What has happened to the Indian-heritage IT service provider that stoked fear into every Accenture client partner? “They think like we do” was the declaration one of Accenture’s leaders made at an analyst briefing in 2016. Well, the slide from grace has been alarming, leading to the appointment of a new leader to stem the bleeding.

However, when the problems cut this deep, you can’t just apply lipstick to the pig, you need to reconstruct the whole farm, or you can quickly find yourself in the zombie services category alongside the likes of Conduent and DXC, where finding any sort of direction and impetus would be a major accomplishment.

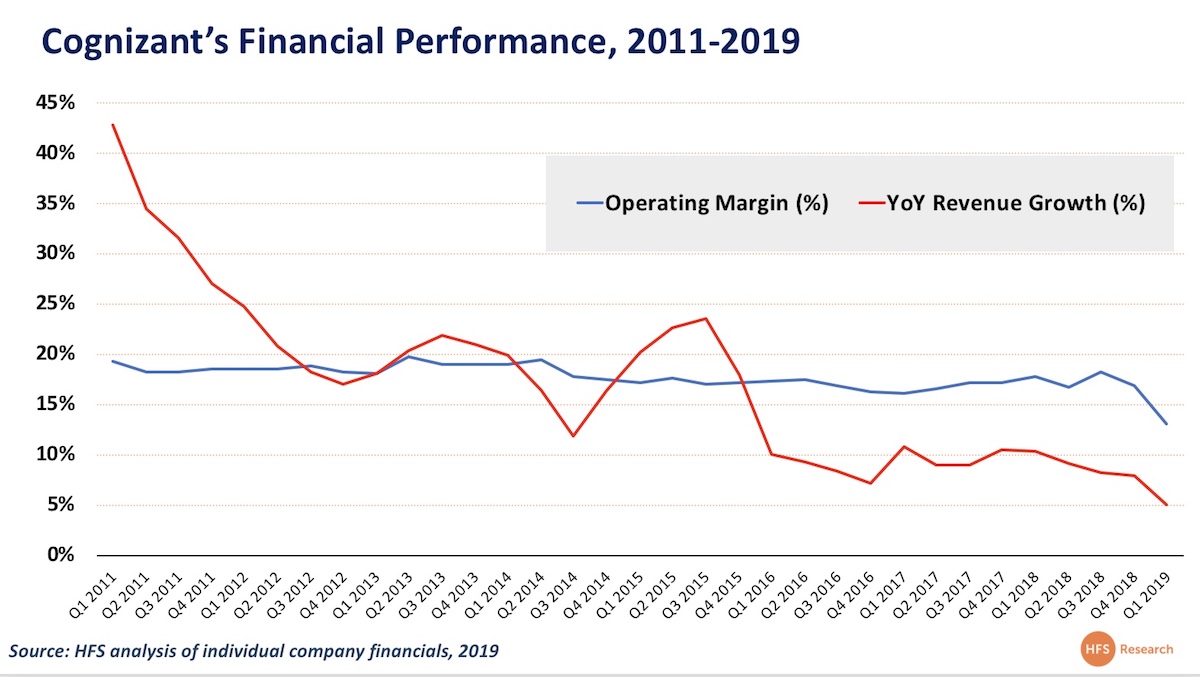

Yes, it could really get this bad, as Cognizant has posted its slowest revenue growth and worst dip in profit margins. Ever. A mere 5% annual revenue growth, when in its heyday it was posting well over 40% (and slipping below double digits was unthinkable until last year). Yes, declining revenue growth is one thing, but declining profit margins is when the panic button gets pressed.

Frank should have left when Elliott came along to poison the well

It’s clear to see why Francisco “Frank” De Souza, the poster boy CEO of the emerging power of the Indian IT Services industry, jumped ship (or more accurately was made to walk the plank a burnt out husk due to the unenviable pressure Elliott Management placed him under to keep the gravy train on the tracks and kick back billions to shareholders.) If anything, Frank should have considered making a move in 2017 as Elliott started squeezing Cognizant’s margins at a time is needed to keep pace with Accenture’s aggressive digital investments. He’d grown the firm to over $15bn by then and could have exited with a legacy no one could rival in the tech business.

