With all the recent fuss in the media and the global sourcing industry about protectionism derailing new engagements, I wanted to set the record straight with some brand new survey data and some views into President Obama's current position, that protectionism is not proving to be as big an impediment behind companies' making outsourcing decisions in the near future as many people have stated.

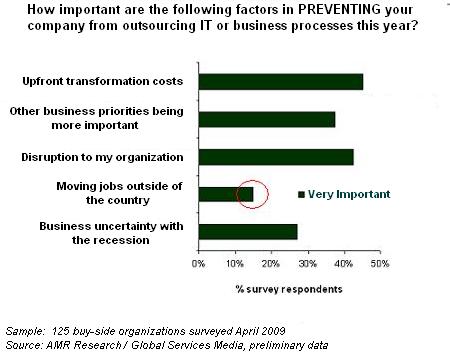

To this end, I wanted to share some preliminary data from our current survey on global sourcing dynamics that tackles the issues preventing companies from making outsourcing decisions this year:

Barely 15% of 125 buyers currently surveyed view moving jobs offshore as a very important factor preventing an outsourcing decision this year, while close to half view upfront transformation costs and potential disruption to their organizations very important factors. As Professor Bob Kennedy pointed out to us recently, there is a growing chasm between political rhetoric and action. So while people in media, politics and in other settings, whose jobs are unaffected by global sourcing, are publicly voicing their objections, those executives fighting to drive costs out of their businesses and move onto more innovative global delivery models, clearly have other priorities.

Clearly, President Obama needs to put together tactical measures if he wants to deter buyers from using offshore resources, but when you look at his new appointments and current lack of anti-offshoring policy, you start to wonder if he is going to pursue any policies with teeth that will impede offshore outsourcing in the future. The following clip from CNN discussed his recent appointments of Diane Farrell, the former Director of McKinsey's Global Institute, and Jeffrey Immelt, GE's CEO. Both are strong public advocates of a global sourcing model:

Posted in : Business Process Outsourcing (BPO)

Phil

This doesn’t surprise me.

Firstly, businesses need to focus on survival, and developing innovative global sourcing models is vital in this market.

It’s not the responsibility of business owners to put their own businesses at risk simply to “save” a few jobs. They need to have the right incentives to retain staff, or hire onshore. That means the US government needs to cut down the cost of healthcare, to find ways to drive down the general cost of labor (which should happen in this recession anyway), and to support education systems to train their US workers with the skills they need. Only those measures will negate the need for businesses to outsource.

Secondly, Obama cannot force businesses not to outsource. Phil, you are correct is stating that the protectionist voices are coming from the politicians and media, who are not directly impacted. You can bet your bottom dollar that they would “outsource” tomorrow if it would save their own job, or company’s survival.

Ravi

I’m not sure I agree with your post, “Clearly, President Obama needs to put together tactical measures if he wants to deter buyers from using offshore resources, but when you look at his new appointments and current lack of anti-offshoring policy, you start to wonder if he is going to pursue any policies with teeth that will impede offshore outsourcing in the future.”

Just take a look at a clause in a major federal government procurement related to the financial crisis that came out early this year:

“The Contractor shall not perform any Contract work outside the United States unless and until it has received the Contracting Officer’s explicit, written approval to perform such work. . . Further, the [government] may refuse to approve any performance outside the United States for any other reason, or for no reason, except as otherwise required by the laws and treaties of the United States. . . Neither performance within the United States, nor the Department’s refusal to allow performance outside the

United States shall ever constitute a change to this Contract or give rise to any entitlement to additional compensation or excuse any failure of performance by the Contractor.”

So, if you go in with a plan to off-shore, you may be denied and have eat the increased cost (if any) of doing the work on-shore. Getting permission before submitting your bid is problematic, in my experience.

IMHO think we’re going to see more “Buy American” requirements in federal government business.

Hi Dennis –

The sectors where protectionism is rife is government / public sector and government-controlled commercial orgs, TARP funded banks and some healthcare providers. The only sector here which previously used a lot of offshore was in financial services. We’ll just start seeing more specific contracts which stipulate which work must stay onshore in some areas.

I am concerned about this wave of protectionism and have made my feelings clear, and my take here is that it appears to be a lot less prominent than we see on the surface when you get under the covers – and the data doesn’t lie. Those firms struggling to compete in this economy are thinking about commercial strategies to drive out cost and increase competitiveness. They will outsource and offshore when and where they need to, in order to survive. And the evidence so far shows Obama will not intervene to stop them. We’ll just witness a few jingoistic RFPs like the one you mention. My concern levels are lot as high as they were a few weeks’ ago…

Phil

Protectionism has epic failure built right into it.

The market based economy model has always been shown to be the most long term resilient model.

It is when governments start interfering that bad things start happening.

No interference leads to the absolute highest wealth and standard of living for everyone on the planet, interfering only serves to make every person on earth worse off.

The only reason we have protectionism at all is because it is the “politically friendly” thing to do. Politicians core competency is in generating votes, not setting good policy. Votes first, then policy. If they can only manage to do one or the other, they will lean toward votes. In regards to protectionism, it is almost always one or the other and they substantially always go for votes.

Phil,

While you have to sympathize with workers when their jobs are displaced in an outsourcing deal, preventing this is just going to cripple businesses at a very tough time. Successful business will ultimately lead to more jobs. The key is for displaced employees to develop new skills that make them non-outsourceable.

Another issue is the fact that if offshoring is banned, companies will simply fire many of those staff anyway, and simply operate with a sub-standard support infrastructure,

Philippe Bression

If government wants to protect jobs lost from offshoring, they should offer the laid-off workers cushy government jobs like they have, with fat pensions, annual payrises above the inflation rate, with no prospect of ever getting fired (even if you’re in California and blow all your budget).

