A momentous event occurred in the world of Robotic Process Automation (RPA) today, when its pioneering vendor, Blue Prism, became the first pureplay RPA vendor to announce officially its intention to IPO.

A momentous event occurred in the world of Robotic Process Automation (RPA) today, when its pioneering vendor, Blue Prism, became the first pureplay RPA vendor to announce officially its intention to IPO.

Naturally, this sparked some feverish debate among the RPA cognerati over whether we may see one of the established services firms make a play to own their very own RPA platform, as opposed the the currently practice of every service provider partnering with every RPA product on the market.

My personal viewpoint is that IBM should take a serious look at Blue Prism, especially now RPA is officially a market-worthy capital asset. IBM is a huge software company and could seriously benefit from having an RPA offering it can build out as an enterprise platform, provided it makes sufficient investment and has leadership attention to develop the solution.

So let’s look at the pros and cons:

Why IBM should probably buy Blue Prism

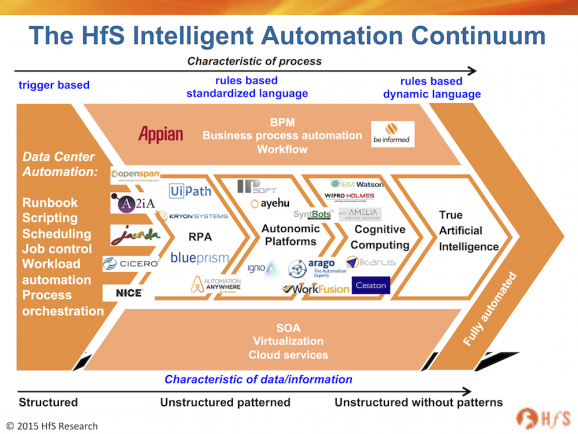

Watson alone is not going to do it for IBM in the Intelligent Automation space. IBM needs an RPA offering as the first building block along the Intelligent Automation Continuum (see below). Pushing RPA onto more clients will also open up the Watson conversation as a logical next step for many clients.

A Blue Prism + Watson platform could create a whole new ecosystem of possibilities. Adding Watson’s cognitive capabilities to Blue Prism would create a real differentiator in the Intelligent Automation domain – you would end up with a whole new ecosystem of services and capabilities for enterprises across automation, predictive analytics and cognitive computing.

IBM needs to focus on becoming the leader in industry-centric Automation/Cognitive services. This is where IBM can really make its future mark in 2020-and-beyond enterprise services. There are limitless possibilities with the potential of artificial intelligence in industries such as healthcare, manufacturing and retail. Simply providing a cognitive engine is not enough – IBM needs to build leading-edge business practices around it. It is doing some very cool stuff in healthcare and medical research, for example, but I believe it can do so much more to help enterprises streamline their processes and act on realtime data, with a defined Intelligent Automation roadmap.

A genuine RPA underbelly for enterprises. IBM can position Blue Prism as a true enterprise RPA platform, as opposed to a mere robotics tool for specific processes. It’s one thing tightening up a few loose parts, another entirely, when you overhaul the engine…

Brand credibility and IBM’s hooks into leadership discussions. IBM has real credibility to dominate the RPA conversation with enterprise leaders – having its own platform adds some serious fuel to the fire. Automation and cognitive are high on the leadership agenda, where IBM has the potential to make it a market of one.

More than BPO. In addition to fuelling its BPO capabilities, IBM could leverage Blue Prism as part of its management toolset and BPM portfolio

Modest initial investment. For IBM, the likely cost of acquiring Blue Prism would be modest compared to its regular mega acquisition habits

Why IBM probably should probably not buy Blue Prism

Alternative offerings could be considered. Some clients prefer (or claim to prefer) using Automation Anywhere and UiPath, among others. However, there is no reason why and IBM-owned Blue Prism could not operate in a multi-solution automation environment.

Citrix issues. Some Blue Prism partners claim they struggle with Blue Prism in Citrix environments.

Longevity of RPA as a “solution”. In two years’ time, nobody will talk about RPA anymore – it’ll be native in any enterprise process solution worth its salt.

Does IBM really need it? IBM’s current BPO business portfolio is active enough to drive significant bot deployments on its own.

Size of IBM’s box of tricks. Will the emerging roadmap for industrializing RPA become lost inside of IBM’s bulging software portfolio?

Reduces attention on RPA as a solution in its own right. Will embedding Blue Prism in IBM lead to a reduction of attention on RPA as a solution in its own right, just at the moment when RPA is becoming a coordinated strategy for many enterprises?

