Month: September 2014

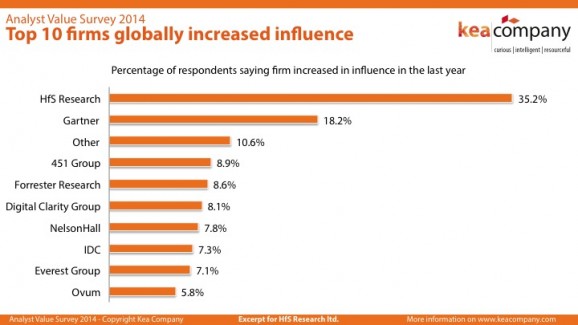

1093 research influencers have spoken: HfS leads the analyst industry for growing influence

1100 research buyers: HfS Research's influence increases more than all the analyst firmsRead More

Cooking up NASSCOM’s $50 billion Bangalore biryani

Charles Sutherland shares thoughts on NASSCOM's ambition to grow Business Process exports from $20 Billion in 2014 to $50 Billion by 2020. Read More

Have most analysts completely given up doing “research”?

We called it three years’ ago and we can now officially proclaim that the industry, once known as research, is close to meeting its makerRead More

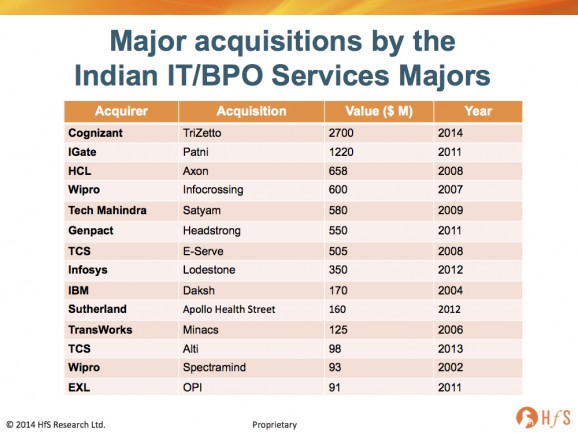

Cognizant’s CEO Frank D’Souza talks to us about his recent $2.7bn shopping trip

We grabbed a few minutes with Cognizant's CEO, Frank D'Souza, to talk about why his company made this move Read More

Cognizant makes the biggest bet ever by an Indian services provider. This is a big bloody deal…

Cognizant has upped the ante; now it's time for the ambitious providers to open their war-chestsRead More

The C-Suite sourcing elite gathers in Chicago this Fall… let’s meet the providers

Let's take a peak at the providers putting themselves in the firing line for the Chicago Blueprint Summit this FallRead More

Shamelessly Shamus: Why Europe is positioned to leapfrog the United States

Did you hear the one about the Mamil (middle aged man in lycra), who got off his bike, donned a suit and tie and joined a Big 4 consulting firm to wax lyrical about sourcing strategy?Read More

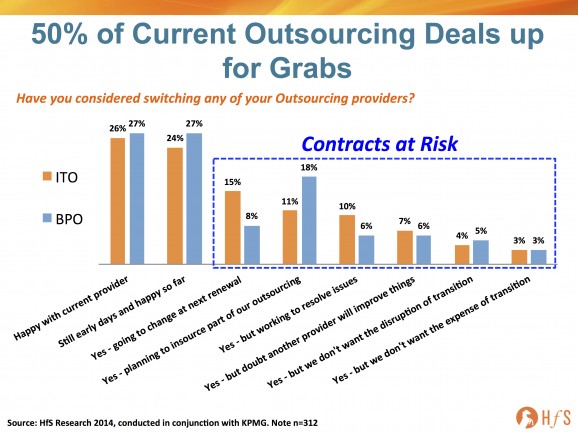

Welcome to the era of churn, where 50% of outsourcing contracts are at risk

Clients are genuinely walking away from outsourcing relationships which provide mediocre valueRead More