And in his place comes IT Services newbie Brian Humphries – well we’re sorry to say this Brian, but the baby you just adopted has got a bit ugly, and is screaming for attention. Let’s just look at the numbers– now we’re going to be generous and forgive Cognizant’s dip in margin, a likely result of a reclassifying activity to meet fresh regulations. But the sinking revenue growth is much harder to look past:

In 2012, Cognizant invented the Digital concept before everyone else jumped on it. They were that cool…

In a punishingly competitive market, it looks like Cognizant has started to lose traction. Back in the good old days, the firm could do little wrong by challenging Accenture’s strategy – driving a hard-digital bargain and bringing in design consultancies along with their pony-tailed nose-ringed jean wearing creatives. In fact, Cognizant can genuinely lay claim to “inventing” digital with its 2012 “SMAC” stack philosophy, which was swiftly followed by Accenture’s 2013 re-branding the SMAC stack as “digital”.

But the market has moved on – away from automation point solutions and funky apps to fend off uberized rivals. It’s now about integrating capabilities and meeting clients with legitimate flexibility, a real willingness to find out what they want to buy, rather than keep pestering them with siloed offerings and poorly verticalized capabilities.

Somewhere in all this noise, India’s rising star lost its way. And, honestly, the hassle of a new leadership team is unlikely to make matters any easier to drag this tired giant back from the ropes to get them punching again.

Is now the right time for Brian to go on a cull? Crush a culture, or fix what isn’t that broken?

Changing a culture overnight is a gargantuan task in a firm that has been steeped in it for two decades – just look at Vishal Sikka’s attempts at Infosys, where the guy couldn’t charter a jet without all hell breaking loose. However, you can instill a new urgency (and a little healthy fear) which is more likely where Brian is heading with all this.

Realistically, we can’t be too tough on Cog’s new CEO – let’s face it the guy is barely in the door and the actions and initiatives behind these disappointing results were already in place before he took over the reins. But the stories we’re getting from insiders familiar with recent goings on paints a harrowing picture. We’re already seeing cuts being made and senior, albeit expensive, executives shown the door (and self-selected to take a package and quit), as the fresh CEO starts pushing for costs savings – but is this the right strategy? Maybe this is more about fixing a machine that just needs a significant tune-up – it’s working well with Salil Parekh at Infosys, where the firm needed renewed urgency, as opposed to open-heart surgery, to find a better direction for itself.

Anyone who plays in this space knows it’s not for the faint-hearted, but with major talent wars popping out across the industry, it doesn’t seem like axing staff and business units is the most prudent course of action – even with revenues in decline. And pushing for lower costs will do little to differentiate the firm from an already cluttered space packed with purveyors of low-cost offshoring.

