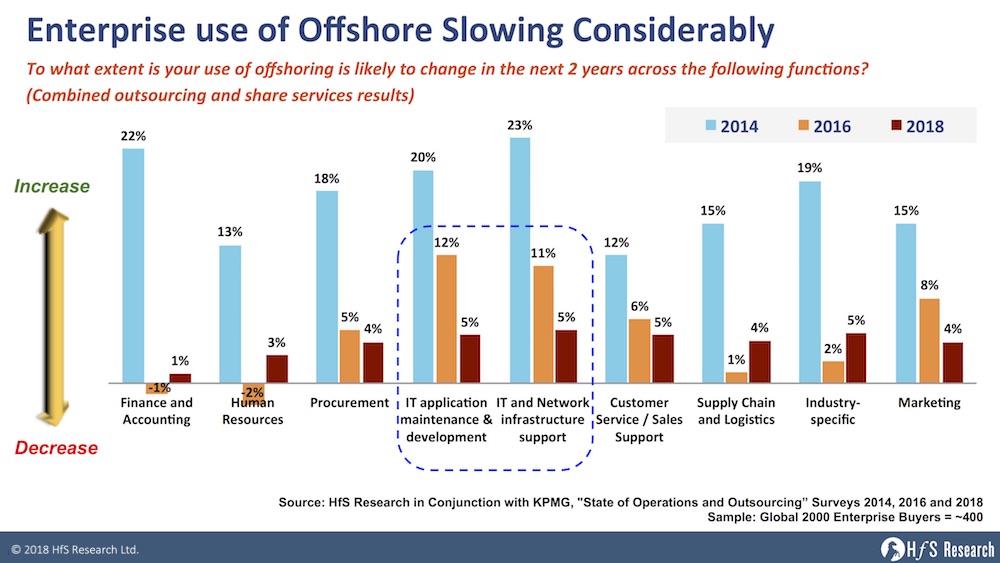

What a difference an election makes. When we ran our State of Operations and Outsourcing study in 2014 (mid-way through President Obama’s final term), Global 2000 enterprises were still planning to increase their short-term investments in offshoring their IT by more than 20%. When we re-ran the study in 2016, offshoring intent was clearly dropping to a 12% intended increase (which is a realistic number for a saturating market), but this year it has nose-dived to a mere 5% increase, which is a clear result of the anti-offshoring sentiment that has hurt offshore-centric deals:

I discussed this trend with one of the lead partners at ISG, the offshore outsourcing industry’s largest deal advisor, and he shared that Trump’s stance against offshoring was considerably slowing down the deal cycle for his firm, and he was even seeing some outsourcing deals going to the likes of Accenture and IBM because it created the façade that work was not being offshored (even though it was). Yes, this is the kind of stuff that happens when a president likes to get fast and loose with his twitter account!

However, while Trump’s open attacks on American firms using offshoring stoked panic into many paranoid C-Suites, what really transpired was a rapid shift in how US firms are viewing their partnerships with global service providers. Today’s reality is technology has become core to business competitiveness by creating new revenue channels made possible by interactive communications technologies with customers, by simplifying business operations to support the business with real-time data, and by supporting broader processes that respond to the needs of customers, as they occur.

Offshoring may be slowing, but the services business is in its best shape for four years

The healthy trend here, for the future of IT and business services, is the fact that the industry finds itself on the healthiest growth footing since 2013 – so clearly offshoring is no longer the primary driver behind IT services investments:

President Trump merely speeded up the development of global services from a cost-reduction to a business-value proposition

Many enterprise leaders are clearly no longer thinking, “How can we shave some more cost off our annual IT budget by moving more work to India?”. Instead, they are thinking, “How can I get quality services delivered at competitive prices that take advantage of the cloud, automation, and global talent.” The subtle shift here is clearly one from an obsessive focus on low cost, to one of getting quality services as the industry matures, where there are many leverage points to find productivity gains, beyond merely relying on FTE rates. The more pricing shifts towards outcomes, volumes and KPIs, the less visible offshoring becomes as a cost-lever.

When you buy electricity, do you care where the supplier houses its generators? When you use public cloud services, do you bother to question Google, Amazon or Spotify where they house their massive data farms? It’s the same when engaging with IT services firms to get work done: business operations leaders are barely thinking about where they are located anymore – and all President Trump has done is shifted the optics, compelled the leading India-heritage firms to make substantially more onshore staff investments – which they needed to do in any case – as the nature of IT work is driving the need for greater client intimacy and physical proximity between service delivery staff and client staff.

