While we all are debating the impact of Brexit, I feel that Brexit will be advantageous to Indian engineering service providers in the long-term, both in the post-Brexit UK and EU marketplaces. And it’s not that I am biased as I cover engineering services sector – so here are some reasons for this hypothesis.

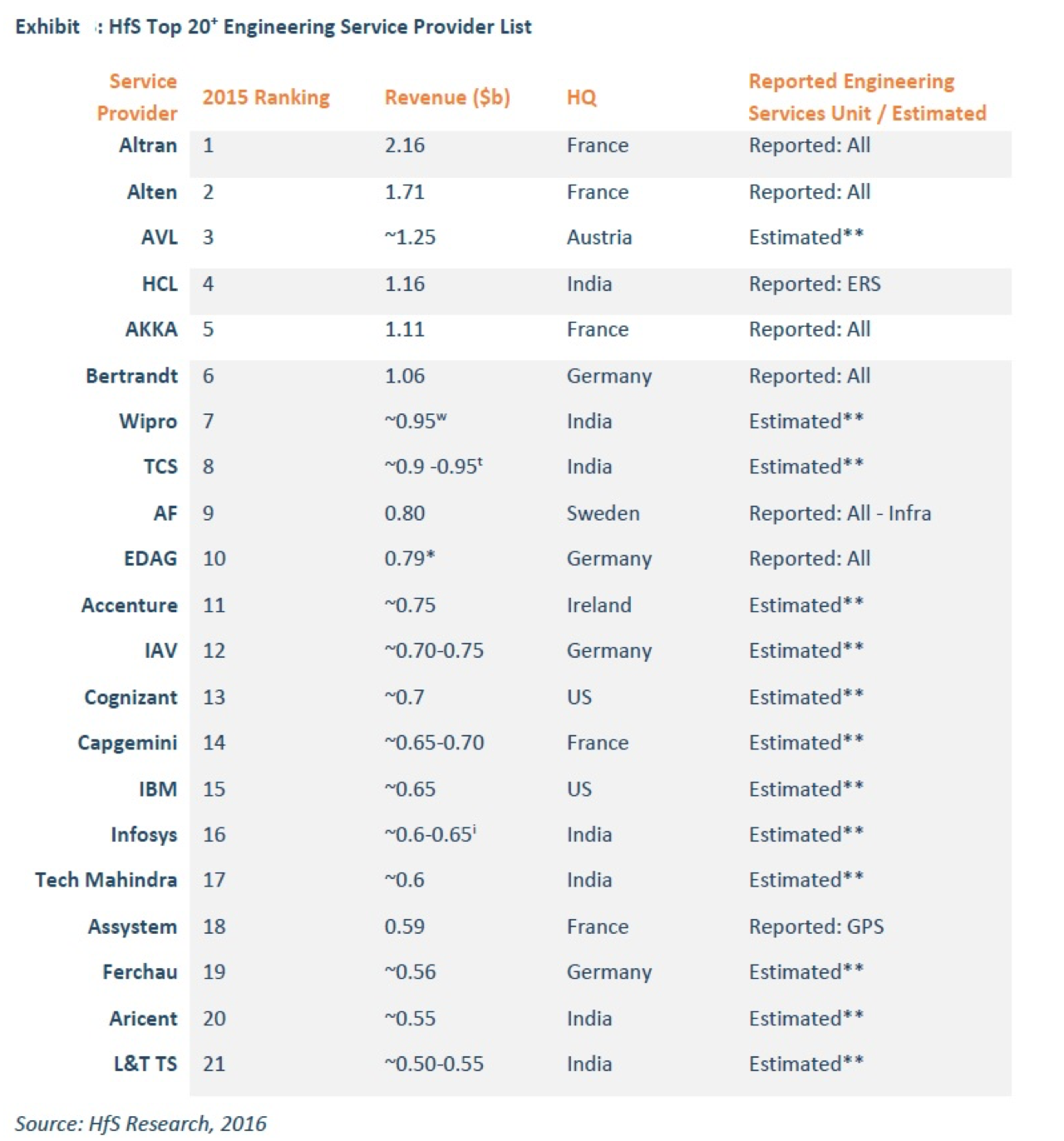

First, some context around the global engineering services outsourcing landscape. The global engineering outsourcing service sector is somewhat unique as it is dominated by European companies (mainly French, German and Austrian Firms). In the top 10 list, there are three French firms, two German firms and one Austrian firm. (Read HfS Engineering Services Top 20)

I don’t know any other services segments which are dominated by European firms to this extent. And there is a reason to this European dominance; product engineering is a core business activity for enterprises which many were unwilling to outsource in the early days of outsourcing, unlike transactional IT Services and BPO services which are not core activities and can be better managed by experts. Product manufacturers’ “secret sauce” that has kept them competitive, has traditionally been their internal design and make capability. It started with Airbus, which wanted to accelerate its product development to compete with Boeing and started leveraging local outsourcing partners to access the expertise it needed to be more competitive. This led to the scaling up of the French engineering outsourcing industry, as more enterprises saw the potential of outsourcing for engineering competency in a country with a strong engineering culture. Still, Airbus will be one of the biggest customers of all leading French engineering service providers and Aerospace being of the largest verticals. There’s a similar story with the German automotive industry. The German automotive firms started outsourcing to local outsourcing partners to accelerate product development to compete with US and Japanese automotive OEMs. In the last few years, there was a lot of M&A among the engineering providers and few French and German firms have scaled-up and surpassed a billion dollars in revenue. Still, European engineering services firms will have automotive and aerospace as their largest verticals.

In contrast, Indian engineering services providers became US-centric and followed general IT services industry footprints. Their largest verticals, for engineering services, are the telecom and software markets. In Europe, Indian engineering service providers have struggled to penetrate the French and German engineering sectors and compete effectively with the local European engineering services firms. When the overall corporate focus for the Indian IT service providers in Europe has been UK-focused, it has become difficult for engineering service providers to leverage their parent companies for to win business in Germany and France. Many engineering service providers have realized this of the late and started locating their senior management to Germany. Simply put, Germans like to buy from Germans and the French from French!

Now with Brexit, Indian IT service providers will reevaluate their European strategy and probably France or/ and Germany will become the center of the action. The language barriers will be taken care of. And this will help engineering service divisions to sell their story and capabilities better in the German and the French markets.

The other factor will be engineering demand in the UK. It is estimated that the UK is facing increased shortages of engineering graduates in the manufacturing sector. According to 2015 estimates from EngineeringUK, UK manufacturing sector needs, on average, 182,000 people annually with engineering backgrounds through 2022, and supply is only at 108,000 people annually. These numbers will be revised downwards post-Brexit, but it should be reasonable assumption that after Brexit, UK will face further supply crunches in the engineering sector as it will rely less on EU engineering talent. This will be an opportunity for Indian engineering service providers to get in and win the higher share of UK engineering services industry.

The Bottom line: It’s all upside for Indian Engineering Providers post-Brexit

There are lots of ifs and buts, but I don’t see any major potential downside to Indian engineering services business from Brexit. It can only provide further opportunities for Indian engineering service providers to increase their spread and penetration both across the EU and the post-Brexit UK. It’s the European service providers which need to worry more now!

Posted in : Procurement and Supply Chain