We’ve now seen three pretty small software firms demonstrate 20x valuations… Blue Prism went public on the London Stock Excheng, UiPath received $150m in series B funding and Automation Anywhere has now announced $250 in series A funding. So it’s pretty clear there are three established leaders at the front of the RPA market and investors are convinced that RPA is the start of something much bigger for enterprises. Not only that, it’s becoming pretty clear that the barriers to entry are high, and we’re unlikely to see new players bulldoze their way into this space in the foreseeable future. So why is this?

RPA is kick-starting the true digital journey for many enterprises by helping create a digital process baseline

People love to espouse that RPA has quickly become commodotized and we’ll barely be talking about it in another year, when we all suddenly become experts so good at building algorithms, we can actually train systems to build their own algorithms on the fly. Suddenly, RPA will be some pervasive capability that is so devoid of value, it will disappear somewhere into insignificance. Utter garbage: anyone who’s got deep into RPA and tried to incorporate it into processes knows immediately that this type of thinking is naive, and likely coming from someone with no experience of the real world outside of their ivory tower. Firstly, RPA and RDA are not apps you sell to IT people to “rollout”, they are low-code solutions, designed for business operators to replicate, fix and digitize their manual processes, or scrape “static” data from screens to integrate into a dynamic workflows. And secondly, “low-code” does not mean “no code”. Talk to anyone with RPA battle-scars and they will tell you about the amount of code customization that was needed in certain areas.

Digital today is all about an enterprise being able to respond to the needs of its clients as an when those needs happen. Today’s RPA and RDA provides integral building blocks that digitizes processes to enable businesses to process the data they need to have business operations support customer needs in real-time. Sure, they may simply be performing dumb tasks, such as running process workflows in recording loops, or scraping data from screens into automated scripts.

The commodization of RPA breeds familiarity – and familiarity breeds innovation. The market is already established

Commoditization is good for bots, but remember that most enterprise folks have had to train to use the products and we already have very loyal followings for AA, Blue Prism and UiPath. The tech needs to be simple, low-code and easy to install, scalable and manageable. Noone wants highly customized solutions these days, so please do not confuse the devaluation of commoditization with the value of familiarization. You think Workday and Salesforce are not “commodity” apps? They are successful because they have crushed their markets through effective channel relationships, the creation of cult-like followings and years of building familiarity with their customers. I’ve even heard of HR people threatening to quit their jobs if their firms refused to invest in Workday – it’s an important part of their entire career path. You think you can’t find quality alternatives to Saleforce, such as ZoHo and Hubspot that are lower cost and even better in some areas, or likewise for Workday with SAP Successfactors and Ultimate? I predict we are already settling on AA, Blue Prism and UiPath as the RPA platforms of choice, as so many business users have already been through the pain barrier of training to understand the whole RPA paradigm. We’ll actually see more “micro-solution” firms, such as Thoughtonomy, which is building a service layer over Blue Prim and reselling that solution with positive results. Another example is Antworks, which is impressing a lot of people with its data ingestion capabilities and integration with automation needs.

AA, Blue Prism and UiPath already have 700-1000 customers each (depending on what you believe) and have energized many new careers for many people – it can take a couple of years for non-IT people to really learn these products (and many experiment with at least two of them). This market is only going to get stronger and more robust over the next three years – and beyond that, it’s really all science fiction as we observe the speed of development and macro changes to our business environments. Like with all other technology-driven markets where the key stakeholder is the business executive, once they are familiar with a platform, getting them to retrain on something else is a massive effort. Remember WorkFusion’s attempts to offer “free RPA”? People don’t want something just because it’s cheap – or even free, they want some skin in the game.

The Bottom-line: Today’s “Dumb RPA” provides a baseline for the development of intelligent bots in the future