Traditional outsourcing is being replaced by partnering, and “offshoring” is not even part of that conversation

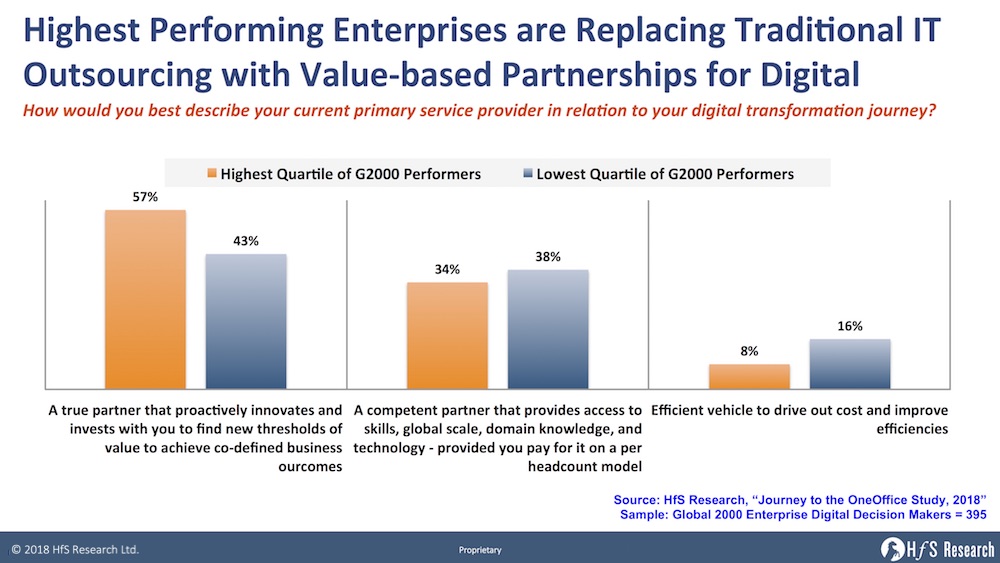

Our recent study looking at digital transformation to the OneOffice reveals that the majority (57%) of the highest quartile of performers in the Global 2000 (based on revenue and profitability) view their primary service providers as supporting their digital transformation roadmaps, as co-innovation partners helping them achieve co-defined business outcomes. Only a third viewed their service providers solely as a resource to provision skills and scale via a headcount model:

This data speaks volumes – enterprises digital leaders need providers which can work with them to achieve outcomes that are increasingly challenging – most no longer requisition 500 developers per year to code in ABAP for strategic initiatives – that is a commodity practice today, usually delegated to lower level manager to lead. Nearly all G2000 firms, today, have a Chief Digital Officer tasked with taking their companies through significant business model change, enabled by smart technology provided by partners which understand what is required. Whether the talent for these strategic projects resides in Bangalore, Basingstoke, Bucharest or Baton Rouge is moot – this is about getting results where top talent is hard to source, and the location is just not very relevant anymore.

The Bottom-line: Trump did us a favor and ripped off the legacy Band-Aid for the services industry

Trump’s stance on offshore outsourcing sparked two behaviors which have set up the future of services to be far more value-driven and business oriented: All the major Indian-heritage service providers have been aggressive adding 10,000+ staff right across North America and Europe. Several are also embarking on ambitious acquisitions of niche onshore digital firms (both creative and tech-driven) to engage themselves higher up the foodchain within their clients and be considered for more lucrative digital engagements where there are deeply engaged with their clients redesigning business models that need sophisticated technical support. So while the industry suffered from a couple of flat years trying to squeeze the last vestiges of life out of a dying body-shopping model, the new reality is a global delivery model that is now embedded in engagements where the focus is much more on business value and outcomes than prehistoric effort-based inputs. We are also entering an era where the likes of Cognizant, Infosys, TCS and Wipro will cease to be called “Indian providers” and merely be referred to as global IT services firms. Location is irrelevant… expertise most definitively is not.

Posted in : Digital Transformation, IT Outsourcing / IT Services, OneOffice

Big difference between the death of a moniker called #offshore #outsourcing and the actual demise or decline in the use of remote or low cost locations. The moniker was long past its life expectancy and kept alive more by analysts and media than by buyers and vendors.

@Sunder – is a fair point that we rarely use “offshore” in an industry context anymore, but clients do still evaluate how much work gets done offshore versus onshore…

PF

‘The reality is technology has become core to business competitiveness today’. True and while cost will continue to remain a key driver, technology is creating more avenues for innovation than ever before.

Offshoring is dead … Welcome BOTshoring.

Offshore companies don’t have the DNA to pivot, let’s see… interesting times Phil.

@Nitin: Some will – and already are pivotting, others will never even come close… change doesn’t come to everyone easily, until it is too late,

PF

This is brilliant insight. HfS doesn’t so much have its’ finger on the pulse, more so it’s actually plugged into the Matrix like Neo. Except perhaps it took its’ own orange pill…

Trump’s comments sparked two trends: Indian IT companies started hiring more in US and acquisitions in digital space

Like the “rip bandaid off” line

Great insights. A few questions though: Does this mean offshore services are moving onshore? Or, is the size of offshore business shrinking because of automation and digital transformation initiatives; impacting services and offerings which are the first ones to get automated? Trump’s policies may have accelerated such initiatives than influencing companies to move their offshore activities onshore.

My view is offshore businesses are evaporating(due to automation) or moving onshore as due to automation cost arbitrage is reducing.

