Insurance is priming the pump for industry-centric As-a-Service solutions. The insurance space is one of those industries where it’s all in the sales, marketing and customer experience, so the more the delivery engine can he standardized and run efficiently, the more cost savings can be passed onto the customer and intelligent data to the service provider to set their policies, pricing and future strategies.

Insurance majors were among the first Western enterprises to open offshore captive centers in India and Philippines to process and adjudicate clients, support customer service etc. However, the main issue that has long-plagued the carriers has been finding value beyond the initial offshore cost-savings. I personally recall hosting a roundtable of eleven major insurance BPO clients five years’ ago, and the common consensus was “The only way to find incremental value is by tech-enabling our processes”.

So has this industry been making genuine progress as we evolve to the As-a-Service model? So who better to ask than the one analyst who has been tracking this space intensely ever since she joined HfS four years ago, Reetika Joshi:

What is “Insurance As-a-Service” and how is it different from insurance BPO?

Phil, insurance is a mature market for BPO – core insurance processes like claims processing have been outsourced for over a decade now. Our discussions with property & casualty (P&C) and life & annuities (L&A) carriers across client markets indicate that these services buyers seek value beyond the transactional back-office work of the past. Their expectations include more delivery of standardized processes on modern business platforms, an expanded scope of services and the incorporation of robotic process automation and operational analytics in core operations. We see increased investment and interest from services buyers along with service providers to modernize core processes across the outsourced/offshored/in-house/partner ecosystem to include these elements. For further reading, we published a report on this topic in May 2015 based on a buyer survey – Moving Insurance BPO into the As-a-Service Economy.

What are some of the changes you’ve seen in the market since the last Blueprint?

Industry forces are definitively impacting the nature of sourcing in insurance – be it more regulatory scrutiny and compliance requirements, aggressive competition, low margins or intensified market consolidation. To pull out a couple of examples:

- Business models are changing in insurance, and service providers are in the midst of the storm: On one hand, carriers have ageing distribution networks with traditional agents and other intermediaries, while emerging ecommerce and direct sales channels continue to proliferate. Carriers are struggling to understand how to shift the sales paradigm with sales and interactions. Some of this requires new capability development in going direct to consumers for New Business—setting up outbound and inbound sales and marketing operations, ecommerce channels, etc. Service providers are reacting accordingly to facilitate this growth, with more focus on the New Business service area than in late 2013, early 2014.

- Growth and focus on TPA model: More private equity investors and reinsurance companies are taking on blocks of business, with the need for strong execution arms that are pushing more responsibility to TPAs. Similarly, ramped up new product development is driving more blocks into run-off. As a result, service providers have scrambled to acquire TPA licenses to service end-to-end insurance processes. We see far more TPA plays emerging in the last 18 months.

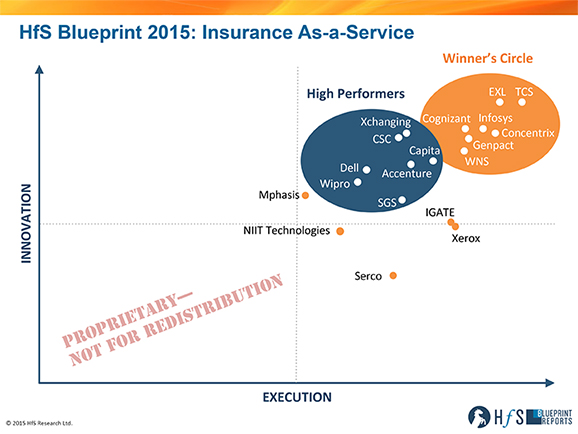

We believe these industry forces, along with other equally relevant shifts in the global technology and services landscape, are gradually changing the nature of outsourcing in the insurance vertical towards more Insurance As-a-Service delivery. Our scoring methodology for this Blueprint has changed accordingly. Compared to the first Blueprint on Insurance BPO (Feb 2014), we increased the focus on innovation toward As-a-Service delivery, with 50% of the Blueprint scoring being tied to proven innovation capability and performance for these engagements, beyond the standardized insurance BPO processes.

How are winning service providers approaching this market differently, moving beyond basic operational services?

Service providers, after more than a decade of technology and business services expertise for insurance processes, are in a position to offer more consultative support to help design solutions and even operating models that are more modular, technology enabled and future-ready. Buyers are willing to act based on their internal culture, appetite for change and established relationships with service providers. Insurance As-a-Service is a reality for a growing subset of insurance BPO/BPaaS engagements today. With this new focus on As-a-Service, we saw TCS, Concentrix, Genpact and EXL hold their leadership positions, as well as the entry of Infosys, Cognizant and WNS into the Winner’s Circle.

- Cognizant advanced due to the strong progress it has made in the last 18 months in integrating its insurance assets and partnerships, driving new business growth. Infosys has built a strong reputation based off its start with McCamish and made progress on its BPaaS strategy. WNS’ focus on outcome based models and embedded analytics coupled with its flexibility and insurance knowledge helped it advance in position.

- TCS and EXL lead the market on Insurance As-a-Service, both on articulating their vision and executing at scale. They are the ones to beat in their respective client markets.

- Genpact and Concentrix continue to hold onto their leadership position based on solid execution and articulation of their As-a-Service vision; they will need to make strong investments to execute in the changing competitive landscape for As-a-Service.

Interestingly, the service providers in the Winner’s Circle stood out for As-a-Service delivery for different reasons. Some like EXL have more BPaaS plays, some like WNS are in for focusing on outcomes. The common underlying factor however is their willingness to evolve, the success of their initial forays into including As-a-Service components and charting out progressive visions for insurance that is visible to their clients.

Reetika Joshi is HfS Research Director, Consumer-centric Operations and Analytics Strategies (click for bio)

What do you expect for the future of Insurance As-a-Service?

Insurance operating models will continue to evolve to a more hybrid approach with in-house decentralized, in-house centralized, Shared Service Centers, TPAs and IT-BPO service providers as insurers gradually “let go” with:

- More complex functions along the value chain (e.g., claims adjudication, actuarial and underwriting support, CAT modeling)

- More integrated technology and BPO solution and delivery models that resemble Insurance As-a-Service, although in point solutions initially

- More collaboration and consultative support from service providers on modernizing core insurance operations, irrespective of delivery responsibility and geographic spread

Overall, HfS sees the insurance vertical as ripe for a rethink in design and execution for the As-a-Service Economy. The foundations are already present—mature processes, service providers’ domain experience, buyers’ appetites for platform-based delivery, and burning platforms for change in business models for both L&A and P&C. However, insurance carriers need to get on board to ensure success. Services buyers need to make concerted efforts to align stakeholders around the As-a-Service economy. From our discussions with clients, service providers and other influencers, we see a pronounced lack of synergy around core operations from insurance carriers in P&C and L&A – across lines of business, inherited assets, TPAs, BPO and IT relationships. We see service providers continue to make investments that will disrupt this mature market in the next two years. Winning service providers are leading the way and starting to help clients navigate through this disruption by offering scalable and adaptable technology-enabled solutions. At HfS, we’ll continue to report on these successes, failures and learnings on the long road to Insurance As-a-Service.

HfS readers can click here to view highlights of all our 23 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report: Insurance As-a-Service 2015

Posted in : Business Process Outsourcing (BPO), HfS Blueprint Results, HfSResearch.com Homepage, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, sourcing-change, The As-a-Service Economy