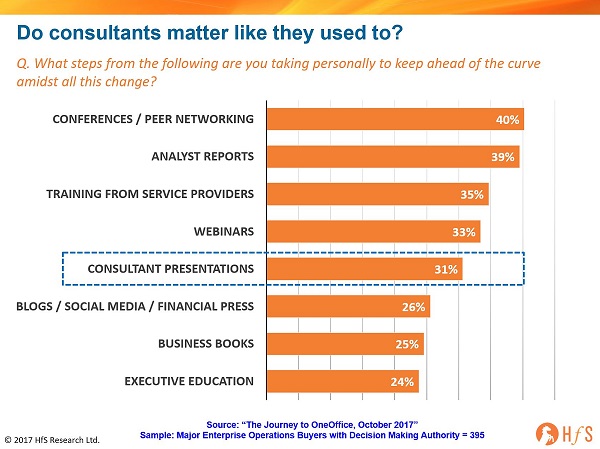

Over the last 15 years, we’ve witnessed the rise and fall of the sourcing consultancy. Clients needed help finding the right services partners – at the right price points – and the likes of EquaTerra, TPI (now ISG), Everest, Alsbridge were there happily to oblige. Today, only ISG survives as a credible boutique sourcing advisor, while the Big 4 have moved into developing sourcing practices of their own. However, new data from our soon-to-be-unveiled, Journey to the Digital OneOffice study, conducted with the support of Cognizant, shows that decision makers for business operations are looking largely to other places to stay ahead of all this change:

However which way we look at this, not even a third of decision-makers are relying on consultants in this ever-confusing market, when you would have thought consultants would be licking their lips at the opportunity. Don’t these guys feed off confusion, hype and nervousness from the well-resourced enterprise leaders, only too keen to pay their rates to get a steer on what to do next? What’s going wrong here?

Consultants just don’t do research. For example, I have yet to see a single set of publications from any of the sourcing advisors examining the performance of the RPA solution vendors. There are a million best practice pieces, but nothing of actionable substance. Clients want substance, not just the fluff. Clients are shifting to soliciting help from firms which can do the work and have the proven knowledge to support it, which is why so many are resorting to analyst reports to figure stuff out.

The MBA bus can’t find its usual parking spot in the visitor’s parking lot. As the demand for expertise in areas such as complex operating models, understanding murky automation challenges and being able to design outcomes-focused models is reaching unprecedented proportions, it’s just not possible for the traditional gaggle of consultants to serve up the inexperienced kids with their Visio charts and park them in the basement for six months to come up with a plan. While most of these people are brilliant, many don’t really know what they are doing. For them, doing RPA and automation tool selection is just plain scary.

Enterprises need consultants with deep, relevant and up-to-date experience. This market calls for hands-on experienced practitioners, skilled in understanding modern solutions and real change issues, who are prepared to roll up their sleeves and live their clients’ pain to find the answers. Simply rebadging outsourcing deal negotiators as robotic or digital experts does not work – these guys need serious retraining if they are to stay relevant in the current market – it’s not like the old days where you could hide behind some fancy new acronyms, utter the phrase “digital disruption” in every sentence, and promise “innovation”. Noone wants promises – they want real business cases, with genuine milestones and measurable, proven impact. They also want people who have got their hands dirty with these emerging solutions and can articulate how they can align to their processes and business models. In short, you can’t get away with half the bullsh*t these days…

Service Providers are in direct competition these days when it comes to transformation support with automation, digital and AI. In the heyday of sourcing advisory, advisors and service providers fed off each other as advisors cultivated clients and brought business to service providers, and service providers returned the compliment when they had clients in need of independent advice. It was a perfect symbiotic relationship. Now that model is rapidly atrophying as these two entities increasingly find themselves now competing for the same dollar. Let’s makes no bones about it, advisors and service providers are now in direct competition for supporting clients with their transformation journeys. Most the service providers are now offering intermediary services to provide automation strategy, implementation and delivery to enterprises, catering to whatever technology tools and platforms the clients require. As you can plainly see above, many operations leaders are now getting more value from them than they are from their advisor relationships. Clients can call on Genpact, TCS and Wipro these days, as much as they can KPMG, EY and Deloitte when it comes to the new stuff.

While service providers are integrating upwards into advisory services, advisors are integrating down into annuity services. Most the advisors are now evolving themselves as service providers and annuity-based revenue models in areas such as cyber-security services, blockchain services, managed RPA services – and even payroll services in certain countries. KPMG even declared it was in the Workday managed services market.

