When the news broke last month about the second largest IT services merger of all time (after the 2008 HP-EDS whopper), the reaction among the services cognoscenti was – and has continued to be – one of confusion. Big services mergers have just not done very well over the years. HP/EDS was a culture clash of immense proportions – and occurred right before the great recession, while other mergers, like Dell’s acquisition of Perot, has resulted in the old Perot business being flipped over to NTT Data at a significant loss, and the Xerox/ACS merger has been shaken up and spun off and needs a major reinvention under new CEO Ashok Vemuri to get the company back on track. Meanwhile, Capgemini and IGATE are still figuring out the best pieces of each other to mesh together, while not taking their eye off the ball, during the services industries’ most cut-throat transition phase.

We heard HPE CEO, Meg Whitman, excitedly address the firm’s key clients and industry analysts at HP’s recent Discover event in Las Vegas, with an obsessive focus on “digital transformation” and the impending impact of “digital disruption”. However, the real opportunity for HPE isn’t really in the design of digital business models for clients, it’s the enablement of them – it’s the provision of the agile “digital underbelly” to make digital change really happen for enterprises.

It’s easy to be cynical about legacy IT services, but there’s an awful lot of it to scrap over as enterprises are forced to fix their plumbing

Digesting the merger of these two struggling services giants has resulted in more rumination than most, considering the timing, sheer scale, transitional uncertain market and motivation. This is not a time when most traditional service providers are looking to add more global delivery scale to already large foundations – most are trying to slim down their delivery armies and sales forces, choosing to focus on new and emerging areas for growth and getting more services delivered for less FTEs by taking better advantage of automation technologies, standard SaaS platforms and more affordable cloud provision.

However, when you consider only $15 Billion is being spent on public cloud services (IaaS) this year and $ 1 trillion being spent on services tied to traditional services delivery, there is a huge amount of “legacy” IT and BPO business in play – for another decade and beyond – to enable the enterprise digital experience. Hence, the opportunity HfS sees for Newco, is to attack the IT and operations plumbing necessary to enable the fast-emerging Digital enterprise, and take on the likes of IBM, NTT/Dell, Atos, Capgemini and the Indian-heritage majors.

Why the Digital underbelly poses a massive opportunity for cost-effective agile IT infrastructure providers, such as the HPE+CSC Newco

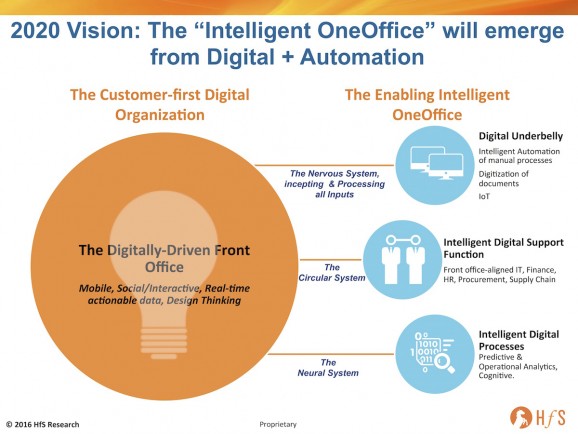

The onset of digital and emerging automation solutions, coupled with the dire need to access meaningful data in real-time, is forcing the back and middle to support the customer experience needs of the front. Our new study on achieving Intelligent Operations (see link), which canvassed 371 major buyside enterprises, reveals two key dynamics that are unifying the front, middle and back offices:

- A “customer first mindset” is the leading business driver driving operations strategies. Over half of upper management (51%) view their customers’ experiences as impacting sourcing model change and strategy, which is placing the relevance and value of the back office in the spotlight.

- Three quarters of enterprises (75%) claim digital is having a radical impact. We can debate the meaning and relevance of digital forever, but the bottom line is that enterprise leaders need to (be seen) to have a digital strategy – and a support function that can facilitate these digital interactions and data needs. The old barriers, where staff in the back office don’t need to think and merely oversee operational process delivery, and those in the middle, which only venture a part of the way to aligning processes to customer needs, are fading away.

