As we've predicted, based on our surveys, many tough discussions with buyers and general chit-chat, sourcing evaluation is now picking up, and we can expect to see a wave of deals in Q4 this year and Q1 next year (and beyond).

As we've predicted, based on our surveys, many tough discussions with buyers and general chit-chat, sourcing evaluation is now picking up, and we can expect to see a wave of deals in Q4 this year and Q1 next year (and beyond).

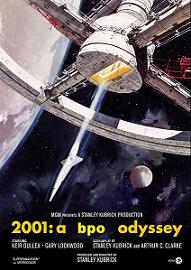

First, the sourcing advisors, management consultants and analysts get busy with their clients showing much more urgency, and then we can expect to see some deals happen. Based on my conversations with the advisory community over the last couple of week we're now in that former category. I've even had a couple of people come to me with the question "Is this 2001 all over again". My answer is: "In some ways yes, but the types of deals and the global delivery execution is markedly different this time".

Now why is this?

Post 9/11 we saw a major spree of ITO, call center and end-to-end HR BPO wave. ITO worked, call center is stuttering with offshore value, and HR BPO – in its past form – failed

The IT infrastructure outsourcing deals were onshore mature contracts with established providers such as IBM, CSC and HP, experienced at driving economies of scale with their delivery models. The application development and maintenance deals back then were among the first to truly leverage offshore

resources, and many have blossomed as clients learned how to managed their service provider relationships and re-train their internal IT organizations.

Call center outsourcing was the first non-IT area (outside of manufacturing) to leverage offshore. And while the call center providers have got far better at improving their global delivery models, leveraging voice resources from locales such as Nicaragua and India, I do not expect this area to significantly grow in the near-term, as business levels are slow, and the quality (and decreasing cost) of onshore is often negating the cost-savings of using offshore.

HR BPO, on the other hand, focused on mass aggregation of HR functions such as payroll, benefits, compensation and staffing, which were not unified on a single HR platform, and involved very little offshore arbitrage. Some experimented with nearshore delivery (i.e. Costa Rica and Brazil) but struggled to generate any significant cost savings for clients and often resulted in poor delivery. In addition, the old HR BPO value proposition challenged the very role of the HR professional, and the HR media, associations did a first class job in ensuring many engagements did not do well.

The 2009/2010 outsourcing wave will focus on areas with heavy offshore arbitrage and mature service delivery models from service providers: namely application outsourcing and F&A BPO

Most large clients which can benefit from outsourcing their IT infrastructure services have already done so. However, we will see many increasing their scope, especially in areas such as Remote Infrastructure Management, where offshore labor can drive out further cost. The major IT area which still has a lot of runway is in application development and maintenance. Less than half of the large companies we surveyed have yet to outsource any of their ERP maintenance / support, application testing, or development. With the plethora of IT service providers hustling for clients, expect apps to lead the wave over the coming months.

The other area is F&A BPO, which seems poised to bounce back after a quiet few months as many firms stagnated over actions plans in this recession. Like apps, we have a host of maturing service providers ready to take on new business. Moreover, several enterprises have already outsourced as much IT as they can handle and need to look and new waves of cost take-out. As several executives have privately admitted: "we need to be seen to protect jobs, but the reality is we have no choice – we need to drive out cost and use offshore outsourcing as the lever to do that".

Also expect to see some activity with these SaaS/BPO models, which will center on helping mid-market clients move onto SaaS delivery underpinned by low-cost process support in areas such as HR, finance and CRM, where these is a need to upgrade technology platforms and there is room to drive out more cost. This, however, will likely take longer than a couple of quarters to materialize, but we can expect to witness the first tranche of clients experiment in this delivery model.

To conclude

The similarities with 2001 are simply the need to drive out more cost and pressure on CIOs and CFOs to look at the outsourcing vehicle to execute on this. This time, we've had another 8 years to experiment with this stuff and the realization is here: you need offshore to take out the cost, you need process acumen and technology to drive common standards and ensure ongoing cost-optimization, and you need buyers to be smarter at realigning and re-training their internal organizations

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, HR Outsourcing, IT Outsourcing / IT Services, Outsourcing Advisors, SaaS, PaaS, IaaS and BPaaS

Phil –

I think another driver behind ITO app dev/maint growth will be smarter/more experienced/more realistic customers taking a broader view of their service delivery models. Many clients are honestly evaluating their first experiences with ITO ADM, improving their internal process maturities, and developing plans to use ITO ADM to optimize their IT delivery models — as well as cutting unit costs. It’s harder work than a straight “lift-&-shift”, but should provide more satisfying results — and ones with more staying power.