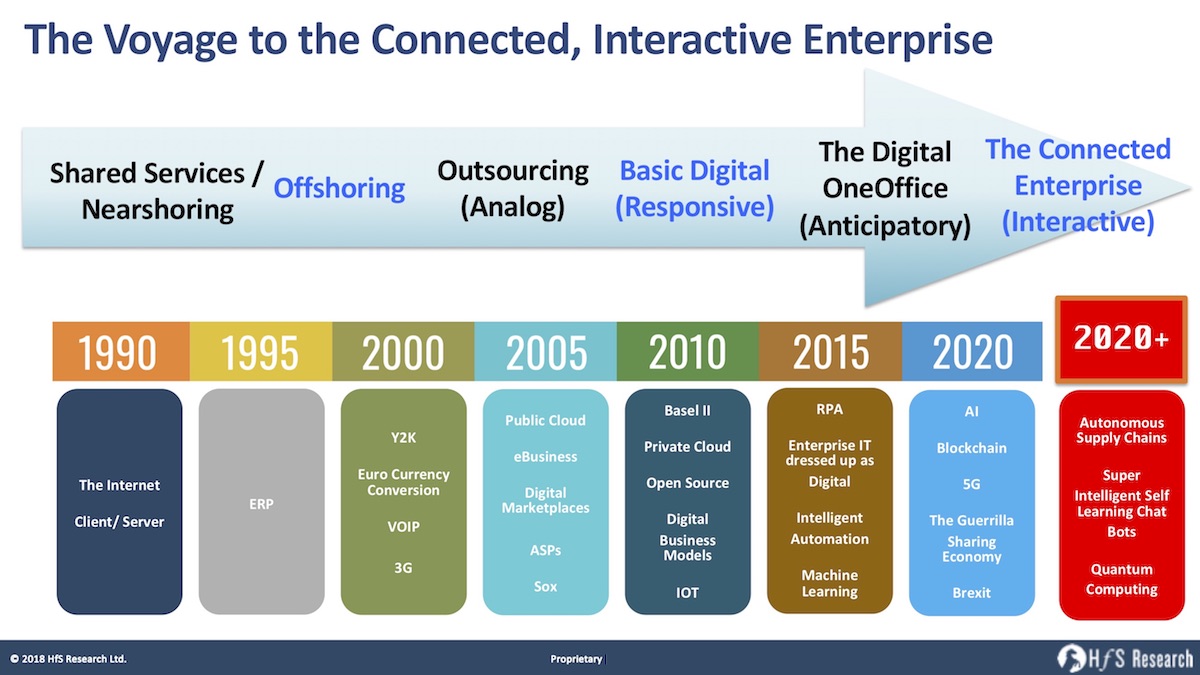

You have to start somewhere, and for enterprises fixing their manual process messes, these three tools have provided the answer, with 70% of Global 2000 clients now expressing satisfaction, according to our new 2018 State of Operations study results. However, if these firms rest on their laurels, this market dominance will be short lived. Once the digital baseline is created, enterprises need to create more intelligent bots to perform more sophisticated tasks than repetitive data and process loops. Basic digital is about responding to clients as those needs occur, while true OneOffice is where enterprises need to anticipate customer needs before they happen (see below). This means having unattended and attended interactions with data sources both inside and outside of the enterprise, such as macroeconomic data, compliance issues, competitive intel, geopolitcal issues, supply chain issues etc.

So we have some clarity for now with three dominant solutions, and enterprises can invest more in learning these tools with more certainty and peace of mind. Some stability, after so much change in the world of business operations, is more than welcome. Now let’s hope these firms will wisely invest in taking their products into the world of intelligent bots, and not splurge all the newfound capital on yet more sales and marketing.

Posted in : intelligent-automation, Robotic Process Automation

Great summary Phil Fersht. The AA investment was surprising, just in terms of its scale, but your point on it validating the market is very true. Next year will be very interesting and exciting!

It is rightly mentioned that these 3 have more depth and berth to offer, it will be important for the big players to keep innovating and futuristic.

I am also interested in how PEGA brings OpenSpan now Pega Automation to this race. Considering Pega platform business.

@KK – Clients often select Pega for its out-of-the box support for enterprise apps and custom and legacy systems with object-level integration. Has potential, but limited presence with the advisors and needs to push RPA to the forefront of its overall impact offerings.

Here’s a sneak peek at the overall findings from 359 user interviews:

https://www.horsesforsources.com/storage/app/media/PHIL%20MAY%20JUNE%202018/RPA%20exec%20summary.jpeg

PF

Phil – excellent insights, and agree with the power of familiarity. You mentioned AntWorks – can you share some more on their offering? Am also hearing good things,

Phil

@Phil Leonard – Antworks:

AntWorks emerged in the top 3 highest rated RPA products in over 30% of the 40+ RPA CX benchmarks. Almost all dimensions of embedding intelligence including processing structured and unstructured data, dashboards, and AI capabilities. Others include automated development tools, set-up coding effort required, documentation, centralized controls, DR and BCP, processing multiple inputs, accommodating process changes, and speed-to-market.

