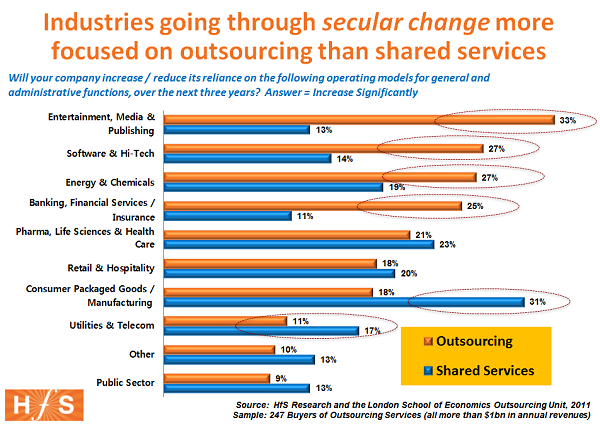

Our recent State of Outsourcing study, conducted with the Outsourcing Unit at the London School of Economics, has revealed that nine out of every ten enterprises will be increasing or maintaining their reliance on either, or both, outsourcing and shared services over the next three years. The key is to identify, at the industry level, what factors are influencing these increasingly aggressive approaches to global sourcing strategy.

The study has uncovered many home-truths about why some organizations are more motivated to externalize their support operations to third-parties, while others prefer to focus on their own shared services investments. We can also evaluate organizations within specific industries that are seeking to assign equal significance to both outsourcing and shared services as they pursue a holistic governance framework across both models.

So we’ve taken a closer look at how 250 large organizations, with annual revenues greater that $1 Billion, are intending to make significant planned investments in either, or both outsourcing and shared services models over the next three years:

It’s plain to see that it’s organizations within those industry verticals experiencing fundamental shifts to their economics, which are more prepared than ever to admit they need to look outside of their current organizational boundaries to keep their business operations competitive. Simply-put, secular changes to industry environments are crystallizing options for businesses and driving more radical and actionable behaviors from executives under pressure to deliver continual productivity improvements. The radical impact outsourcing can potentially have on business performance is clearly becoming more attractive to those businesses in the throes of tackling fundamental challenges and opportunities to their business environments.

Buyers are getting savvier at focusing their outsourcing plans to improve their competitive advantage

Increasingly, we are seeing a realization that retaining some processes internally isn’t – in any shape of form – bringing organizations a competitive edge, and these sourcing decisions are no longer only about cost – they represent a fundamental change in the way business leaders now view outsourcing as an integral function of their operations.

For example, many of today’s leading banks do not lead their markets because they process mortgage applications better than their competitors. Their management teams typically prefer to find a services partner to process them at lower cost, using industry-standard process flows and technology, while it focuses its internal competencies on business functions that can help the bank gain marketshare, such as smarter customer targeting, or upselling new product through customer support channels etc.

Similarly, most of today’s leading insurance providers have already embarked on long-term engagements to have their claims processes managed, processed and adjudicated by third-parties, allowing their internal talent to focus on market-leading initiatives, such as competitive advertising strategy and new service development that can help them gain an edge over the competition. Customers do not care about how their claims are processed – they care about how much their policies cost, the additional benefits they can receive as customer and the brand and reputation of the insurance carrier.

In addition, does a retailer really need to maintain its entire application portfolio inhouse, when it can devote its internal talent and IT resources to improving its customers’ online shopping experience, where it can actually grow its business?

Today’s buyers are getting a lot smarter at figuring out how they can improve their organizations by using the resources and knowledge available through third-party relationships.

Industries experiencing dramatic secular shifts are developing long-term aggressive outsourcing strategies

The five most bullish industries planning significant increases with outsourcing, are not only basing their planning on achieving ongoing cost-reduction outcomes (read here for more on this topic), but also because the fundamentals of their industries have dramatically shifted in the recent past, for example:

» Entertainment, media and publishing: The crash of newspapers and network news; The Web 2.0 impact; Radical new distribution and business models.

» Software and Hi-Tech: Rapid commoditization of packaged software models; Impact of Cloud computing on licensing and pricing dynamics; Dominance of India, China and other low-cost nations to drive out the cost of development; Willingness to “Eat their own dog-food” as providers of outsourced services themselves.

» Energy & Chemicals: High price volatility for oil products; high capital costs of oil exploration projects; Shortages of talent; Aging infrastructure and constantly-changing compliance requirements.

» Banks: Massive de-leveraging; Re-regulation; Unprecedented debt/credit pressures.

» Insurance: New compliance measures (Solvency II, ObamaCare) causing unprecedented administrative cost and workload; Shortage of risk analysts and actuaries to take on the higher level work.