However, we might be on the cusp of a whole new era of new digital operations advisory boutiques, equipped to help clients make sense of it all

What gives me hope that we haven’t just witnessed the demise of the sourcing consultant, is the emergence of several small, but highly practical, boutiques of mid-career process guys who are in serious demand – and some of them are scaling up at a breathtaking pace – and we’re seeing some serious hitters make the jump from established consultancies to lead these boutiques, such as David Poole and his excellent team at Symphony, Paul Donaldson who has just moved from leading ISG’s RPA practice to being the new CEO at Robiquity with a very compelling automation bootcamp, Mohit Sharma and his determined drive from Down Under with Mindfields, the brand new “Agilify” (not quite launched) that Lee Coulter will head up as a new initiative from healthcare giant Ascension Health, Jan Rapala’s NEEOPS, driving RPA advisory from central and eastern Europe, Christian Voigt’s compelling Roboyo business emanating from Germany, and Richard Jeffrey’s ActiveOps firm, which is driving Workware, a back office optimization solution with a strong alignment to RPA effectiveness and now expanding aggressively from the UK to the US market. I’ll stop there for now, but there is a significant influx of very smart, experienced operations experts branching out and taking advantage of a market where clients need hands-on real help – and need it fast.

The emerging advisory market is about hiring people with the capabilities to understand client outcomes and implement solutions using the right mix of new tech on the market. What’s more, most of these consultants are relishing working in a boutique environment – it just feels like the age of the boutique is coming back, and we will see several more of these spring us with the barriers to entry still pretty low. Only GenFour has got absorbed (by Accenture earlier this year), as a first-mover in RPA implementation, but I’d be surprised if many of these other boutiques really want to get swallowed by the mega-firms… most seem to be hell-bent on building up organically in this market.

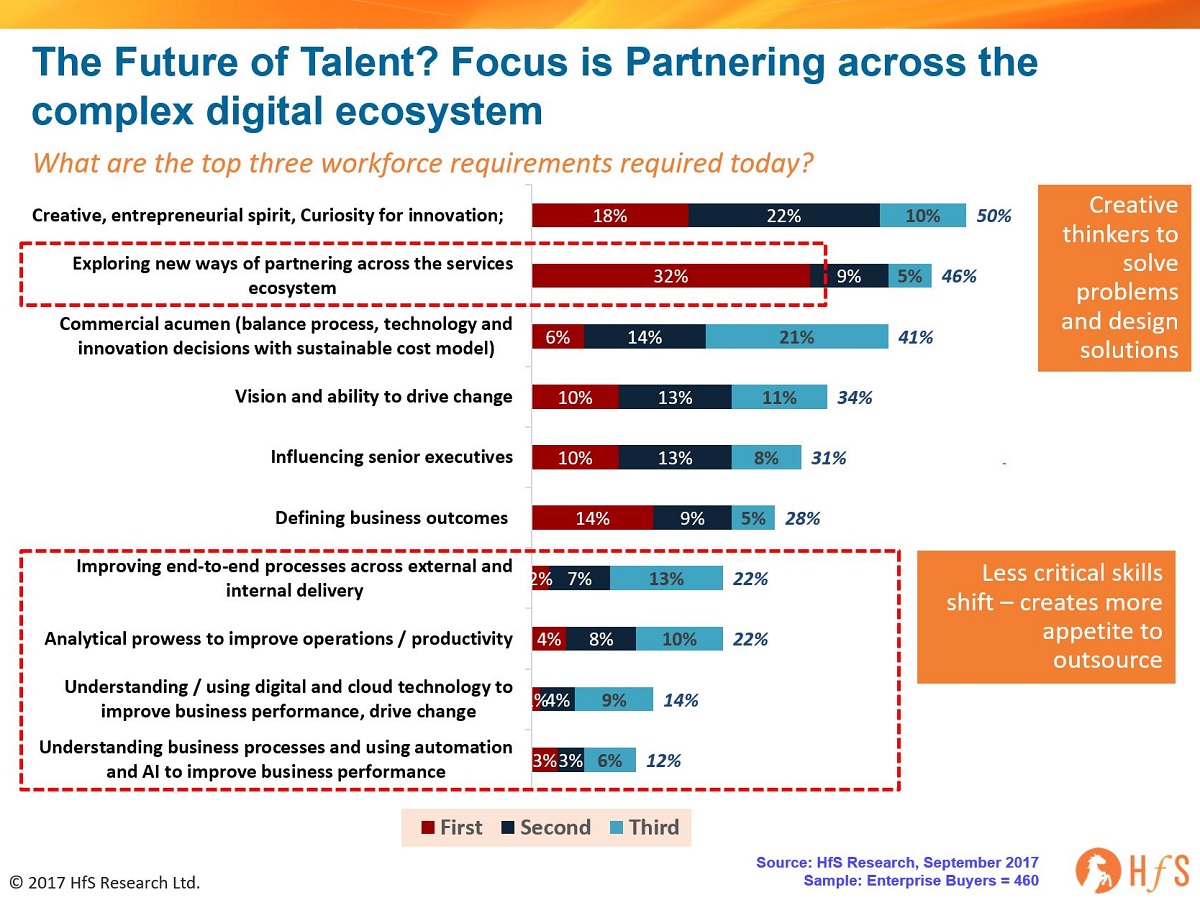

And there’s another reason why these emerging boutiques are so compelling… many have the emerging skills to support enterprises with their number one talent requirement – the ability to partner across these increasingly complex ecosystems of RPA, AI, and digital firms to help them:

