Month: August 2018

Have you got your #fakenews strategy figured out yet?

Yes, folks, fake is now part of the corporate marketing agenda...Read More

Accenture’s Allen Valahu: The TOP 10 will allow us to have more regular and meaningful interactions with analysts

Accenture's global head of analyst relations, Allen Valahu, welcomes the changes the HFS TOP 10 will bringRead More

Time to kick out quadrants, paralyse peaks and wash away waves. Hello HFS TOP 10

HFS is out of the quadrant business, unveiling the relevant way to rank vendor performance: The HFS TOP 10Read More

Fired by DXC for refusing to be a nodding dog. Ugh.

Nigel Barron was sacked by DXC for refusing to nod like a dogRead More

Don’t dog nod your way to unemployment. Read this and get on your soap box

Nigel Barron comments on the fact that he had no choice but to be a dodding nog...Read More

Rant Warning: Nodding dogs and vendor marketing – this is all our industry deserves

What business are most ”analysts” operating in these days? Not “research”, that’s for sure…Read More

Passionate about #AI? Then look no further…

HfS Research is seeking a passionate Research Director for Artificial Intelligence.Read More

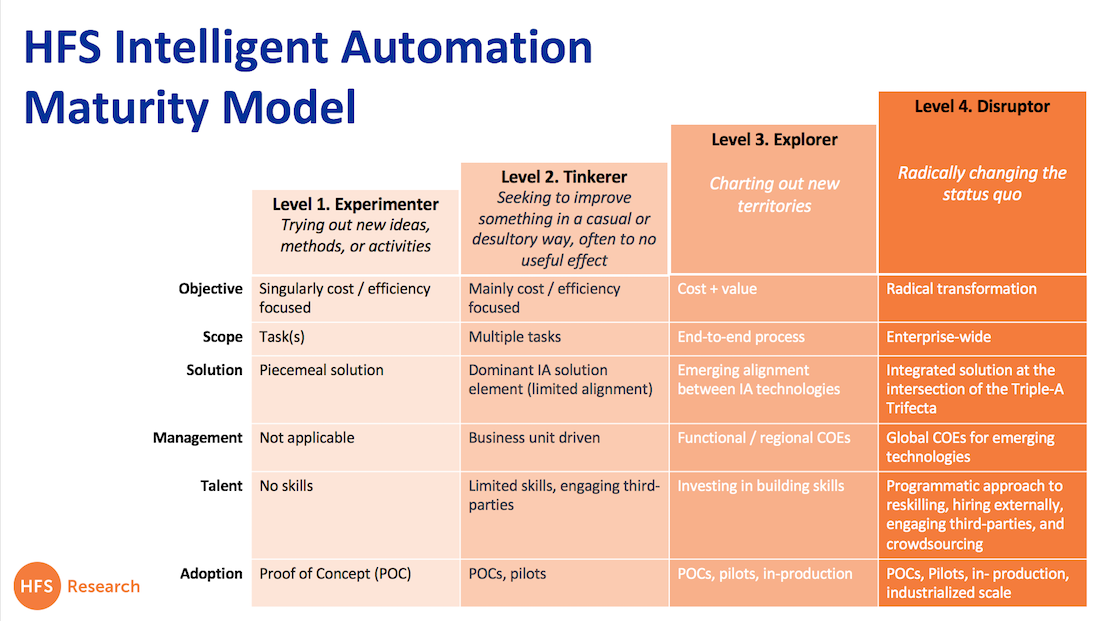

Tinker, experiment, explore, then disrupt: The Hyper-Connected Enterprise will be driven by Intelligent Automation.

The "Future of Work" is merely a phased transformation of the presentRead More