The beauty of procurement is that is was never really geared up for cheap and cheerful labor-arbitrage based BPO. In short, most procurement functions have been cut to the bone in most organizations, and many still rely on fax machines, photocopiers and copious filing cabinets of yellowing contracts to get the job done.

Shipping this stuff off to far flung offshore destinations for a few FTE savings has rarely proved to work very well. However, creating a capability where clients can plug in to a whole new experience of procurement capabilities, category expertise, spend management analytics and gain-share opportunities As-a-Service is now happening for many ambitious buyers and service providers.

The procurement outsourcing market has evolved significantly since 2013 since HfS launched its first Blueprint, covering 14 service providers, to this new report that covers 18, co-authored by analysts Charles Sutherland and Hema Santosh. This new report is looking very closely at the evolution of procurement services from its legacy outsourcing roots in lift and shift mega-deals, coupled with strategic sourcing consulting, to the increasingly available As-a-Service solution models offered today.

The latest HfS Procurement-as-a-Service Blueprint captures the transition of service providers into the As-a-Service Economy:

What has changed since 2013 in procurement outsourcing services?

If we look at where we are today, or starters, we’re living in a post Procurian world, as its acquisition by Accenture in late 2013 shifted the competitive landscape. Both were in our 2013 Winner’s Circle and when combined they created a market leader by share and by innovation. When we first commented on the acquisition we expected several more would quickly follow especially for Genpact and Capgemini who needed to replace the partnerships they had been developing with Procurian. It turns out that rather than buy at least for now, those service providers who had gaps in capabilities or technologies turned to partnerships instead.

Indeed, partnerships between service providers born out of the transactional procurement market (e.g. TCS, Genpact, WNS) and those out of the technology (e.g. GEP) or strategic sourcing (e.g. Proxima, AT Kearney) are more prevalent in 2015 than they were back in 2013 as service providers construct end-to-end offerings to better compete with Accenture and IBM in particular.

But acquisitions didn’t end with Procurian. Xchanging has followed suite with two more that have revitalized their presence in North America and brought them a new proprietary technology base. While Infosys has accelerated the value of the 2011 acquisition of The Portland Group by utilizing their procurement consulting skills

Internal investments have also mattered over the last several years with service providers increasing their development budgets significantly while also spending on adapting solutions models. In fact over the last two years we have seen previous solution models of end-to-end procurement lift and shift and sourcing consultancy become impacted by the arrival of more modular technology supported service delivery models. While still not the broad norm, this “As-a-Service” approach is setting roots in many service providers and we expect this to increasingly be the norm in the years to come.

So in many ways the last several years have been less revolutionary than they have been evolutionary with a slow and steady acceleration for all end-to-end service providers in the breadth of their offerings and only modest movement in their Blueprint positioning as a result. It should be noted though that the specialist service providers have markedly picked p their game in the last few years and now have a much more prominent place in our evaluation than before.

What matters today in procurement outsourcing

- We are seeing slowing growth. Procurement outsourcing while still much smaller than F&A or HR is becoming a substantial multi-billion market and with that we have seen a slowdown in overall market growth from 10%+ a few years ago to something more in the 6% range and so the competition for new clients and renewing deals is greater than ever.

- The nature of transactional procurement is changing. Transactional Procurement for the last decade has often looked like a “lift and shift” model supplemented by post transition process excellence projects by service providers. In the last 18 months, we have seen a rapid evaluation of the potential first for robotic process automation and of late cognitive computing as well to this process in order to move away from the labor arbitrage heavy model of the past and to improve overall delivery speed and quality

- Sourcing and category management still in demand. Client value creation and service provider differentiation often depend on the breadth and depth of the available sourcing staff in the service provider. The battle to hire and retain sourcing expertise is significant especially as clients in both North America and Europe are looking for the on-site availability of consultants from their outsourcing service providers. Many of the strategic actions undertaken over the last several years by the service providers including acquisitions and partnerships have been made in order to address gaps in organic indirect sourcing category coverage.

- Procurement technology and technology management has never been more important. Service provider technology has always played a role in procurement delivery but in the present market with the increased availability of SaaS solutions it has increased again in importance. We have increased the attention and weighting given to technology in this iteration of the Blueprint and spent even more time reviewing service provider capabilities and strategies for technology as well as what it feels like to be an enterprise client today that is increasingly reliant on technology they no longer control to deliver procurement results.

- Moving to As-a-Service. We are certainly not there yet, but procurement outsourcing service providers have made extensive efforts over the last several years to further transform their offerings from “lift and shift” transactional procurement together with consulting led sourcing to more modular, integrated, technology based as-a-Service solutions.

Which service providers are taking advantage of this market?

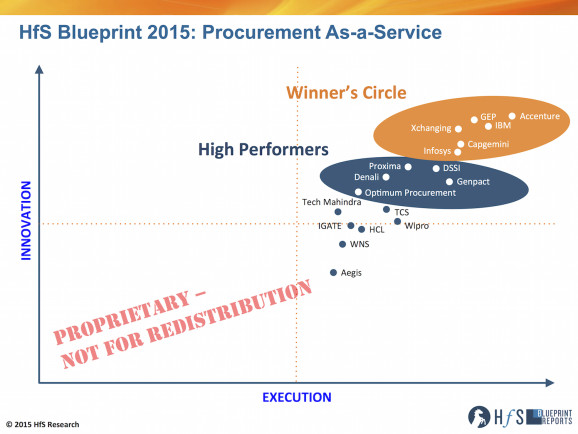

Our 2015 Blueprint Winner’s Circle members who led in our evaluation of the criteria on Service Provider Execution and Innovation are: Accenture, Capgemini, (promotion) GEP, IBM, Infosys and Xchanging (promotion).