The keys to victory are to be found moving up the value chain, not down it

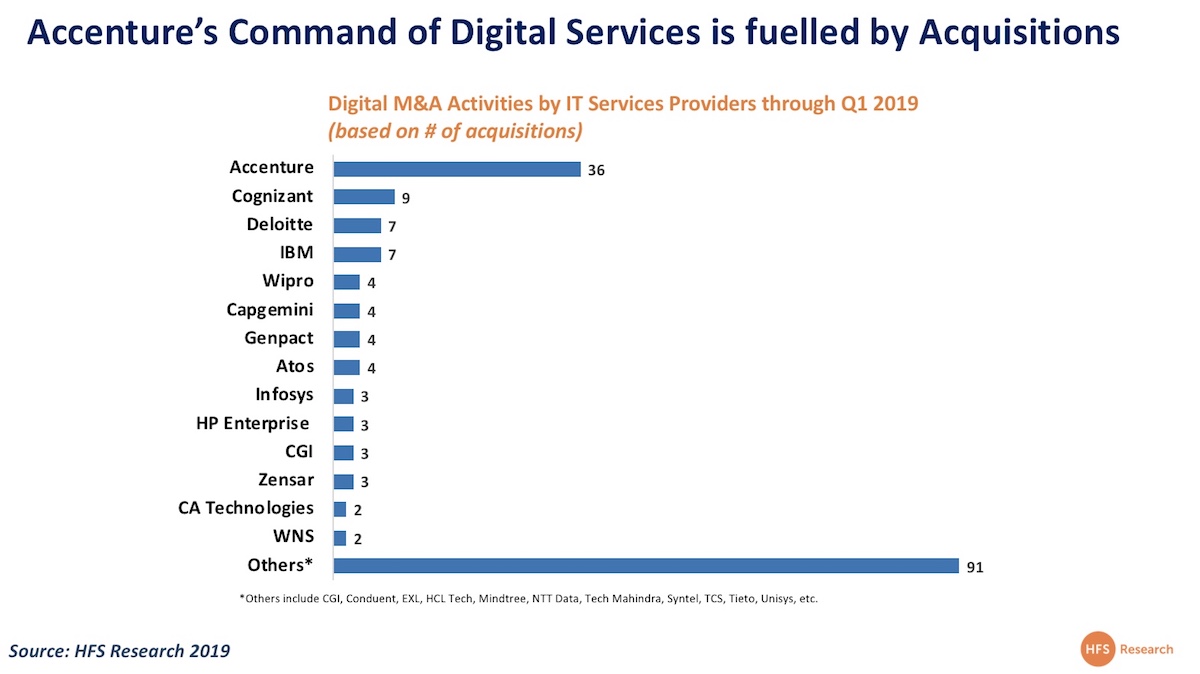

Anyone who things they can “out-Walmart TCS” or “out-price HCL” needs a lobotomy. The reality is that Cognizant has little option but to loosen the purse strings – rather than tighten them – and bring in some real consulting and digital capability. It’s been a long time since the acquisition of cool kids Idea Couture, and even then this group was hardly big enough to make waves across the organization. To make a difference and reverse its decline, Cog needs to make some major investments – bringing in a BCG or Bain-sized consulting group wouldn’t see them too far wrong. They’ve actually shown more focus in digital than it’s India-heritage rivals, so it’s not too late to reboot this strategy, especially if it hands some war-chest to Malcolm Frank:

And perhaps that’s the plan all along, make savings now to open up opportunities for investments later. This may keep the accountants happy, but it does little to help the perception of a firm in decline – which in a market where the financial stability of partners is moving further up the priority list is a major concern.

What do we think of the new CEO?

But all of this isn’t to say we’ve taken an immediate disliking to poor Brian – far from it. He’s barely through the door, what we’re conscious of is there’s now a huge to-do list for an executive relatively new to the space to pull off.

When we’re asked what we think of the new CEO, our honest answer is we don’t know. He has, for all intents and purposes, kept a low profile externally, instead focusing his energies on extensive liposuction internally. But there are some concerns. First off, try to follow Brian on twitter – tried it? That’s right his account is locked down as “private”. Now this may seem innocuous enough but for the CEO of a major IT Services player it’s a big no-no.

We’ve been talking for a long time about the power of the CEO as a front-person for the firm. Take a look at Tiger at Genpact, CVK at HCL, Caldwell at Concentrix or even Ginni at IBM – they are their own firms’ evangelists – and in an over-hyped complex space, clients are desperate for that clarity.

If Brian’s not even confident that he can tweet without upsetting clients, employees and analysts to the extent he keeps his account locked down, there may be little hope of him taking to the stage to push the virtues of services. But we guess we’ll have to wait and see.

Bottom-line: Let’s give Brian a hand with a to-do list if he wants to right the direction of the Cognizant ship

Investments: Cognizant has been starved of major investments for years, ever since activist investor Elliot Management came in and held a gun to Frank’s head demanding billions in shareholder kickbacks. Elliot’s gone now and Brian should be using his fresh perspective and enthusiasm to home in on acquisition targets in the market to bring in the capabilities the firm really needs to differentiate itself. It’s 2014 $2.7bn splash on healthcare platform TriZetto is long in the distant past (and sadly healthcare probably wasn’t the best bet for the firm when we look at the sorry state of that industry today). Brian needs to look at key industries, such as banking, and key capability areas, such as further expansion of digital marketing, so get Cognizant back on track.