@Shailendra: The trend to automate more processes was already in play, but Trump’s policies created the weapon to pull back much more aggressively with offshore. PF

Cost is always one of the prime factor for any buyer, be it product or services. But some service providers have been reinventing themselves to be relevant and futuristic in a competitive market to cater to buyers of varied needs. While Trump’s policies are a warning bell for offshorers, it’s also a forced conversion of offshoring buyers to become value buyers.

As I recall, past surveys showed that providers fail to meet expectations regarding innovation and applying new technologies. So, while this new data shows a positive trend, one that has been predicted for a few years now, it is up to the providers to “show us the money” so to speak and demonstrate that they can apply automation on cloud platforms that underpin strategic initiatives.

I am looking forward to this next wave. It should be good for everyone.

@Paul – there’s lots of talk and several many challenges, but the data has consistently shown several providers have upped their game in recent times. The rub here is this increased focus on partnerships with providers from ambitious, high-performing clients – the old model of simply hiring providers for cheap delivery will continue for many, but this partnership model is the real future of our industry and it is really happening,

Cheers old chap

PF

When having been involved in back office BPO more than 15 years ago, it already was an obvious learning that wherever possible, tasks should be automated by clever technological solutions. Offshoring any tasks to a low-cost location was second choice. For me, this was a step towards an industrialisation (= automation and preferably standardisation right away) which was a first move towards digitalisation in the back office.

As the article rightly explains, new service models, cloud based offerings are major drivers in IT. In the specific case of outsourcing of application development and maintenance I see lots of formerly manual tasks or consultancy replaced by tools or platforms. This is where we try to focus on as a small niche player with our SaaS tools (https://www.plixos.com/en).

Still, classical offshoring of application development is remaining at a certain level. We have just finished two offshoring initiatives, one by a German customer as well as one from the US. In both cases, main driver was scaling up the development team with a focus on high quality by keeping the costs. In simple words both were looking for “an option to ramp up at good quality for the money”. Worth to mention, the German customer as well as the one from the US selected Eastern Europe as their preference.

In sum, your statement “How can I get quality services delivered at competitive prices that take advantage of the cloud, automation, and global talent.” is right to the point.

The India GSI model was never based on investment, transformation but on cost mgmt. Now that the Global 5000 need dynamic partners to complete with the Tech 10k they need partners who are “real” experts have true references & quals in their focused book of business.

India GSI’s investment “void” of the last 10 years is so large, they can never overcome it. Having worked 15 years for one of the top 3 Indian GSI’s and trying to spend 5 years as a sub-BU head trying to transition talent, processes, solutions, client line of business services, etc.. There is not the ability to cull the legacy businesses, processes, models, etc..

Where is the vision, strategy, investment, model changes. The Indian GSI’s investment is 5x less then US GSI’s (SG&A/Talent/Training/invest deals for quals) Huge stock buy-backs, BAU Ops driven models, Selling more to IT or Corp backoffice is all there is. The US GSI’s are getting hammered by “new model” SI’s who are small and selling directly to the LOB’s. The new SI’s which are spending 25-35% of revenues on investments in people, process, tech etc.. while offering real Line of Business solutions.

The idea of ‘value-based partnership rising from the ashes of dead outsourcing model’, resonates with our message to the customer

• Old World : We’ll drive down your cost (Outsourcing/Offshoring)

• New World : We deliver value to your business (Digitization, AI/ML/Automation/BOT-shoring et. all. And KPI-based / output-based Managed Services through non-linear business model)

• Next World : We not only invest in your ecosystem as partners, but also share your risk! (IP Partnership around Products & Platforms)

The concept of customer & service provider is becoming blur. Change in inevitable. And the is change is for betterment.

In the conventional offshoring model, the customer was taking interest in and responsibility for the quantum and nature of work to be done at the low cost location. Returns were mainly measured through cost saving. The customer will still expect the cost of the outcome to be optimum. Pricing pressures will continue to be there. The provider or partner will have to take the responsibility of deciding how much work can be done at the lower cost location while ensuring that quality and on time delivery is achieved. This will encourage the providers to enhance the skill and capability of the offshore teams, to remain competitive. The teams interfacing with the customers will also have to be strengthened to take over the role that customers will transition to the providers.

“True that the traditional offshoring practices has been affected by Trump’s stance against it. The idea for having a redefined business model which delivers more value to businesses rather than just reducing the overall cost was already on its way in IT Industry due to rise of automation before his arrival. Many providers have already started shifting to more innovative service delivery models for their customers especially for offshoring ones. Value based Outsourcing is more prominent as customers look to ramp up their business and increase scalability rather than just hire providers for cost savings. Therefore a shift from traditional offshoring business model to digitalize and innovation driven outsourcing whether offshore/nearshore/onshore is and will be the futuristic business model.

Importantly, one should evaluate the benefits and values in all the cases offshoring/on shoring/nearshoring or might be an in-house team building for improving productivity along with saving time/money and energy of-course. In the light of above we see that many of the 3rd party consultancies will be replaced by online platforms just like Amazon, Google, etc. This will be the beginning of real globalization and industrialization in IT Sourcing. As the cloud services strives to provide organizations automation in many manual tasks, we try to focus on this as a niche player in IT Sourcing with our Marketplace and SaaS tools http://www.plixos.com/en/products