Finally, we can stop freaking out at all these lovely projections, such as “AI will eliminate 1.8M jobs but create 2.3M” in the next couple of years, and “47 percent of total US employment” being at risk and “AI being possibly the last event in human history”. Oh, and who can forget that recent whopper, “96% of clients are getting real value from RPA”.

We got so sick of this nonsense, we just went out and surveyed 400 enterprise automation and AI decision makers across the Global 2000, split across IT and business operations functions, and hit them with some very straight poignant questions about their attitudes, satisfaction levels and genuine plans for both AI and Automation across their business operations.

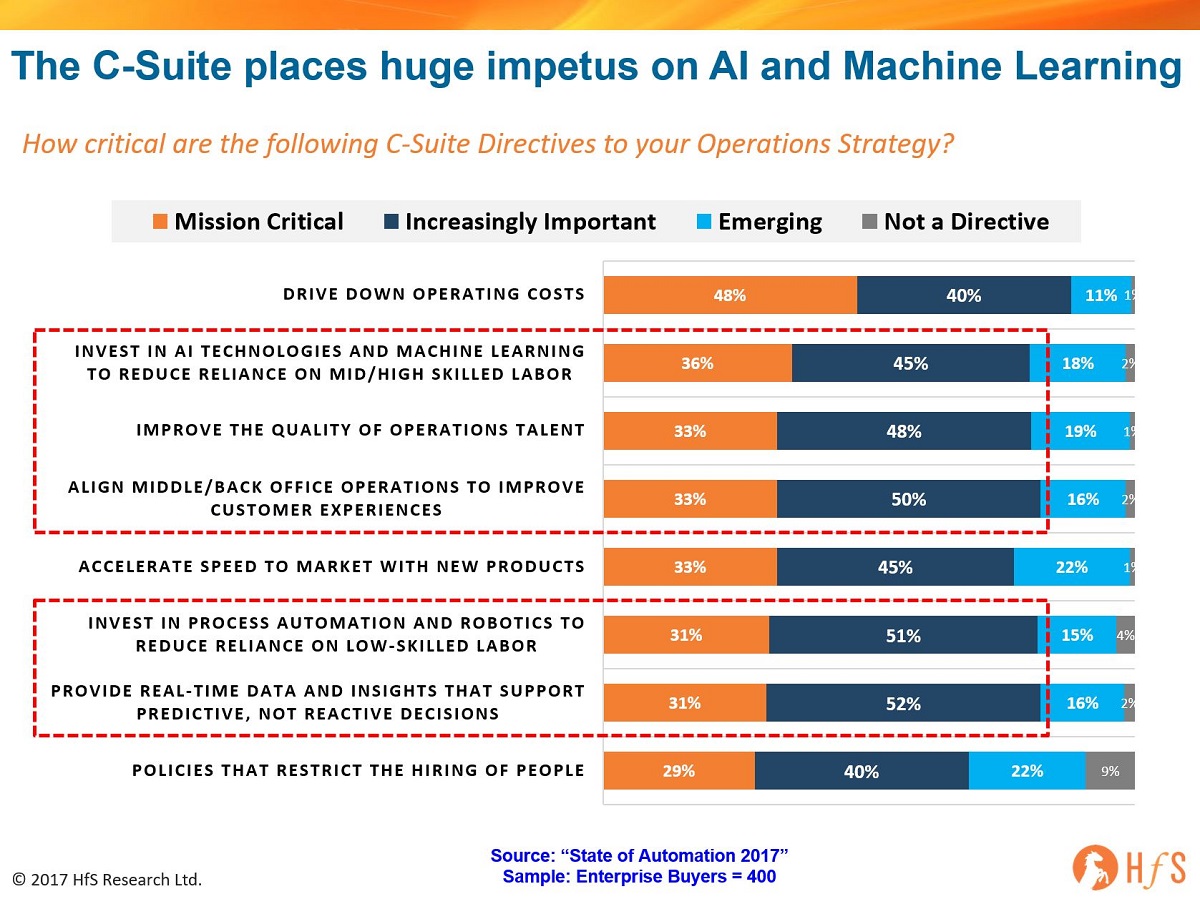

But let’s start with the hype: AI and Machine Learning is now one of the most critical strategic directives being dictated from the C-Suite onto the operations function

81% of operations leaders are feeling the pressure from their bosses to reduce the reliance on mid/higher skilled labor, viewing AI and Machine Learning as increasingly important or even mission-critical directives to drive this. Only cost reduction beats this out as a priority, but as we all know, we can’t reduce costs much further without investing in our digital underbellies:

What’s clear is that enterprises are frantically evaluating their talent (81%) and looking to collapse these silos in the middle/back offices to improve their customer experiences. And they see AI, Machine Learning, and process automation as the levers to achieve this.