Talent: By the sounds of it Brian is moving through the organization with a scythe at the ready whenever a potential cut can be made. In some instances, this may be right, but we’re already hearing of talented professionals and executives getting ready to jump before the blade comes swinging round to them. We’re in a people business – and if all the best professionals jump ship, and they will, then Brian may find himself sitting alone in the boardroom desperately trying to figure out his AIs from his RPAs.

Perception: With the departure of Frank, and a crushing first quarter under Brian, there will be myriad perception battles to fight. Brian might want to start by stepping in to reassure the crew – and then it’s time to let current and future clients what the plan is – because right now, none of us have a clue.

Marketing: Finally, all the time Cognizant’s future is up in the air, its rivals are busily chomping into the limited mindshare bandwidth. Brian needs to push out a clear marketing message that lays out their differentiators and roadmap, if he’s to reverse the decline of one of the sectors most promising companies.

Mojo: Find it – and fast. Today’s market is harder than ever to build momentum, and bludgeoning people over the head with a blunt instrument is really the only way to get out in front. So find the right message, stick to it, and batter it home. There is no room for dithering anymore – and many may already think it is too late to rebound, but Cognizant’s position is way, way healthier than a Conduent or a DXC, and can quickly find its way back to the top if it stays laser-focused, makes some significant eye-opening investments and brings a fresh message to the market that defines what it stands for.

Posted in : IT Outsourcing / IT Services

Well said Phil. Brian’s asking all right questions but then it’s easy to ask questions than to stand up and lead from front ! Of the last few weeks, there’s been more of market messaging and posturing (by low balling growth nos) than taking genuine interest. May be he thinks our firm needs a shock therapy and he is right too, but key will be his vision, strategy, positive execution and ability to be the best salesman for the company . That is what will be his real test. Not bossing and bullying around people !

Very well written article. When the damage is enormous, it would need an extreme level of thought-process and efforts to even make one step forward. Undoubtedly, Brian has got a tough job ahead.

I wish your article would have given some glimpse into C2020 and how it impacted. C2020 split the organization into commercial Vs. delivery, which (IMHO) didn’t work well resulting in key people at mid-level management leaving the organization in the last couple of years. Looking forward to seeing Brian’s next steps in revival.

As we continue to assist our clients navigate through the disruption jungle that is digital, it would be foolish to NOT expect a fair amount of disruption internally as we adapt and adjust to the market. Anyone that banks on the sustainability of the legacy offshore labor arbitrage business model will regret their inability to map the future. Don’t weep for Brian. I for one believe his hiring reflects the vision of a Cognizant and that he has the perfect timing and opportunity to shake up the old guard and culture. New day dawning!

Eventually, all companies come to this. There is a lid on leadership and the trick is to keep shifting the lid upwards, thereby giving oneself breathing space and creating some headroom for growth (growth = learning, innovation and discovery of new business spaces). Some figure a way out (TCS, Accenture, HCL) and some don’t out (EDS, HP, IBM, Unisys, others), and some hang on desperately (Wipro, Infosys). All comes down to the DNA and the organizational model – culture that has set in over the decades will show up in the journey ahead.

Having said that, all these firms are fundamentally similar under their polished exterior and show similar challenges in the recent 4-5 years in their (people, clients, services mix/GTM, leadership and market positioning) operations. No firm will be immune to it.

While the investor must share some of the blame, let us also recognize that there have been other issues too, some in the public domain and perhaps some hidden. All of this hurts the organization collective soul, confidence and mojo.

While it is early to comment on this particular firm and it’s leadership changes, there are other clouds that will impact these firms. These clouds are gathering in the external eco-system and in their global business context, we will know soon enough.

Welcome to the de-coupled, uncertain and closed world of the 2020s. Exactly a hundred years since the roaring twenties and the beginning of the open markets revolution across the west.

Thanks,