Consequently, we’re evolving to an era where there is only “OneOffice” that matters anymore, creating the digital customer experience and an intelligent, single office to enable and support it:

The Digitally-driven Front Office drives the Digital Transformation

Digital, in its purest form, is all about transforming the business to create, support and sustain the digital customer experience. It’s about leveraging the omnichannel (mobile, social and interactive technology) and accessing meaningful analytics to make it happen. Digital enterprises need a support function to service those customers, get their products/services to market when they want them, manage the financial metrics, understand their needs and future demands and make sure they have got the talent which truly understand the outcomes of their work.

In their current forms, HPE+CSC has some real capabilities in industries like travel and insurance to lead the market here, but is its stated digital focus is going to be in the operations and infrastructure rather than on design and industry expertise; it will struggle in markets against service providers with very strong digital design practices, such as Accenture Digital and Deloitte Digiday. In fact, Newco would be smart to partner with these firms to provide the digital underbelly capabilities at scale.

The Digital Underbelly creates the building blocks

Digitally-driven enterprises must create a Digital Underbelly to support the front office by automating manual processes, digitizing manual documents and leveraging smart devices and Internet of Things, where they are present in the value chain. Smart enterprises have realized they simply can’t be effective with a digital transformation without automating processes and fixing manual interventions and breakages in their process flows. Service providers can get ahead by working with their clients to make their processes run digitally so they can grow successfully their digital businesses and create new growth for themselves. Think about a central nervous system that incepts and processes all the elements necessary to make the enterprise function.

This is where HfS views the sweet spot for Newco, provided is can really optimize the economies of scale with the merger to be price competitive with the Indian heritage majors, such as TCS, Wipro, HCL, Infosys and Cognizant. It also needs to convince clients it brings world class engineering talent, security and automation expertise to the table.

Intelligent Digital Support breaks down the legacy functional silos

Enterprises need their support functions (like an enterprise circular system), such as IT, finance, HR and supply chain, to be aligned with supporting the customer experience, as opposed to operating in some sort of vacuum, hence, we are terming this “Intelligent Digital Support”, where broader roles can be created. HPE and CSC together have tremendous depth in areas like finance and accounting, contact center and HR from HPE’s traditional services business, while CSC brings it’s newly acquired procurement capabilities from its Xchanging acquisition.

Newco’s focus needs to shift towards creating a work culture where its delivery staff are encouraged to spend more time interpreting data, understanding their clients’ needs at the front end of their businesses, and ensuring the support functions keep pace with the front office. This is especially the case in industries that are more dependent than ever on real time data, using multiple channels to reach their customers and being able to think out-of-the-box with disruptive business models.

Intelligent Digital Processes must help enterprises predict and orchestrate, as opposed merely to react and maintain

Newco much focus on enabling business processes that align with their clients’ desired digital customer experiences. It’s not about throwing off historical data just to discover what went wrong, it’s about being able to predict when things will go wrong and finding clever ways to get ahead of them. It’s about embedding smart cognitive applications into process chains, about learning from mistakes and new experiences along the way. This is the enterprise neural system. Several of HPE’s IT service competitors have already made strides here with autonomics platforms, such as IBM’s Watson, TCS with its Ignio , Wipro with Holmes, Infosys with Mana and Accenture’s evolving partnership with IPSoft’s Amelia. Without a genuine story in service orchestration and autonomics, Newco could quickly fall behind, as its customers become increasingly eager to embed cognitive and self-learning elements into their business and IT processes.

However, one key service orchestration platform where we see some real growth potential for Newco is with CSC’s industry-leading ServiceNow practice, which has enjoyed continued growth, especially following its 2015 acquisition of Fruition Partners. As CIOs increasingly seek ServiceNow implementations on their CVs (in a Workday-esque manner), Newco should be able to divert many existing HPE clients onto its newly-acquired managed service. Newco just needs to figure out how to grow that competency as two forces coming together, as opposed to ending up with competing P&Ls.