While the traditional consulting firms have continued to bury themselves in supporting the “left-brained” areas of process delivery, digital tech etc., where clients really need help right now is understanding how to cement the right partnerships across the digital operations ecosystem to truly understand these change agents and devise the right plan to achieve their outcomes. Net-net, it’s not just about left-brain support these days, it’s about entrepreneurial, savvy, “right-brained” capabilities and nimble boutiques are able to mix up their teams with the talent clients really need to address the complexity.

The Bottom-Line: The digital operations train has already left the station and not all the consultants are on it

It’s not all doom-and-gloom in the management consulting firms, as KPMG’s Cliff Justice leads the firm’s AI strategy, with some promising key industry partnerships, most notably with IBM Watson, and Dave Brown’s SSO advisory is leading the industry with RPA transformation revenue; EY has jumped in aggressively with strong RPA deployments; ISG has held onto Chip Wagner, one of the first advisors to “get” RPA during his time running Alsbridge; Deloitte has developed its own brand of “process robotics” with some eye-opening projects, such as their work with NASA, and PwC is boasting some impressive work with the likes of Tesla, as it seeks to make up ground on the rest. The challenge is how to support clients with the experienced talent which actually understands how to implement this stuff in a way that is affordable.

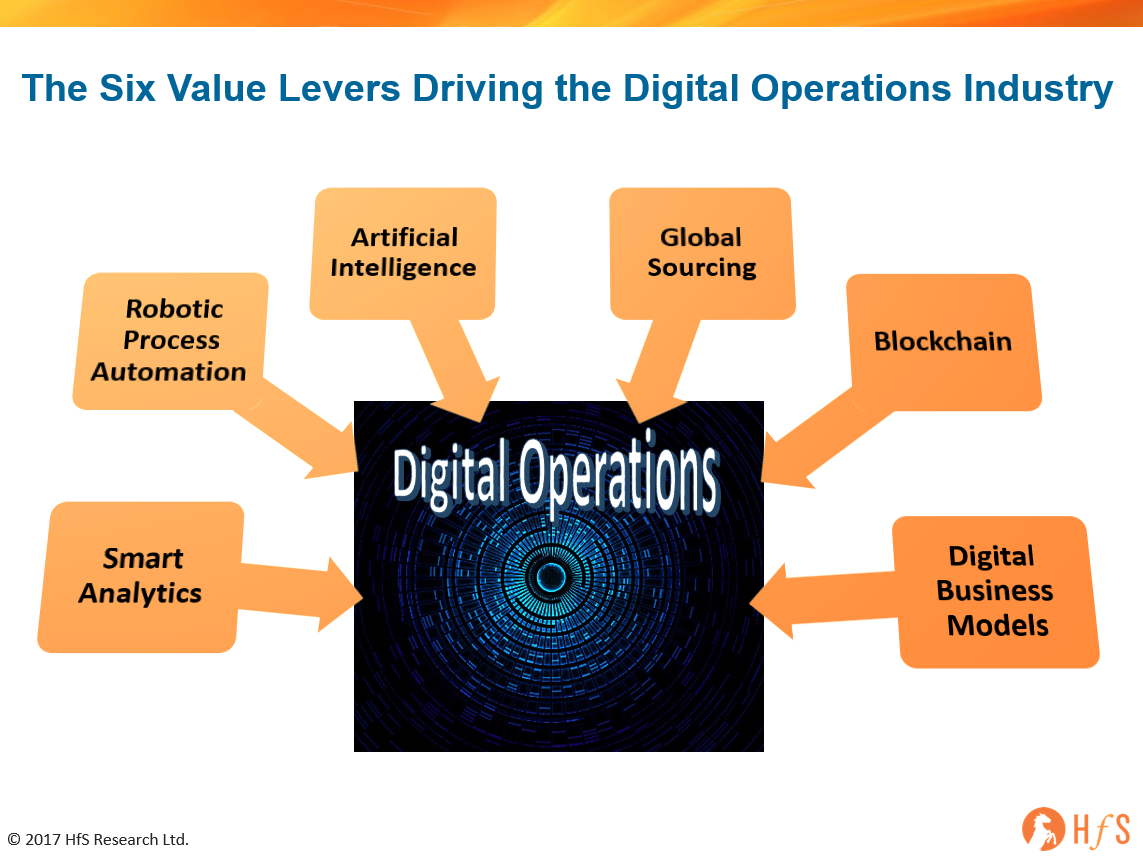

However, the change upon us is seismic and we need advisors which can surf the wave of change agents forming the new Digital Operations industry:

In short, the worlds of software, business operations and services have always been chasms apart – different mindsets, vernaculars, conversations, ideas of what constitutes value – and vastly different cultures. Software people never understood the operations folks and vice versa – each thought they were top of the corporate food chain.

