Month: November 2011

As InfosysBPO reaches the $500m mark, is it ready for the big-time?

InfosysBPO is now a major BPO contender in the global marketplace, having quietly gone about building its BPO business streams since its inception via the buyout of FAO provider Progeon, exactly five years' ago and expects to reach the landmark of $500m in revenues this year. HfS has always been encouraged by the firm's approach to developing both horizontal and vertical BPO services, and its focus on leveraging its IT heritage to augment its value proposition. Infy is by no means the biggest player in the BPO business nor does it want to be, but it has been able to establish itself as a smart and very respected player in the BPO business.Read More

Don’t miss today’s web-debate – The Future of BPO

Are you ready for our next installment of HfS' Live and Unfiltered series, broadcast live infront of the HfS Research community?Read More

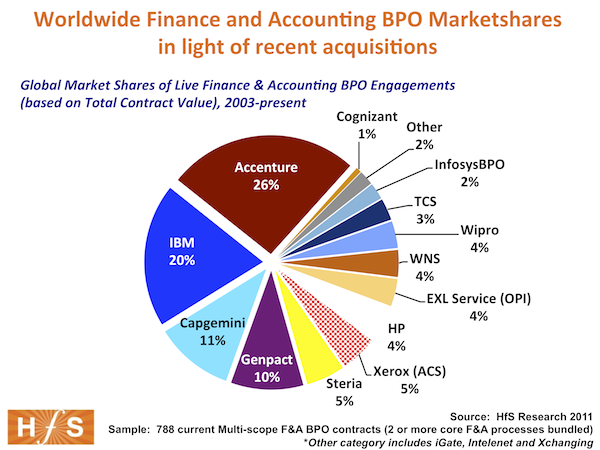

Capgemini collects Vengroff Williams to slip into third spot for global Finance & Accounting BPO

Capgemini has made a major move towards strengthening its position in the global F&A BPO market by today acquiring Vengroff Williams and Associates - and leaping to third in the market share spot for F&A globallyRead More

What are Business Platforms and why they represent the future of outsourcing

The ability to develop some best-in-class processes as "Business Platforms", whether they focus on horizontal or vertical process clusters, is becoming a real differentiator in the market, as buyers seek more standardized solutions from their outsourcing engagements. The gauntlet being laid out to providers, with these Business Platforms, is their ability to support their clients’ transitions quickly and inexpensively. Simply selling “products” is not the concept of business platforms – it is the provider’s ability to work with their customers to facilitate and support the ultimate business outcomes of managing the processes associated with the Business Platform offering.Read More

The three tenets of Global Business Services execution: customer alignment, accountability, and economies of scale

So how do you take shared services leaders and blend their expertise with the outsourcing governors? How do you go from fragmented service delivery with multiple points of contact, to a global governance model with a rationalized and centralized administration of third-party service providers?Read More

Satisfying customers’ needs profitably: can marketing BPO revive marketeers?

CMOs have it tough today, whichever geography or market you look at. They’re stretching dollars for myriad activities in a function that’s undergoing major change. HfS Research's Reetika Joshi discusses her new report "Marketing BPO Services: Solving the CMO’s Dilemma"Read More

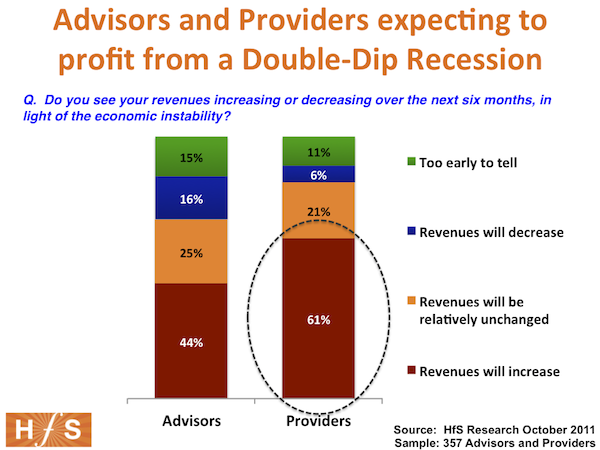

Why outsourcing professionals must stay in touch with the 99%

Governments are very capable of passing measures very quickly to restrict outsourcing if things get really bad - and they won't have any choice if the 99% demand it. All outsourcing stakeholders - buyers, providers and advisors - need to focus, more than ever, on helping organizations approach outsourcing as one supporting component of a holistic solution.Read More

A big cat for a big job: meet Tiger (Part III)

The final installment of our recent discussion between HfS CEO Phil Fersht and Genpact's new President and CEO, NV “Tiger” Tyagarajan, which delves into Tiger's vision for the future of technology and BPO. Read More