The Bottom-line: The industry is in transition and the winners are those which can pivot and focus fast. Those which can’t will fail

Let’s cut to the chase here – we’re operating in a services world obsessed with preserving the past and ignoring the new. The past was all about predictable revenue and highly-visible cost reduction opportunity – there was a method to the madness. But this was because the true value was about doing things slightly better, but at much cheaper costs. The future is not so predictable – it is about being smarter, more business aware, and technically superior to piece it all together for clients. Oh, and without increased investments. It’s hard, and requires a very different focus, which is one of developing talent to learn on the job, one of evaluating experiences professionals to assess their ability to change, of being able to learn new tools and platforms, which require a mixture of process and business understanding to align with real business outcomes.

The Newco that is HPE+CSC has as good a shot as most to survive the impending service industry carnage, as growth flattens and prices hit the floor for anything that is a mainstream service. It’s sheer size and client portfolio should help it absorb the blows as the market shakes out and the need for increasingly complex “digital underbelly” services proliferates. As we evolve the levers for the survivors to pull are the right combination of labor arbitrage, automation enablement, cognitive understanding and digital enablement. But spending years constantly reorganizing internally to create the beast to deliver all of this with the speed, affordability and agility needed will not work. These two firms need to be slammed together with an urgency and focus not yet seen in our industry. This won’t be pretty and needs to be like a very sticky BandAid being ripped off very, very quickly…because their biggest threat is within themselves.

For a deeper dive into the nuts and bolts of the HPE+CSC merger, download our POV now!

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Cognitive Computing, Design Thinking, Digital Transformation, Financial Services Sourcing Strategies, HfSResearch.com Homepage, IT Outsourcing / IT Services, OneOffice, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, Security and Risk, smac-and-big-data, Sourcing Best Practises, sourcing-change

Phil,

Best analysis written on the merger by some way. My only reservation will be how HPE can compete effectively with the likes of Amazon in public cloud as that creeps deeper into the enterprise space,

Gavin

Phil – very good insights. You say the two firms need to move very fast here – do you envisage large layoffs? Where do you think they will make them?

Rahul

@Gavin – thanks for your kind words. Let’s take a look at the various “public/hybrid cloud” scenarios here:

• Scenario one, rapid public cloud dominance. This is an option that in some ways seems the least likely, this would mean 40-50% of enterprise organizations, by 2020, taking a cloud first option for new initiatives and replace/repair to the public cloud approach to existing infrastructure, the “all-in” approach to public cloud that supports digital business transformations. Whether Newco can really provide a differentiated offering against the likes of AWS in the short term is highly doubtful.

• Scenario two, eventual public cloud dominance. The dominance of public cloud takes much longer, it will take until 2025 to reach the same level of acceptance. With private and hybrid cloud taking up the slack, this gives hybrid a chance to properly establish itself and lengthens timeframe private/hybrid cloud is relevant. Hybrid is where Newco could have more likely success by moving existing legacy clients into hybrid public-private cloud, based on trusted relationships, geographic scale and trusted security capabilities.

• Scenario three, hybrid cloud dominance. Public cloud will be successful, but most enterprise organizations will adopt a hybrid approach for their core IT infrastructure, at least until 2025. The longer it takes major enterprises to make the shift to the the public cloud, the more opportunity Newco will have to position itself and a trusted IT infrastructure provider of choice to enable that digital underbelly. The challenge for Newco here will be convincing clients to avoid low cost offerings from the Indian-heritage majors. If HPE’s leadership believes clients will go with them because of its traditional trusted brand, it will surely fail, as so many clients have as much (or more) trust with several of the Indian majors in today’s market. Newco will have to work hard to prove it has superior cloud delivery, talent, digital understanding and digital enablement in the wake of very aggressive Indian competition.

The closer we get to 2020, the more it becomes clear that scenario one seems too rapid – as enterprise purchasing cycles dominate the time frame and general reluctance to take a big bang approach to public cloud adoption, sees scenario two as the most likely of the scenarios. This is good news for all the traditional services firms as it allows for a longer run off of legacy business and a longer time for hybrid platforms to establish and be the primary route for enterprise organizations to adopt public cloud. This was apparent in examples at the Discover event of HPE helping clients find the right hybrid balance, including in the one case of Dropbox, a shift off of AWS to a hybrid platform.

