Month: May 2018

The G2000 is still cost-obsessed, but getting there now depends on process robotics, predictive data, OneOffice alignment and a whole lotta pain

Sometimes ripping out the very fabric of what got you here is what you have to do to survive in the futureRead More

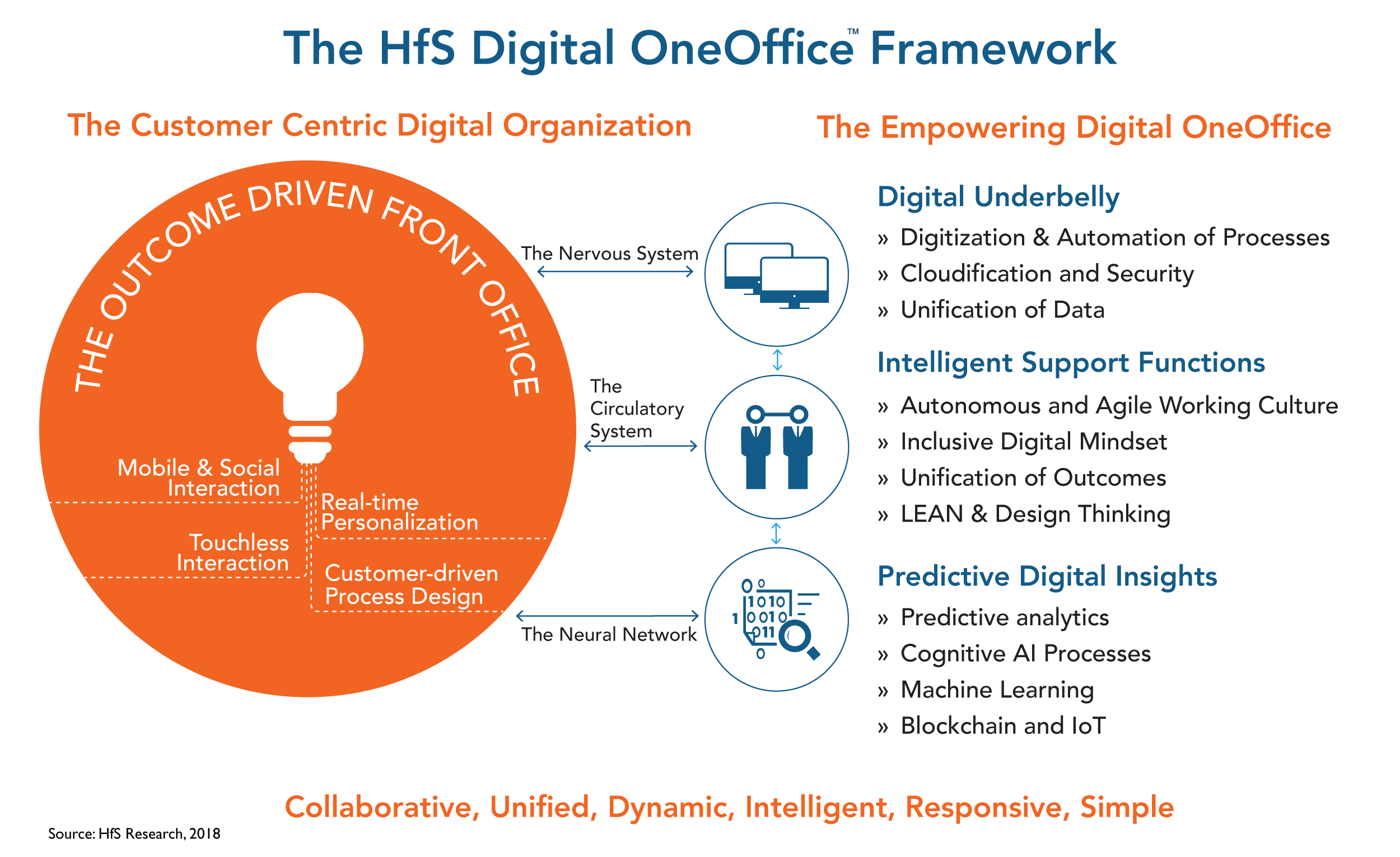

The why, the what and the how of the HfS Digital OneOffice

The HfS Digital OneOffice operating framework is the HfS vision for the business operations endstate for #digital organizationsRead More

Sticking to his Nitin

Phil Fersht interviews Mphasis CEO Nitin RakeshRead More