Our 2015 High Performers include: Denali (new entrant), DSSI (new entrant), Genpact, Optimum Procurement (new entrant) and Proxima.

So what does HfS expect will happen next as this market unravels?

HfS’ Charles Sutherland, report co-author, having a bit too much of a good time in Kraków last week

Crystal ball gazing in procurement has proven to be challenging over the last few years but let’s throw caution to the wind and make at least three bold predictions about where we will be by the next Procurement As-a-Service Blueprint.

- There will be a much greater commercial adoption of As-a-Service in procurement as current trends towards modular processes and hosted software make further inroads.

- There will be much more extensive adoption of robotic process automation and cognitive technologies in procurement than we have seen so far. For most service providers these are still at the PoC or limited deployment stage in procurement but we don’t see that being the case for much longer.

- Some of the recent partnerships especially for sourcing and category management not lasting the test of time and leading to increased efforts to grow organic capabilities

- Attracting and retaining leaders in strategic sourcing and category management will continue to be a struggle for many service providers as that is part of the solution we don’t see diminishing in value or importance anytime soon.

So that’s our take on Procurement As-a-Service in 2015. Please do share your thoughts with us as this important segment of the business process market continues thrive, and…

For you HfS subscribers, please click here to download your full copy of the report

Posted in : Business Process Outsourcing (BPO), Digital Transformation, HfS Blueprint Results, HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, Procurement and Supply Chain, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, sourcing-change, Talent in Sourcing, The As-a-Service Economy

Good one Charles.

Adding to you 4th point, I believe that in coming years, one critical aspect for service providers will be ‘how to manage the talent in area of strategic sourcing and category management space’. Initially people (including myself and many of my present day colleagues) moved from Industry to service providers. But now the pipeline is drying and it’s difficult to find the right talent. Specially in India as traditional Industries recognized the value of procurement talent and started paying well. Upgrading transaction procurement people into sourcing /category management skills is an option but the effectiveness of classroom training is limited as compared to real life experience.

[…] For most service providers these are still at the PoC or limited deployment stage in procurement but we don’t see that being the case for much longer. Some of the recent partnerships especially for sourcing and category management not lasting the test of Procurement makes its move to As-a-Service…. so who’s leading the market? […]

[…] June 21, 2015 Horses for Sources post entitled Procurement Makes Its Move to As-a-Service…. So Who’s Leading the Market? announces and provides highlights from the latest “HfS Procurement-as-a-Service […]

As the author of the first of these, I compliment HFS on continuing coverage in this niche area. Kudos also to the new entrants, who really aren’t that new (Denali, that’s you!). Capgemini must have picked up some wins, so good for them. Infy is pretty solid. Xchanging shook things up – will be interesting to see their position next year. Proxima is a great company with outstanding leadership. I like this grid!

So, I’m struggling with the application of robots in procurement, except in those really high volume MRP/stock level trigger scenarios. Maybe the analysts can comment?

Frankly, these solutions are procurement consulting killers. EY, ATK, etc, can’t hold a candle to the category knowledge @ Accenture. Maybe there’s a specialty category or a couple of really great consultants, but I’m really impressed by the outsourcers’ overall strength in general indirect spend. Don’t hire the $500/hr guys, CPOs. Get yourself one of these teams – but watch those price points and figure out how to build customer relationships if you’re outsourcing….

It all started when Chris Messina, not the Americaan actor

but the open source advocate, posted a message with

a hash symbol on Twitter iin August 2007. If your

business products or services are ones that peopple lke to talk about you

will have a much easier time acquiring social media interest,

fans and followers. In fact, such strategies can backfire if would-be “fans” vkew a company’s social

networking effortgs as manipulation.

@Tony

Thanks for the support as always. It was a real pleasure undertaking this Blueprint and tracking how the market had changed over the last several years and how it hasn’t. We agree with you that the level of sophistication and competence in the leading service providers when it comes to indirect categories have never bee stronger. These service providers get it and they really have become consultant killers.

When it comes to robotics, we have mostly seen their application to the world of transactional processing and in particular to the support of AP and master data related processes. There the high volume world you cited is at play and the tasks are very rules based and repeatable and so we expect to see even more penetration of software bots in the coming years. We have also seen some limited use in support of sourcing as well. In particular for support of catalogues and e-events seems to have some applicability as well.

Lets continue the dialogue

Charles

@Durgesh

We couldn’t agree more. The level of demand for sourcing and category managers in procurement outsourcing is very high and is beginning to outstrip demand. In some service providers a real effort has been made to “convert” consultants into more of an outsourcing team member but that’s not enough if this sector is going to continue to grow at its potential. Service Providers should be thinking of a form of “apprenticeship” to bring up transactional resources more effectively at the same time, looking at how robotics can be applied to a certain % of each sourcing leads day in order to boost their availability across clients as well

Charles