Hope this helps clarify,

PF

Phil – what about future BPO potential of HPE/CSC? Do you seeing them gaining traction?

Cheryl Smith

@Cheryl – In terms of BPO, Newco has real potential to make its mark, with deep experience and footprints in finance and accounting, contact center/omnichannel, HR and procurement (via CSC’s recent Xchanging acquisition). However, with the laser focus on the cloud and the need to support digital initiatives, I fear its BPO offerings may get neglected, or even sold off. For years, HPE’s BPO business has managed to sustain a $2 billion BPO business, despite limited focus from various leaderships (now $2.6 billion with CSC) and HfS doubts new CEO Mike Lawry (coming over from CSC) has an appetite to take the firm down a BPO path.

However, with the increased focus on the omnichannel and the need to manage business process delivery, it would be a smart move, in HfS’ view, to invest in smarter BPO delivery with further investments in analytics, cognitive tools and automation. Maintaining a relationship with the remaining parts of HPE will allow the BPO business to continue using certain analytics and automation tools as well as remain a channel for those businesses. HP is one of the few major IT/BPO service providers to have retained its contact center business, which could be a major facilitator of digital-led initiatives but without focus and investment in design of front end processes, risks going down the path of many large contact center players, of huge FTE and voice focused commoditized services with little differentiation or ability to service the digital customer. Developing a capability or partnership to address omnichannel and the digital customer will be critical for success; CX/ contact center leadership seem to have this clear focus, the question remains whether the new CSC-HP giant will have the appetite to support it.

PF

@Rahul – yes, there will be significant layoffs, there has to be. I would imagine these will be in areas with over saturation of staff in certain regions and across certain functional domains. There will sure be reductions in the US, UK, continental Europe and Australia, where these is a lot of overlap. Imagine less in India, Philippines and China which are more complementary. Imagine IT apps and infra maintenance will be the hardest hit. BPO probably a lot less so as this is very complimentary…

PF

Phil

Excellent write up of the implications of this merger. I see this more as a desperate scramble to cut out costs than anything else. Merge, shed the fat, try and survive.

Wonder who’s next?

Ed

The folks who sort of slipped down the ladder (metaphorically speaking), as a consequence of the last disruption (labor mobility & arbitrage, offshore skills scale, global processes & low telecom costs, asset light models) from over a decade ago and have been struggling on a difficult path ever since are actually leading on the early consolidations/M&As this time. They recognise perhaps the inevitable outcomes they face as they enter the deeper disruption underway now and if they waited much longer. Dell-PS, iGate-Patni, HP-EDS, CSC, Mphasis..others….

Great explanation of the possible “public/hybrid cloud” scenarios in the period ahead. Thanks.

@Ed – can see more “traditional IT services” consolidation as these firms rationalize costs and focus. Don’t rule out more HP and IBM activity (apparently Hitachi may pick up IBM’s mainframe business). Atos and Capgemini could get active…

On the BPO side, expect private equity carve outs and some potential new robo-centric suppliers being formed. Could be all sorts of interesting things developing there – look at Xerox, HP, the Indian majors… some of the mid tiers.

What’s clear is there is a lot of talking going on. And consolidation is a good thing IMO – takes the conversation back the real topics of service delivery and less about the confusing hype around digital and robotics.

PF

@Manish – thanks. I really get the sense this market is constantly evolving. Consolidation of the established firms will create some new dynamics – at worst, it will shape the conversation back towards real enterprise dynamics and how to move them along, than the constant puff around Digital that just confuses the hell out of most clients…

PF

Phil,

Excellent insights as always. We always loved your insightful observations!

My PoV is that these organizations are fishing in the same pond. Nothing wrong about that, except they need to have right expectations. The question around cloud dominance was a good one, and I believe that a merger has to complement core competencies. If your competencies are grounded in the traditional boundaries of the value chain, and if your aspirations are broader, it would be wise to find your match outside. Would be great if you can share your thoughts.

Thank you

Srini