However, the past couple of years have seen the coming together of these diverse groups of people to rethink completely how we run global operations in this robotically digital era (or whatever we want to call this curious period of time in which we exist). What’s uniting this array of industry players is the fact that we’re all now in the business of addressing clients’ desired business outcomes, as opposed to simply selling them some product or service with some vague ROI attached to it. And those desired outcomes are unifying around the fact that nearly all clients are under immense pressure to become digital businesses with touchless customer interactions, supported by digital operations to make it all possible.

One thing is abundantly clear: the outsourcing phenomenon which has gripped the Global 2000 over the past decade is making way for a genuine industry in which we all play a part – an industry where we have no choice but to develop learning programs, sustainable business strategies and make real, actual investments in order to survive. And what’s most fascinating are the new conversations that have rapidly emerged to bridge this divide between the technologists and the business operators.

Suddenly, we’re talking about business logic, about datasets, about redesigning processes with genuine business outcomes in mind. We’re talking about deep learning AI systems that store what has been learned in the past, take notes of how variables and results have changed under different scenarios and then make decisions based on that.

The narrative has radically changed and the focus is now firmly on bringing together all the components that can escort us to this promised land of Digital Operations. And the firms to take us there might just not be the ones who got us here in the first place…

Posted in : Digital Transformation, Outsourcing Advisors, Robotic Process Automation

Phil,

This is the best piece I have read on where the whole advisory space is going. Your data reflects what I am seeing in the market – traditional advisors are scrambling and a lot of the best individuals are moving to small firms where they can get more involved in these emeging opportunities. It’s early days, but I think your view is correct – there is a new set of advisors emerging who are better placed to help clients,

Jason

Interested to hear more about the behaviors of Service Providers providing guidance: Is this truly transformative i.e. will they apply transformation to their own labor-based revenues or just sales disguised as “consulting”?

@Simon – am seeing service providers offer transformative deals to win greenfield business (especially from competitors), but most are not being so compliant with their own legacy deals, where keeping the status quo is optimum… the only game changer is when the client itself threatens to dislodge the incumbent. So a mixed bag is what we have currently…

PF

Phil, I’m particularly interested in hearing the experience of those who have been brave enough to tie true cost to outcomes achieved over our typical volume/time pricing models. Good topic for HfS!

@Simon – It’s all work in progress for most engagements when it comes to automation – sure, there are some aggressively productivity plans in place and the onus is on the provider to deliver (some as high as 50%). Not seen any definitive results yet… when we do, we’ll shout them from the rooftops =)

PF

Phil – agree with most of your points, but the extolling of the “right brain techniques and nimble consultants” is a bit reminiscent of the boutique Internet consultancy era (e.g., US Web, CKS, CTP, US Interactive, Sapient, et al) and we know where most of them ended up, though I blew their collective horns at the time. Scale as always will be important as will a full service set of consultative offerings – i.e., being address to actually address change and talent management, risk, compliance, cyber-security, contractual, etc. issues vs just highlighting they are important. Market consolidation is inevitable as is the blurring between IA advisory services and actually managing, hosting and delivering IA services. Boutiques will help mature the market and pressure the old guard but legacy consultancies have solid capabilities, albeit only when they can get out of their own collective ways. .

@Stan – I blew some of those horns too, back in the day. The difference today is the conversation is about bringing the back and front office closer together using technology we just didn’t have back then. Some of the big consultants are (slowly) getting it, but the big issue is the type of support needed is shifting to much more nimble, outcome thinkers who can get their hands dirty at the same time. Clients need more than the big sparkling strategy abd fantasy business case… they need hands-on support and a reality check like never before. Will all the boutiques make it? Of course not… but there’s definitely change in the air and we’ll see some roadkill before this chapter is over…

PF

@Phil – yes, nimble and new approaches are key, with the former not always the forte of legacy consultancies with big revenue targets overall and per key account. Lots of opportunity out there beyond the “usual (consulting) suspects.”

Phil finally got to read this …. you hit bulls eye …. we are seeing this in our business. Our Transformation Services now 20 % + of our business is growing @ 25 % + and in 3 years could become 40 % of our overall business. Practical execution and roadmaps to actual outcomes are winning the day ! …. very well called out and perfectly timed …. Tiger