***Strengths***

*** Innovative solution.**Compelling vision around holistic approach to automation straddling across RPA, AI, and data capture.

*** Cognitive capabilities.** Links core RPA capabilities with machine reading including semi-structured content such as handwriting in forms as well as broader cognitive capabilities including pattern recognition, even in images.

*** Dashboards and analytics.** Ability to process multiple inputs across structured, semi-structured, and unstructured data.

***Development* opportunities**

*** Limited market awareness.**AntWorks is still early on its journey and therefore needs to demonstrate client references to the broader market.

*** Core RPA engine.**Despite strong cognitive capabilities, users need better core RPA functionality from AntWorks such as better access right management.

*** Customer support.**It needs to further invest in customer support, certification, and training programs.

Hope this hekps – you can download the full report here:

https://www.hfsresearch.com/blueprint-reports/hfs-blueprint-report-rpa-cx-detailed-assessment-of-10-leading-rpa-products

PF

Now that we have that part figured out, companies like IBM, Microsoft, Oracle, … can check their deep pockets to see if it worth spending that amount of money on taking a big chunk of the #RPA market. Any guesses on who will be gobbled up first and by who ? My guess: Microsoft+UiPath. Would be a great fit for their low-code citizen development PowerApps platform

WorkFusion has raised $120m, is still the only vendor with an AI-native platform, and consistently leading on RPA2.0.

Many have even purchased WorkFusion despite starting with one of those 3, because they want to scale faster and automate more.

So big 4 is much more accurate.

Also shouldn’t underestimate Nice and Pega who are looking to invest and have strong base in contact centres/BPM respectively.

The market is growing and evolving very rapidly, so a lot changes even in a year – as we saw between the two Forrester reports. That said, new entrants will really struggle at this point, as you’re looking for $100m to build your own. Also surprised not to see any consolidation or major buys.

@James – WorkFusion never got much traction with its free RPA push last year, but its 2018 Lumen offering may get somewhere, but still uptake is slow and we haven’t seen use cases (we covered 359 users in our recent report). It is amongst the first to combine RPA with AI/ML models providing the “integrated human” in loop with RPA – this could be a powerful place for the product to play, adding that ML layer to make dumb robots more intelligent.

Nice is only almost exclusively used for chat related projects only, hard to manage complex automation scenarios.

Pega has broad functionality by extending bots to its BPM suite. Clients often select Pega for its out-of-the box support for enterprise apps and custom and legacy systems with object-level integration. Has potential, but limited presence with the advisors and needs to push RPA to the forefront of its overall impact offerings.

Hope this hekps – you can download the full report here:

https://www.hfsresearch.com/blueprint-reports/hfs-blueprint-report-rpa-cx-detailed-assessment-of-10-leading-rpa-products

PF

I think RPA is very powerful when you combine with BPM. You will see more and more BPM products adding one of these RPA tools into their BPM products. This will reduce need for many integrations which are way too costly and time consuming for applications

Building learnability and cognitive capability into the botsystem are key to raising expectation on what RPA can achieve. Computer vision advances are at the centre of intelligent process recording, editing, deploying automation. The automation of Process Discovery itself with seamless integration to deployment is a big step up from standalone process mining tools that need specialist integration. Watch out for Kryon!

@Vinaya – Look forward to seeing the product develop further. Kryon brings strong OCR integration through integration with FlexiCapture. Its Leo platform integrates pattern matching, neural network, and machine learning technologies as well as operational analytics. The Smart Analytics engine provides insights to fuel continuous improvements and Process Discovery provides organizations complete visibility and clarity on processes most suitable for RPA.

Kryon might be underselling its capabilities with lack of remote or online training materials and limited collaterals. Our research shows clients are not satisfied with the bot performance and control version system. Partner management and after-sales support needs further investments.

PF

Phil,

we have discussed this topic in the past. AA with greater investment (almost 3-4 years back they had a team of about 250 developers I think) on the product to bring in intelligence into their RPA suite, we were clear that they might emerge as a leader in the RPA world. However it is indeed surprising to see BP coming back. couple of years back i had expected them to phase out as they had no investment on product R&D, and was not very happy with their sales & marketing with an arrogant approach. they didnt have a good partner network either, except someone like thoughtonomy. UI Path in my view is still at its initial days and good to see. One thing I am now surprised with your view on WorkFusion. In the past we had discussed about their unique approach of coming from AI to RPA would probably give them impetus to become intelligent RPA faster than anyone else. I would still like to believe that they would also be one of the leaders.