Mark Peacock

Archstone Consulting

Phil,

Many large corporations work with multiple vendors – often multiple offshore vendors working in different pockets within the IT Organization. In last 6 – 10 months I have seen some consolidation but not a lot. Primarily, this to spread the risk and continue to leverage the existing relationships and the infra-cost already incurred by these big corporations. In coming months do you see a trend towards more aggressive consolidation to reduce multi-vendor overheads and perhaps negotiate better pricing with the providers to do more with them?

Mark –

Agree on the new thinking here with service delivery models. “Lift and shift” is clearly a fast-track route for the first-time outsourcer who wants to move quickly into an end-state. With new ADM models, it doesn’t make a lot of sense, especially whre the requirements are for new technical skills being provided 90-100% from the service provider (i.e. ABAP development).

Lift and Shift is much more dominant for BPO deivery models, where process re-engineering is a long journey for clients, where there is no way they can transform everything quickly without the catalyst of an outsourcing transition,

PF

Vikas –

To some degree, buyers will scale back the number of ITO providers where the larger service providers offer favorable terms for doing do. Clients use niche providers because they tend to provide quality people they have got to know and respect, and can fill valuable gaps in their skills requirements, particularly in niche and legacy areas. However, the common drive from senior management is often overriding this multi-vendor strategy in favor of more attractively-priced longer-term outsourcing models.

Hate to say it, but the driver here is more about cost than expertise and quality. I do see smaller providers (especially onshore ones) driving down their costs to remain in large clients – they have to apply tougher wage pressure on their own staff in this economy to remain competitive. Their challenge will be retaning their talent and avoiding it being re-badged by the larger providers. Survival of the biggest will likely prevail…

PF

Offshore outsourcing more and more takes the shape of Business Process Outsourcing, where whole business processes (such as support and development) are outsourced.

Very well analyzed Phil.

Agree the offshore lever is the major driver 8 years’ on. Those areas that relied on onshore labor need other areas of leverage, such as utility (i.e. IT infrastructure services) and technology platforms (i.e. payroll/benefits services).

The offshore components also need these leverage areas, but they at least provide the initial cost-impetus for clients to get started,

Dave

Phil – the HR BPO market is very different now from 2000/2001. Some of the pioneer HR BPO contracts did not deliver all expected benefits, for both parties. However the market is much more mature now. Some of the the differences include better mid-market provision, much better tools inc Smartforce, SaaS, realisation that more HR strategy requires HR transformation, a much more varied competitive vendor marketplace and better contract/vendor management in HR (with all the lessons learned since 2001). HR BPO 2.0 is very different to the first generation.

Andy Spence

HR Transformer Blog

Phil,

No doubt that outsourcing will continue to flourish but the offshoring boom is over. Offshoring will become increasingly irrelevant; simply a better solution to yesterdays problems.

Andy – you are preaching to the choir here… see this piece from earlier this year:

http://blogs.amrresearch.com/outsourcing/2009/03/outsourcing-hr-in-this-recession-why-this-makes-sense-for-many-multinationals.html

PF

Hi Phil,

Outsourcing will definitely transform itself in the next boom. Globally, organizations are faced with two major challenges – sustain themselves during the current tough times and the second – be ready to take competition head-on when the boom is back. Having both these together is tough business. And this is exactly where Business Process Outsourcing can step in and help organizations. In order to be successful one needs to partner with the right organizations and look for the right signs in the outsourcing partner.

Keeping this in mind Vijay Rangineni, CEO, Mahindra Satyam BPO has authored a white paper titled ‘Benefiting from the recession through outsourcing’ where he discusses a number of points on how to go about outsourcing business processes during this recessionary time. He talks about how Process Outsourcing presents an excellent opportunity for organizations to not just cut costs in the immediate future, but create a lean organization that will be even more profitable once the economy recovers and deliver enhanced customer value. The white paper can be accessed at http://www.mahindrasatyam.net/about/documents/Benefiting_from_the_recession_through_outsourcing.pdf .