So let’s summarize the key findings from the study, and you can download your copy here :

- Automation is the number one strategic priority four-fifths of enterprise C-Suites are placing on their operations. Enterprises see AI and machine learning (81%) and process automation and robotics (82%) as important C-suite directives toward operations strategy – higher than any priority other than cost reduction.

- 98% of enterprises have an automation agenda, but a third already have embedded it into their service delivery. Every organization today needs to have an automation strategy and that is reflected in the responses in our survey; only 2% suggest not having a strategy as of now, while 20% are in the process of formulating their strategy. Already, 31% of enterprises are integrating automation into the fabric of their service operations. Others are setting up dedicated CoEs (18%) and working with service providers (13%).

- Corporate leadership and IT are most active driving the automation agenda. Decision making is increasingly being led by the CEO (54%), CIO/IT Director (57%), and CFO/Finance Director (35%). Additionally, a diverse group of automation influencers and stakeholders emerge, notably the finance department (49% consider as influencers), procurement (47%), data center managers (51%) and purchasing managers (48%).

- Deployments of RPA as well as AI starting to scale out with varying degrees of maturity. RPA is seeing rapid adoption and AI will become mainstream in two years. More than 70% of customers are planning to deploy RPA over the next two years and more than 50% believe that AI will be applicable for a broad set of processes within the same timeframe. Therefore, investments, planning, and training of talent around the notion of Intelligent Automation is pivotal for staying competitive.

- Many customers are in an automation dichotomy: they want automation to drive long-term quality and agility, but need rapid cost takeout to sell the ROI. For a significant number of enterprises, their automation strategies are expected to deliver, primarily, better quality of operations (52%), more workforce agility and scalability (49%), and superior data accuracy (48%). Only a minority of respondents are seeking short-term cost savings (21%) or a way to displace employees (12%). However, when you ask what is inhibiting automation adoption, the top criterion is that the “Immediate cost savings are not high enough” (35%), indicating a disconnect in expected benefits and business case.

- Satisfaction with initial automation deployments is mixed as customers struggle to define success and execute against it. Only a little over half the enterprises (58%) that have gone down the RPA path are satisfied with the level of business value and cost savings from their implementations thus far. Enterprises that have yet to explore technologies like RPA point to struggles with establishing business cases (41%), while 30% expect that automation capabilities will be absorbed by enterprise applications in the next five years. In addition, many enterprises struggle with developing an effective centralized governance structure for automation initiatives, citing that projects are too siloed, don’t have success milestones established, and lack organized training to use the tools effectively.

- Despite the growing pains, RPA is starting to be used effectively in this era of innovation and the current satisfaction results reflect this. IT operations have the most satisfied clients for both cost savings (70% satisfied) and business value (72% satisfied), followed by marketing (70% satisfied with cost) and procurement (63% satisfied with business value). Regardless of the level of satisfaction on cost and business value as of today, operations leaders are making incremental progress, one process at a time. In the interim time between sawing off broken processes and legacy systems and replacing them with costly new systems and services, RPA seems to be helping enterprises get some level of access to new business value from their current processes.

- Automation Centers of Excellence (CoE) proving a major success. Of organizations with the CoE approach, 88% believe that the automation CoE has been effective in delivering business value (scores of 4 or 5 on a 5-point scale). HfS has been hearing advisors in the RPA arena claim many clients are failing miserably with their CoEs, but this data proves, beyond doubt, these are scare tactics and those customers who are centralizing automation projects into one governance team are already reaping significant benefits.

Posted in : Cognitive Computing, Robotic Process Automation, Sourcing Best Practises, the-industry-speaks

Great study, Phil and team. I recommend anyone interested in AI/automation read this. Kudos for providing this

Thanks Phil – good insights.

Great study Phil and team. Particularly like the breakdown of what’s important in terms of "increasingly important" and "emerging".