We can finally draw a line under the market that was RPA as we transition to the broader value of integrated automation, AI and analysts solutions (the “HFS Triple A Trifecta” – see definition below):

Our analyst team conducted the most exhaustive research process ever conducted in this space… here’s the overview:

RPA Customer Experience Survey. HFS fielded a detailed RPA satisfaction study with 255 super users of RPA (enterprise clients and product partners) that yielded 311 product ratings across 30+ CX dimensions

Detailed References. HFS conducted reference checks with 75 active clients of RPA product companies, including detailed interviews with ~20% of the sample

RFIs. Each participating vendor completed a detailed RFI

Vendor briefings. HFS conducted briefings with executives from each vendor

Download your copy of the ‘HFS Top 10 RPA Software Products 2020’

So without further ado, let’s hear from our lead analyst, Elena Christopher, for this Top 10 exercise:

Phil Fersht, CEO & Chief Analyst HFS Research: Elena… 7 years on, is the RPA bubble bursting or is something else happening?

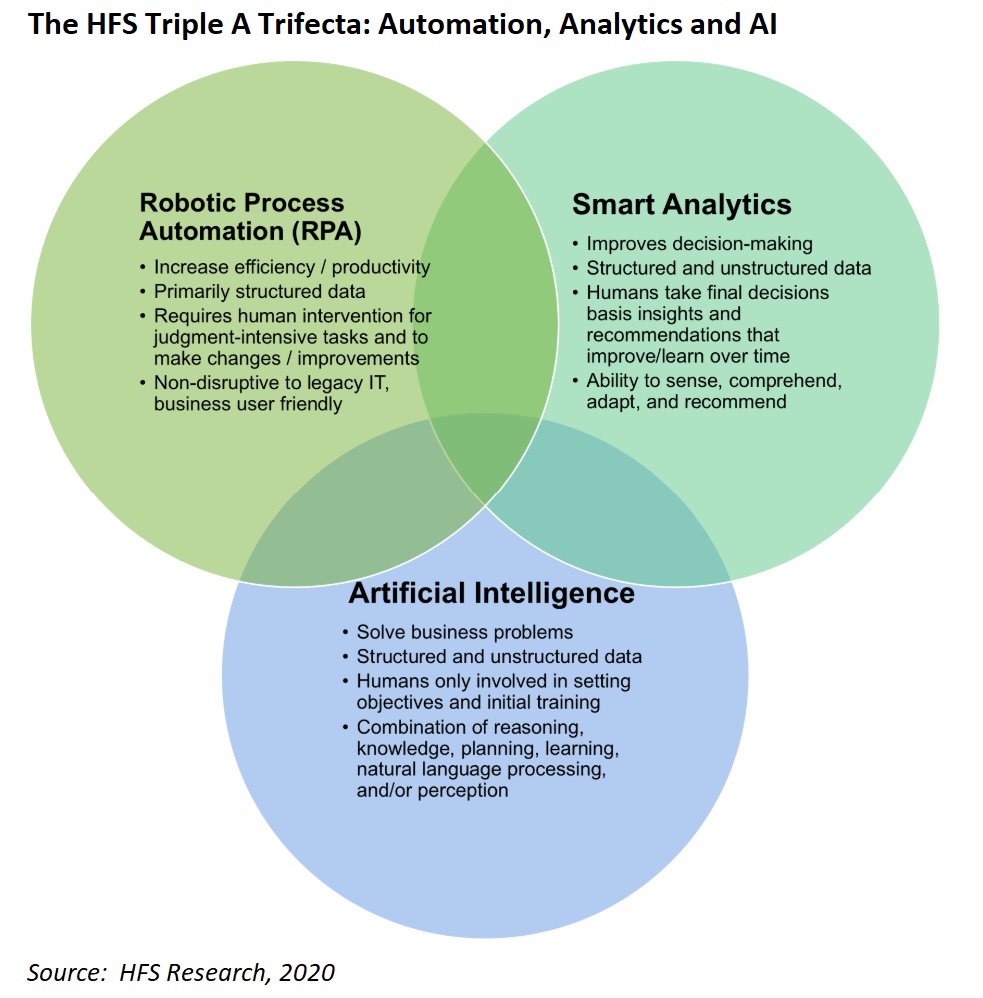

Elena Christopher, SVP HFS Research: In 2012, HFS launched the concept of robotic process automation (RPA) to the world via a seminal report and blog. In the seven years since, the ugly truth is that we’ve simply succeeded in using RPA to move data around enterprises faster with less manual intervention rather than to rewire our business processes and create new thresholds of value. We are largely missing the opportunity to transform business operations. RPA gets loads of guff for creating technical debt. But the reality is that it has the potential to clear enterprise decks of years of process debt! Process transformation is the still unfulfilled mission. As we said last year, RPA is dead, long live integrated automation platforms. RPA alone is a great tool. But no singular tool can deliver broad transformation. As I’ve been saying of late, RPA needs friends. Sort of my own weird children’s show – RPA bot, cognitive capture, machine learning algorithms, APIs etc all work together to reinvent processes and create value. But honestly this is just another way of reflecting our Triple-A trifecta of automation plus analytics plus AI. Powerful alone, but better together.