There are just a few examples of major industries, being shaken to their very foundations, where we can discuss secular shifts driving unprecedented demands on organizations to remain competitive. HfS believes it is no coincidence that it is these industries that are today the most aggressive with embracing third-parties to redefine their global operations? Secular changes drive bolder, more radical behaviors, and it is already clear that a more aggressive approach to outsourcing is high on these organizations’ agendas.

Industries that have already experienced much of their secular changes in the past are more focused on investing in shared services frameworks

These businesses are typically reactive to market conditions and often radical long-termism doesn’t fit as well with their mentality, especially when faced with uncertain times ahead. In addition, many of them have already shaved their operating costs to the bone, hence digging out new productivity benefits via outsourcing is often challenging – and mistakes can prove fatal in a low-margin business.

» Industries such as retail and manufacturing, one can argue, have already been through their secular shifts over the last three decades or more. While they have had to experience much fundamental change, for example mass globalization of markets and volatile changes to consumer spending behaviors, the very essence of these industries is still the same – their organizations are focused on inventory management and supply chain optimization, maintaining operating margins and accurately predicting demand. To them, outsourcing has always been an option, and has been readily explored over the years to find more pennies to save. So while economic conditions may have been vicious, focus on short-term cash-flow has clearly been the priority for many in these sectors, and radical overhaul of operational infrastructure clearly not an attractive option.

» Utilities are also proving to be more conservative with outsourcing, with a strong shared services focus. While many of the large utilities organizations have been among the earlier adopters of hybrid outsourcing and shared services models, many of them have not felt such secular change as many of those industries that were more dramatically impacted by the 2008 crash and many of the fundamental shift mentioned above.

» While there are many active outsourcing engagements – both existing and new – in telecom and wireless, HfS sees more these engagements as relative small in scope as these firms opt for more incremental, conservative ventures into outsourcing. For example, several major telecom firms are evaluating smaller BPO initiatives in areas such as sourcing and transactional accounting, and still prefer to engage in several smaller multi-vendor engagements in the ITO space.

Hence, it’s no surprise that these organizations are more conservative with their long-term operational planning. Moreover, many have proven to be heavy outsourcing adopters in the past, and we expect these sectors to remain focused on maintaining their outsourcing initiatives, but with a large proportion opting for a more reserved approach, with increased focus on improving, and in some cases expanding, their internal shared services competencies.

The Public Sector: Facing up to unprecedented challenges

One industry which is going through more secular change than any today is the Public Sector. Quite simply, national and local government bodies are under unprecedented pressures to drive austerity measures and make long-term plans to drive new productivity programs. This explains why 55% of public sector bodies actually foresee some moderate increase in outsourcing activity over the long-haul. Huge political bodies, such as the US Navy, NASA, the UK Inland Revenue and National Health Service – and even the FBI – all outsource elements of their operational support functions to varying degrees. With increased onshore delivery resources becoming available from several providers, this could well turn out to be a surprisingly large growth sector for outsourcing.

The Bottom-line: New fundamentals are creating new rules to manage one holistic and comprehensive outsourcing and shared services strategy

Outsourcing is entering a new era – one where organizations can no longer afford to ignore its benefits. As these radical and secular changes to many of our core industries take hold, business leaders simply cannot overlook the competitive advantage outsourcing offers: enabling them to focus on developing competitive advantage. These secular shifts are threatening the survival of many businesses, but at the same time are opening up major opportunities to build smarter, more globalized and leaner organizations. Business leaders can no longer afford to cling to many of the methods of yesteryear to steer their organizations, and this data points to a more bold, radical approach to embrace the benefits of global sourcing.

However, most smart organizations are no longer evaluating shared services and outsourcing strategies in silos; while these initiatives are singularly successful at providing benefits to that individual function, our research has shown that these initiatives have failed, in many situations, to improve comprehensively the broader corporate strategic objectives of these organizations.

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, Sourcing Best Practises, sourcing-change, state-of-outsourcing-2011-study, the-industry-speaks

Phil,

This is a very thoughtful and informed article and the first time I have seen data that draws out some of these trends you highlight. This really shows that the outsourcing model is much more appealing to many businesses forced to re-examine their core needs to survive and invest accordingly. It also reveals those industries which haven’t had the impetus for change until they experienced some of these secular changes you mentioned,

David Wentz

Great post and great analysis which supports my observations.

Not surprised with the manufacturing sector – many of these companies are today so focused on short term targets that anything like outsourcing that upsets the apple cart is not very appealing in today’s economy.

[…] more here: Which industries are more inclined to outsourcing versus shared … Comments […]

Phil,

The most surprising data here is how aggressive the financial services industry is moving towards outsourcing and away from shared services – a real reversal since the crash. Clearly that industry is much more prepared to move non-core processes outside of the enterprise and make far-reaching changes to their operating costs for G&A,

Eric

Finally the public sector is getting serious – they must be hurting!