GOVERNMENT KEEP YOUR NOSE OUT OF BUSINESS!

The real question is “Should protectionism succeed?”

In a troubled economic environment, protectionism naturally tends to increase. But is it advisable? Remember Smoot-Hawley? This was a protectionist law enacted in the US during the Great Depression. It sparked off a trade war with US trading partners in Europe and aggravated the depression.

While Smoot-Hawley laws were restrictions on imported products, todays laws are restrictions against imported labour. Smoot-Hawley was a failure; it was the advent of WW2 that boosted the economy.

Outsourcing and Offshoring are business initiatives that make a lot of economic sense, but are political hot potatoes in the US today. Hopefully, the sentiment will pass when the market starts picking up and when the public and the politicians realise the need for competitive business practices.

Vikram Ramankutty

Hat tip to Joe G. and Vikram R.

Protectionism, though, works GREAT! The question is, what does “works” mean?

If by “works” it means “Allowing the ‘protected’ business to continue in operation while maintaining substandard methods, management, models, and/or customer service.”

If, on the other hand, by “works” you mean “raises the living standards of the nation as a whole,” the protectionism is, was, and always be an abject failure.

In short, it makes people in the economy poorer, and ensures that those resources employed by the ‘protected’ industry/business will not be used in their most efficient way.

Bill Losapio

“No interference leads to the absolute highest wealth and standard of living for everyone on the planet, interfering only serves to make every person on earth worse off.”

No interference leads to polluted air, water and soils. No interference leads to unsafe food and drugs going into the marketplace. No interference leads to substandard wages and working conditions. No interference leads to price gouging. No interference leads to collusion between business interests that are to the detrement of the consumer. No interference leads to an erosion of consumer confidence, because corporations of their own free will cannot be trusted to do what is in the best interest of the consumer.

No interference led to the economic and environmental situation we are in right now.

Protectionism resulted in turning a stock market crash (1929) into a deep and long depression (Smoot Hawley Act). In the long run, attempts to impose it will be destructive resulting in global inefficiencies and higher local prices.

Laura Hazen

Phil – insightful survey data.

This is a classic case of political rhetoric coupled with media frenzy!!

I (would like to) believe that President Obama’s speech was made in a different connotation, against the popular perception that it was intended to target IT/Business Process Outsourcing and Offshore Outsourcing model.

The background to this goes back to American Job Creation Act (AJCA) which was passed by the Bush Administration in 2004. Under this act, there was a specific provision titled “Invest in USA” (HR#4520). This provision allowed US companies to repatriate profits back to the US from their offshore operations. These are not Business Process Outsourcing or IT Outsourcing operations. These are “Business” Operations. For instance, , if Ford setup a manufacturing facility in Mexico and if they made profits out of the automobiles exported from the Mexican unit, they could repatriate those profits back to the US by paying a lower tax rate.

The provision provided companies with a tax break of 80% of repatriated earnings, with only 20% of the repatriated earnings taxed at the corporate tax rate of 35%. The net effect of this to the corporate tax rate on companies repatriating foreign earnings was ~5.25%

The spirit behind the introduction of this tax break was to encourage repatriation of funds into the US which would then be invested in industries and business in the US which would, in turn, create jobs. As per accountability committee reports and surveys, US companies repatriated somewhere in the range of USD360 billion after this provision was introduced! A survey of several hundred of these companies found that they used, on average, 25% of those funds for U.S. capital investment, 23% for hiring and training of U.S. employees, 14% for U.S.-based R&D, and 13% for U.S. debt reduction.

Per the provisions of this Act, this was meant to be a one-year tax holiday only. There have been some moves by Republicans to extend this tax break to encourage companies invest in the US. However, President Obama is against the re-introduction of this tax credit. The irony is that this tax break does not even exist any longer!!

Republicans tried to insert a provision in the stimulus bill to re-introduce this tax break to spur repatriation of funds and the consequent job creation in the US. That amendment was struck down in Senate negotiations. This, I believe, is what President Obama was referring to.

Allen Sinai makes a compelling case in Wall Street Journal to provide tax breaks to companies to bring in funds into the US to spur investments and to create jobs in the US. Per recent studies, if this provision is introduced now, this could help bring in USD545 billion. A nifty sum to battle the 3 trillion deficit, I would say!

Of course, for every argument favouring the introduction of this tax break, there are 10 arguments against why these types of breaks are ineffective.

The truth is, if the corporations are not incentivised (instead tax them at 35%) to re-invest their foreign earnings back in the US, they will park those funds in some tax haven and use those to invest further in foreign countries! So it’s a trade-off

Again, this has nothing to do with offshore outsourcing as the popular rhetoric believes it to be!!

Links:

http://online.wsj.com/article/SB123310439653922291.html?mod=googlenews_wsj

http://www.govtrack.us/congress/bill.xpd?bill=h108-4520

We can’t tell if protectionism will fail until we try it.

So far all we’ve done is open up US markets to foreign businesses. And we’ve done it at the cost of our US customer base. Every US job lost is a customer who can’t afford your products. The economic “crash” is directly caused by people who’s income didn’t keep up with their expenses. Yes, some percentage spent more than they made, but not nearly as many as have lost their jobs.

Oh, yes about selling to foreign countries, we have a negative balance of trade because we buy more than we sell – not just in one industry or with one nation – over all.

As an employer one must be able to take on Government’s role to give working people a life (good salary, health benefits, vacations etc.). If you can’t and won’t give people a life they deserve, you should not be employing anyone. Corporations and large companies or any employers must remember – GIVE YOUR EMPLOYEES A LIFE.

My friends are a business as well and they give my people a life they can’t complain about. That makes them so much happy than looking for a longer buck by outsourcing and making both your ex-employees and your customers unhappy.