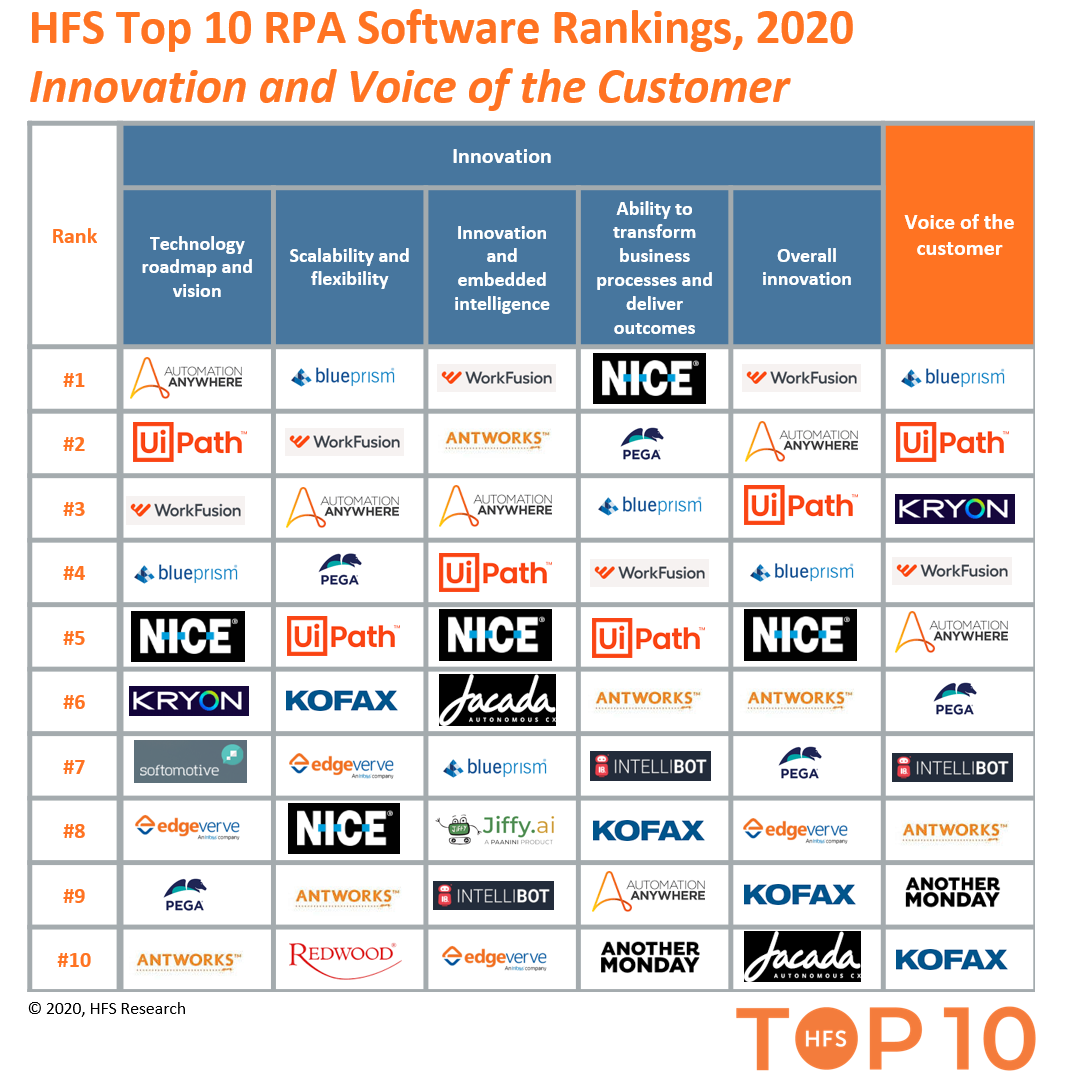

With transformation on the brain, we focused our 2019 RPA Software Product Top 10 on how the RPA product companies are supporting and enabling their clients to scale their automation programs and drive real change. We looked at our normal mix of execution, innovation and voice of the customer criteria with special emphasis on factors such as customer scale, richness of ecosystem partners, product roadmap and R&D, embedded intelligence, and ability to drive business outcomes.

We expect that vendors can talk well and compellingly about their capabilities, thus we also conducted deep due diligence with their customers to get a straight story

What stood out during the Top 10 analysis? Who are winners and who needs more development, Elena?

Well before getting specific, the most important point to make is that no single RPA software vendor is truly leading compelling process transformation at scale. Those that are headed in the right direction have clear roadmaps and deliver enhanced product functionality that clients need to grow their automation programs, have strong ecosystems of well-trained implementation partners and technology partners that extend functionality, and they focus on driving success beyond the sale. Technology may be the enabler, but getting companies to change how people work and processes are executed is tough business.

