire process. HFS predicts BPO providers have, at most, 18 months to reinvent themselves – everything from value propositions to commercial models and delivery platforms.

The BPO expectation gap is widening. Less than a quarter of enterprises report that they are in AI AI-run state across BPO operations, but almost all of them expect it to deliver productivity gains of over 20% in the next three years. The gap proves enterprises are demanding more than pilots and incremental changes. They want partners who can deliver wholesale improvement, embedding AI into real workflows, delivering on the promise of Services-as-Software, and taking accountability for the outcomes.

Bottom Line: The services industry has 18 months to prove it can deliver AI-led outcomes or get replaced by providers who will.

2025 ended the AI honeymoon. Enterprises stopped buying vision decks and started demanding measurable results from agentic systems embedded in real workflows. The winners in 2026 won’t be the firms with the biggest headcount or the best boardroom pitch. They’ll be the ones who can govern multi-agent systems, turn enterprise data into competitive advantage, own the last mile between technology and business outcomes, and price on productivity gains instead of FTEs. Mid-tier providers with outcome-based commercial models will capture market share from incumbents protecting legacy revenue streams. BPO players face extinction if they don’t swap labor-intensive delivery for agent-driven automation. GCCs will separate into those that enable AI-led growth, and those that fade away. There will be no middle ground.

Posted in : Agentic AI, Artificial Intelligence, Business Process Outsourcing (BPO), GCCs, GenAI, IT Outsourcing / IT Services