-

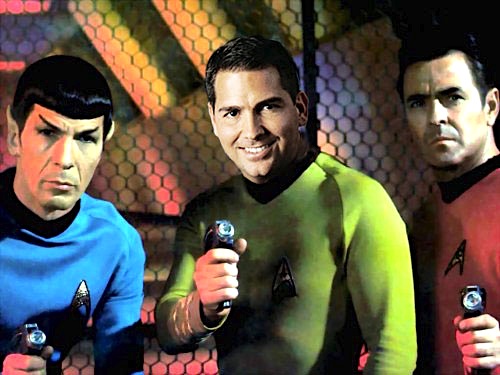

Captain Cliff of the Sourcing Enterprise Part II… The Death of Outsourcing

And welcome back to our interview with KPMG's Captain Cliff who has proclaimed the Death of Outsourcing in a recent white paperRead More

-

Captain Cliff of the Sourcing Enterprise Part III… The Death of the “O” Word

Welcome back to the Captain Cliff chronicles. And since Part II, we have actually witnessed Cliff speak for a whole hour at an outsourcing conference and manage not to mention the "O" word once. That's quite a feat, so let's find out why... Read More

-

Captain Cliff of the Sourcing Enterprise… Part I

allow us to introduce Cliff Justice, KPMG's very own kingpin of the extended enterprise, who's calmly building out one of the most impressive collections of experienced sourcing operators and thinkers in the global shared services and outsourcing industryRead More

-

Captain Cliff of the Sourcing Enterprise Part IV… The Final Frontier

Let's boldly go to the final frontier of our discussion where KPMG's Cliff Justice talks about how the world of "outsourcing" has changed in today's economyRead More

-

Coulter tackles Justice

Among the regulars we all expect to see such as IBM, Accenture and CapGemini, was KPMG. KPMG? Yes, and represented by Cliff Justice. Cliff is KPMG’s new US Leader, Shared Services and Advisory. This isn’t the first time that a major accounting services firm has placed a bet on getting into the shared services and outsourcing advisory businessRead More

-

Cliff riffs on GenAI’s Edison moment…

We recently had the opportunity to sit down with Cliff Justice, KPMG’s US head of Enterprise Innovation, to delve into the transformative power of AI and its implications for individuals and businesses.Read More

-

Mike Sutcliff, Digitally Distinct

Mike Sutcliffe, Group Chief Executive, Accenture Digital, talks to HfS analyst Phil Fersht on the disruptive impact of Digital technologies on Business Services and OperationsRead More

-

Mike Sutcliff, Digitally Dangerous

Accenture's Group Chief Executive of Digital, Mike Sutcliff, catches up with HfSRead More

-

Europe’s finest enterprise operators take on the USA at the Cambridge University Blueprint Sessions. Who’s sourcing smarter?

This June we are assembling the ultimate pool of European and American services talent to duke it out on the hallowed lawns of Cambridge's Gonville and Caius CollegeRead More