Now for specifics – Overall, the big three (Automation Anywhere, Blue Prism, and UiPath) all had a strong showing. Automation Anywhere prevailed overall buoyed by a decent base of scaled, or perhaps more fairly, scaling customers. Of the big three, they offer the most native capabilities and have actively been working to address unstructured data for a few years. UiPath, who was the media darling of 2019, came in second overall. While they are doing many things right, its lower level of scaled customers and unrealized vision for the future of RPA set them back. Blue Prism took the three spot. While it exceled at execution, it fell behind in innovation criteria after a year of major announcements but limited actual impact on clients.

While we share overall rankings, the goodness is really in our subcategories where we showcase different facets of each provider’s strengths. This is our “choose your own adventure” approach to rankings. Consumers of this report can leverage the overall rankings or review the subcategories that are most important to their business needs. For example WorkFusion and AntWorks were recognized as leaders for their embedded intelligence. Kryon and Softomotive were recognized for their ease of use, NICE and Pega snared the top spots for delivering business outcomes, and EdgeVerve was a leader in security and governance.

So what’s your expectation for this market as it matures? Are we settled with the key players, or do you expect this market to turn upside down? What must these current firms need to do to survive?

RPA really is the gateway drug for AI and cognitive tech. As we move deeper into 2020, we expect to see more examples of Triple-A trifecta integrations emerge. Right now most enterprises are Frankensteining these, piecing together various tools and components to create the solutions they need – either directly or with service partners. We’ll see more integrated platforms come to fruition – some natively developed and some acquired a la Appian’s acquisition of Jidoka earlier this year. We’re also keeping a close eye on enterprise software vendors like Microsoft who announced Power Automate as its entry into RPA and let us not forget SAP bought Contextor in late 2018.

Meanwhile, enterprises can take a gander at our RPA Manifesto for Success for the Next Seven years. Among the recommendations, it reminds us that technology alone cannot drive business transformation.

Great insights Elena… Now have a stiff drink =)

Damn dry(ish) Jan!!!

Appendix

The Trifecta elements intersect with each other. While each element of the Trifecta has a distinct value proposition (RPA drives efficiency, Smart Analytics improves decision-making, and AI can solve business problems), there is increasing convergence between the three elements. For instance, smart analytics are increasingly reliant on AI tools such as NLP to conduct search-driven analytics, neural networks to do data exploration, and learning algorithms to build predictive models. In fact, the Holy Grail of service delivery transformation is at the intersection of automation, analytics, and AI

The Trifecta is nonlinear without a definite starting point. Transformation is not a linear progression. Enterprises can start anywhere across the Trifecta. It is not necessary to start with basic automation and then advance to AI-based automation. However, it is critical to understand the business problem that you are trying to solve and then apply the relevant value lever or a combination of value levers.

Posted in : Artificial Intelligence, intelligent-automation, Robotic Process Automation, robotic-transformation-software

Excellent work, Mrs. Christopher! Congratulations. Especially your insight Trifecta meets exactly our perception of the reality. And, as we believe here in Switzerland, mentality shapes reality.

Thank you and keep us posted with your ideas.

Bogdan Preda

CEO at http://www.bim.ch

P.S. we’re fans of UiPath

Hi,

I am just wondering (or curious) how come that in the table Overall and Execution (first table) is Blue Prism at first place for 4 out of 5 parameters but Automation Anywhere is at the first place for Overall HFS Top 10 Position. Am I missing something?

Thanks for clarification.

Zdenek

I have a similiar question Zdenek, why are UiPath and Automation Anywhere the top two when they do not take a single #1 ranking across any of the categories in the “Overall and Execution” table above? It would help to have some of the reasoning as to how the categories are valued to drive the overall ratings as it is not apparent with the data provided.

Same question asked by both Zdeněk and Matt.

Organizers please provide clarity. Thanks.

Zdenek,

Great question. The answer is…. it’s all math. The overall ratings are a roll-up of scores and weighting for each sub-category. The sub-category leaders are stack ranked. So being #1 in a category does not mean the vendor scored 100 out of 100. As our study was supported by a detailed customer experience survey, we used the input from the CX scores as a starting point. As a result the top score for certain categories like functionality and ease of use was only 84 – ie: less than 100 and reflecting real customer and partner opinion.Thus Blue Prism can lead in several sub-categories, but when its scores are weighted and totaled, they land in the #3 spot overall.

Notes:

1. The Overall HFS Top 10 score is obtained through adding Overall Execution, Overall Innovation, and Voice of the Customer scores. They are equally weighted.

2. The Overall scores for Execution and Innovation are obtained by multiplying each subcategory score by its weighting and totaling.

Hope this helps.

Elena

Really comprehensive article. Explains the RPA landscape wonderfully!

Regards,

Medha, Marketing Manager at nuummite.consulting/