The Bottom-line: No clear Intelligent Automation services leader has yet emerged. Acquiring one of the leading RPA platforms could be the catalyst

IBM needs to do something – buying up Weather Channels and Workday implementers is all great for today’s markets, but with its huge bets on Watson and cognitive computing, the addition of an enterprise RPA platform underbelly could be a killer move. Service providers such as Accenture, Cognizant, HP and TCS are already very active pushing RPA deployments, and, while IBM is also deep in the mix, it is already playing catch-up to some of the service providers. And maybe Blue Prism is not the right move to make – there are other potentials to look at (which it surely is doing), but the pros are far outweighing the cons in today’s climate, where aggressive moves are critical.

Thanks to my colleagues Charles Sutherland and Tom Reuner for contributing their viewpoints.

Posted in : Business Process Outsourcing (BPO), Cognitive Computing, crazymergerideas, Finance and Accounting, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Robotic Process Automation, Security and Risk, smac-and-big-data, sourcing-change, The As-a-Service Economy

Phil,

Great blog and touches on some very important points. I agree that the ambitious Tier 1’s need to consider owning their own RPA platform – this is the start of a much longer term strategy,

Warren Stevens

Phil, what you and the team are suggesting simply makes perfect sense- but not just for IBM. Any vendor wanting to reach beyond BPO / BPM / BPA would see immense value in acquisition of such capabilities right now. Traditional Tier1 players have the opportunity to regain the high ground where new entrants have been establishing a legitimate footing and blurring the lines. I expect M&A to increase as innovative new players emerge and acquisition proves easier than Think, Design and Build in-house.

David

A purchase like that would have to potential to create a near monopoly. Might actually hurt the development of the market.

@Sougata – yes it could, hence my last point, “Reduces attention on RPA as a solution in its own right”. I do not believe we will be talking about RPA in a couple of years as it becomes native to services, hence the buzz and investment in the space right now is great to driving product development and adoption. Taking out the key players could well slow everything down,

PF

@David – I think all the major service providers are looking at each other trying to figure out their longer play here. If one takes the plunge and buys up one of the RPA software vendors, I can see others following suit It suits the market right now to have several independent competing products, but as history has shown us, this will probably not last. Automation is too important and the leading services firms need to differentiate beyond merely having good people – some are already building out their own RPA/Cognitive platforms (Wipro, TCS etc), while others are still preferring to stay agnostic. End of the day, it’s about having a proven solution, a set of scalable capabilities and a book of business. Acquiring a Blue Prism / Automation Anywhere / UIPath etc gives you that… and some will bite,

PF

Phil,

Brilliant piece and I agree with your observations that IBM could benefit enormously from an acquisition like BluePrism. In my mind, this is a ‘Build versus Buy’ scenario for the service providers. If there is unique IP to be acquired in a product like BluePrism that allows IBM to get to the front of the market then its a no-brainer,

Paul

@Paul – there’s the classic “Build v Buy” decision to be made, but the key difference here is whether this is truly time for leading service providers to intertwine their services with robotic process automation technology (and IT automation tech). Outside of IBM, most the service providers have shied away from sizeable software investments (with the big exception of Cognizant/TriZetto), but we are dealing with a genuine paradigm shift of delivering services that are no longer tied purely to headcount. Being able to “own” that capability is surely a major de-risk element for service providers, as there is less risk of competitors offering the same services on the same tech for less… but it all depends on having the right tech, the right talent and the right credibility to be the automation provider of choice…

PF

Phil- Only if IBM changes Blue Prism’s pricing model. It is not viable or competitive.

Phil, great article … Watson analytics and RPA together have a powerful compelling story. As these are two emerging technologies the key is to implement proof of concept to have real life examples so it turns ideas in to action

@CL – I thought that was what IBM loved about them =)

@Jesus – I agree they need to be in the same conversation… and the same solution!

PF

A company such as IBM buying Blue Prism is possible but what is stopping IBM developing their own RPA platform. I personally find the look and feel of Blue Prism dated and clunky. Of course once automated a process 95% of the time it runs itself. If IBM were going to buy Blue Prism then I believe they would invest heavily in Blue Prism. In my view gathering data is one of the key benefits of implementing RPA then it makes sense for an RPA / Analytics solution to come onto the market. Would not suit Wipro to buy Blueprism to merge with Holmes and stop competitors using BP. As we all know the majority of RPA vendors are all small companies and any of them could be bought by any of the Top 25 IT vendors or even one of the Big 4.Consultancies all of whom are or are looking to be involved in RPA. Another thought would be Kofax and Watson coming together, now that would be a powerful business tool.

If IBM were clever and they were going to buy it, would they not buy it when it was private, before the 44% share price rise on the first day of trading?

http://on.ft.com/1MiWHiK

Just asking.

@Douglas – it’s still a modest price by their standards (~$50m?). If they were really smart, they’d buy up Automation Anywhere, Blue Prism and UiPath and own the market…

PF