Just a few short years after ADP introduced the basic fundamentals of Business-Process-as-a-Service to the corporate back office with its managed payroll offerings, Workday has rapidly introduced HR-as-a-Service to the corporate, world with its comprehensive HR platform suite, creating a whole new ecosystem of service providers eager to slake the Workday thirst of so many HR heads.

Just a few short years after ADP introduced the basic fundamentals of Business-Process-as-a-Service to the corporate back office with its managed payroll offerings, Workday has rapidly introduced HR-as-a-Service to the corporate, world with its comprehensive HR platform suite, creating a whole new ecosystem of service providers eager to slake the Workday thirst of so many HR heads.

Mention the very words “Workday” to any HR executive today and their eyes light up – they need a Workday go-live on their resumé, just like CMOs need Salesforce experience and most CIOs, in the past, an SAP or Oracle roll-out. However, what’s truly disruptive about the new HR-as-a-Service environment that has sprung up practically overnight, is the emergence of a whole new breed of As-a-Service providers now feasting on the lunch of the traditional providers. What once cost $50m for a complex technical implementation, can now be done for a fraction of the price, with the bulk of the investment being refocused on post-implementation support and HR transformation.

Being able to tap into consultative support that can help with organizational design, or workforce analytics, that is delivered via virtual on-tap models, in addition to the bread-and-butter fulfillment work, has changed the game forever – and for those only just waking up to this seachange, it is already too late.

So let’s take a look at how the Workday services environment is shaping up with the industry’s first ever Blueprint report into Workday services, with the help of HfS principal analyst and report co-author, Khalda de Souza:

Khalda…. why do so much research into Workday?

Enterprises are increasingly interested in SaaS applications, as they promise speed, cost effectiveness and simplicity. We’ve seen great and growing interest in SaaS for HR functionality over the last several years and momentum behind the Workday HCM product has been especially strong. Today there are medium and large global enterprises alike deploying Workday, mainly because of its functionality, attractive user interface and its common code instance. Customers are increasingly fed up with constantly adding complexities to their application environments which is often the result of some of the on premise options.

Most Workday deployments to date have been for North America-headquartered enterprises, in some cases including their international offices. In the next year we expect deployments in other regions to increase, particularly in Europe. In addition, other Workday modules are also in growth mode, including Workday Financial Management. So this is the right time to highlight the trends and the leading providers for plan, implement, manage, operate and optimize Workday services in this exciting growth market.

So if SaaS is so easy, why do enterprises actually need a service provider?

Workday wants to help its customers to be as self-sufficient as possible. To this end it has developed the innovative Workday Community, which is an online resource for all customers to ask questions, share experiences and even find partners. Customers can also find resources on the Workday Consulting Services Marketplace. These are invaluable – and our research shows, very popular – resources, but there are still massive opportunities for service providers to provide additional value-add services.

While SaaS applications are generally easier to deploy than on premise applications, it does not mean that enterprises do not require any in-house services skills at all to make the SaaS adoption successful. Unfortunately, some enterprises have learnt this the hard way, by radically reducing their in-house IT team when deploying SaaS. Workday service providers have seen demand across the value chain of services, from consulting through to BPO services. For example, enterprises need to understand the implications of using a SaaS application including the organizational change management that may entail. Workday partners with a deep knowledge of HR and/or finance have also brought deep functional expertise in a holistic manner to customers.

So who are these partners offering to Workday the organization… and how did they do?

Workday’s services ecosystem is one of a kind. For starters, it’s a closed ecosystem, with Workday carefully selecting and inviting partners to join the club. To date there are 28 deployment partners, including Workday boutiques (such as Ataraxis and OneSource Virtual) , HR specialists (such as Aon Hewitt), consultants (such as KPMG) and global general service providers (such as Accenture and IBM). Moreover, all partner consultants are trained by Workday so that they all use a consistent deployment methodology to maintain the same high standard. As a result, there isn’t a weak partner, as they are all at least technically very capable. The differentiators lie in commitment to developing proprietary technologies, customer engagement methodologies and having a clear vision for the market.

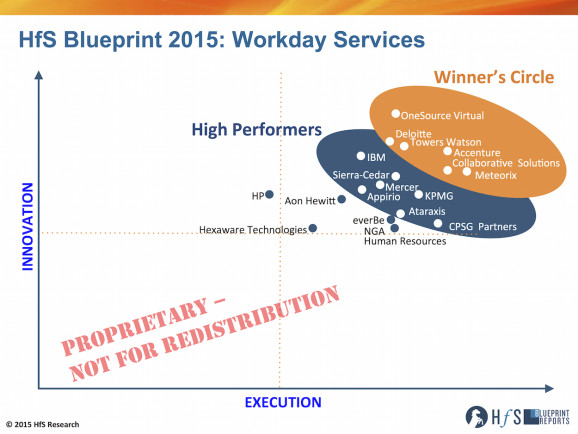

In our Blueprint, the boutique partners shone, especially for their commitment to making customers’ Workday experience a success. The HfS Blueprint Axis shown today captures a healthy mix of each category of service provider in both our Winner’s Circle and our High Performers, highlighting the need for the global partners to not take their usual dominant position for granted.