Warren M

Great piece, Phil. Really shows how management attitudes are changing towards outsourcing. Not surprised at all about those industries looking much more aggressively at long term outsourcing planning,

Paul McCullough

Phil,

Very insightful from you (as always). Can you elaborate more on these hybrid shared services and outsourcing approaches and how businesses are approaching these today? Would love to hear your views on this,

Amanda

Neat piece of analysis and interpretation and consistent with our experience: economic factors driving a rethink of SS and outsourcing leading to outsource enabled SS where we have seen benefits in excess of 30% higher than retained SS.

We are seeing an increased take-up of ‘ship then fix’, rather than fixing in-house, and an increasing adoption of hybrid SS&O models; Combination of shared services and outsourcing with one and sometimes multiple partners, with the allocation of services between parties varies depending on complexity, sensitivity and capability.

This clearly points to a trend that is building significant momentum.

Russell

@Amanda: Good to hear from you.

We’re seeing more of these “global business services” (GBS) models developing within mature clients who are handling multiple service provider relationships, in addition to expanding their shared services operations.

Simply put, GBS encompasses the collective set of resources, capabilities and systems to deliver support services such as IT, finance, human resources, procurement, sales support and other business processes across an organization on a global scale, using multiple service delivery models, including elements of shared services, outsourcing and, increasingly, cloud solutions. You can read more about GBS here: http://www.pwc.com/us/en/outsourcing-shared-services-centers/publications/benefits-of-shared-services-outsourcing.jhtml

The bottom-line is that shared services heads are having to learn how to integrate their service provider relationships more effectively into the business and create more holistic end-to-end process management… the lines between what is “outsourced” and what is “captive” are becoming more and more blurred…

PF

Hi Phil,

Very insightful way of putting it all together, business and outsourcing trends intermingled. I think your long shot bet on public sector will probably pay off. The town next to us in CA, population 27,000, is outsourcing it’s police force to the county sheriff’s organization. My town, population 26,000, (where I pay taxes) just brought the Fire Department back in-house for “more control”. Can you imagine?

Mike

[…] governance framework across both models. It's plain to see that it's … Read more on Horses for Sources This entry was posted in RE Outsourcing and tagged reelection, seek, StockstillCobb. Bookmark the […]

Phil,

Great Article. I was wondering if there was a Level 2 Analysis done for the above industries from a geography perspective i.e. if there is a difference in approach between the US vs Europe HQed companies.

Prakash

Prakash,

Great question, and we have just completed a huge study of close to 2,000 companies globally which reveals the answer.

The predominant model among $1bn+ enterprises is shared services across both regions (close to 90% use shared services in both regions), however, barely a quarter of all business processes are currently sitting in the shared service centers.

However, when we look at investment intentions, NA firms are far more aggressive than Europeans, with three-quarters looking at more outsourcing-focused strategies in the next two years, compared to barely 50% in Europe.

More to follow in the blog, so stay tuned!

PF

Why Business Should Outsource This Year

In today’s economy, one of the revenue generators is outsourcing. It is the process that businesses used to combat the effects of the economic downturn that happened not too long ago.

Global Link BPO wants to share some of the reasons why companies should consider outsourcing. http://www.globallinkbpo.com

It can expand your business’ coverage. Because companies are now also trying the offshore outsourcing setup where they acquire the services of a provider or establish a captive overseas, they have also increased their customer reach and are now able to segment their processes properly.

Control over ongoing and capital costs. Outsourcing also allows businesses to have more control in allocating their budget, as initial investments or capital costs can now be transformed into an ongoing cost.

What you see is what you get. Along with business level agreements, providers now have a fixed metric so that buyers know what to expect. This eliminates discrepancies in contracts and can give clients a head start on how they will draw their strategy.

More control over the entire operation. As the company expands, more and more processes are overlooked and become redundant, causing losses to the company and inferior quality of output. Outsourcing enables companies to centralize control over the entire operation and rule out the unnecessary steps that cost money and time.

Outsourcing can help businesses meet the standards. Trying to keep the operation to have an equal cost of money and time with the business owner. A credible provider, one that has quite the experience in streamlining business processes for companies, can help reassure businesses that they can achieve, monitor, and maintain standards according to the industry’s requirements. Companies can also choose to outsource only the basic processes instead of sharing sensitive internal information.

It can ignite a business’ capability to grow. Outsourcing offers several business frameworks, enabling companies to expand and maximize their potential.

Increase options for resources. Having an outsourcing operation overseas makes it easier for management to gain access to the fresh talent pool and compete with other global players in the industry. It can also reinforce merger acquisition plans and help fill open positions.

Providers can take care of the basic stuff. Outsourcing companies can take on the processes that are usually considered as additional tasks by the client, providing all the necessary tools and management skills that can help executives focus on their core processes.

[…] research has continually shown it’s those industries experiencing intrinsic and structural change to their very foundations, […]