The members of our Winner’s Circle for Workday Services include: Accenture, Collaborative Solutions, Deloitte, Meteorix, OneSource Virtual and Towers Watson.

Our High Performers include: Appirio, Ataraxis, CPSG Partners, IBM, KPMG, Mercer and Sierra-Cedar.

In our Blueprint we also profile the capabilities of other Workday partners including: Aon Hewitt, everBe, Hexaware Technologies, HP, NGA Human Resources as well as of Workday itself.

Thanks for your great insight, Khalda. So… to sum up this Blueprint research, how do you see this market evolving further down the road?

Most Workday engagements to date have focused on consulting and implementation services. We are now seeing an increasing demand for application management and BPO services. Some of the partners have these capabilities but have not necessarily fully marketed them yet as the demand has not been there. We expect these partners to strengthen their offerings and step up the marketing effort. As the Workday financial management (FM) product also grows in demand, partners with both the HR and finance capabilities will be in a stronger position to offer Workday as a platform. Overall, partners with international capabilities will have increased opportunities to grow in the growing Workday services market. For those partners with a gap in any of these capabilities, they will have to at least have an answer for it all – that being, build it, acquire it or partner for it.

HfS readers can click here to view highlights of all our HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report, “HfS Blueprint Report 2015: Workday Services“

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Digital Transformation, Global Business Services, HfS Blueprint Results, HfSResearch.com Homepage, HR Outsourcing, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, sourcing-change, Talent in Sourcing, The As-a-Service Economy

What was the ranking criteria for how the various partners got grouped into the winners circle vs. high performers vs. other and how was this information assembled?

Workday is beyond shared service. If we were to look at it primarily from a HR-as-a-Service model then ADP would be miles ahead in the criteria. In my opinion what Workday has done is to primarily leverage its understanding of HR domain because of its founders experience with PeopleSoft and build a better mousetrap.

Mrinal | https://www.linkedin.com/in/mrinalsingha

@John – it’s all explained in this document here,

PF

@Mrinal – this is about how service providers can implement, manage and provide value-added business services around the Workday platform. ADP is different because it is a service provider / BPO firm and a technology provider in payroll/HR. Workday does provide services, but its core business is selling software, not services.

PF

I agree with what you say in your comment Phil. But in the post some of the service providers that have been highlighted e.g Aon Hewitt and Towers Watson are to an extent competitors to ADP.

In my opinion ADP along with Aon Hewitt and Towers Watson are different from pure play system integrator like Appirio and to an extent Hexaware.

Have you considered doing a similar report for Workday software partners? They are also an important cog in the Workday eco-system.

@Stephen – we’re covering Workday financials next (services), and Salesforce.com. We plan to revisit the fuller Workday software ecosystem later in the year,

Cheers

Phil

This is an excellent example of the HR As-a-Service journey for enterprises and approaches via SaaS products and how service providers can offer value around that. This is the kind of research enterprise (and providers) need to ponder over.

[…] healthcare, 401K etc. Isn’t that what things like ObamaCare are for? Just look at how the new class of Workday service providers, such as Collaborative Solutions, Meterorix, and OneSource Virtual, all of whom are upending the […]

[…] as healthcare, 401K etc. Isn’t that what things like ObamaCare are for? Just look at how the new class of Workday service providers, such as Collaborative Solutions, Meterorix, and OneSource Virtual, all of whom are upending the […]

[…] transformative partner for 45% of the world’s Workday financials rollouts… now it is playing with the leaders in Workday based HR delivery, namely OneSource Virtual, Deloitte, Accenture, Collaborative Solutions and […]

[…] to be the transformative partner for 45% of the world’s Workday financials rollouts… now it is playing with the leaders in Workday based HR delivery, namely OneSource Virtual, Deloitte, Accenture, Collaborative Solutions and […]

[…] in the market with a total of 380 certified Workday consultants and elevates IBM into the coveted Winner’s Circle of Workday service […]

[…] The industry’s first Workday services blueprint: A new breed of As-a-Service providers has disrupt… – Mention the very words “Workday” to any HR executive today and their eyes light up – they need a Workday go-live on their resumé, just like CMOs need Salesforce experience and most CIOs, in the past, an SAP or … s first ever Blueprint report … […]