To your point Phil, here at AntWorks, our investment is laser-focused on ANTstein, our enterprise-class, fully integrated (data to insight) intelligent automation platform, not splurging on marketing. Happy to connect with folks who wish to learn more. Bill Schrank, SVP-Sales

I see lots of competition on the horizon. My money is on AWS, Azure and Google Cloud providing the cognitive capability for smaller RPA software companies. This will allow the smaller players to compete against the big three without making a massive investment in AI. Under this model, enterprises would use relatively cheap and dumb RPA software to get data from their systems and put it back in; and they would use cloud-based tools such as AWS Sagemaker, Azure ML Services and Google AutoML to provide the smart “AI” and “Cognitive” layer (which is what the big three RPA companies have raised $millions to build). The smart, smaller players will tout tight integration with Cloud providers and spruik to management and corporate developers the benefits of learning how to do AI in the cloud rather than AI in a locked-in RPA platform.

@Bill – good to hear from you again.

Here’s a sneak peek at the overall RPA customer experience findings from 359 user interviews:

https://www.horsesforsources.com/storage/app/media/PHIL%20MAY%20JUNE%202018/RPA%20exec%20summary.jpeg

We view AntWorks as an emerging and innovative RPA product with strong cognitive capabilities.

Strengths:

* Innovative solution. Compelling vision around holistic approach to automation straddling across RPA, AI, and data capture.

* Cognitive capabilities. Links core RPA capabilities with machine reading including semi-structured content such as handwriting in forms as well as broader cognitive capabilities including pattern recognition, even in images.

* Dashboards and analytics. Ability to process multiple inputs across structured, semi-structured, and unstructured data.

Development opportunities:

* Limited market awareness. AntWorks is still early on its journey and therefore needs to demonstrate client references to the broader market.

* Core RPA engine. Despite strong cognitive capabilities, users need better core RPA functionality from AntWorks such as better access right management.

* Customer support. It needs to further invest in customer support, certification, and training programs.

PF

Phil, what happened to the discussion around scale? This conversation cannot be ignored. We all agreed last year, the ease of implementing RPA isn’t there. I loved where you were going with this whole story then.

Lets be clear, legacy applications are not easy to automate, never have been, never will be. Once people take the time to understand what the technology behind a "legacy" application is – and why the UI is a fragile place – even with the best RPA technology in the world, then we will can some serious conversations about what the future can look like. You mention customer counts – buts surely it’s about scale, no? I’m now unravelling a "top 3" customer that’s spent millions on RPA and in pretty bad shape with regards "scale".

Whilst I agree, there are now 1000’s of customers who have used/tried/in production with RPA, in 15 years – none of us have seen the scale for RPA unattended. I’m glad UIpath now see the value of RPA attended, like Nice and Pega but even then, we have to accept that RPA is UI automation and is the reason, we are for the 4th time in my lifetime, seeing the repeated patterns around why screen scraping really can only scrape the surface towards digital process automation.

@Francis – from our new study, RPA products are able to accommodate process changes and process multiple types of inputs relatively well.

The top three leading products (AA, BluePrism, UiPath) have an edge over other products in their flexibility to handle multiple types of processes. Pega and AntWorks lead with processing multiple input types. However, clients are not entirely satisfied with the licensing model options—including both understanding pricing and flexibility:

https://www.horsesforsources.com/storage/app/media/PHIL%20MAY%20JUNE%202018/scale-rpa.jpeg

PF

On the menu for 2020+, #superintelligentselflearningchatbots – one small step closer to our robot overlords

Antworks has possibilities. I have been asked to do an eval on the product by an investor and the lads have yet wanted to show me the tricks this new dog can do. When I have looked at the published literature, I don’t know if this tool will stand up in a regulated industry environment…yet. Time will tell.

Phil, I am not sure being able to do multiple process types really addresses @Francis’ observation on scale. The reality is the "big three" are focussed so much on being the largest, biggest, most bigly cognitive. Reality is of three largely functionally equivalent tools that do the same thing with the same approach. What we see every single day are enterprises that approach us with one common problem "we have written cheques to our organisation based on the promises of these tools, and they simply cannot deliver". They are coming to us for help as they know getting one of the other two isn’t going to help. Two of our most recent wins are in accounts that have the largest COE’s and deployments of two of the big three. They are telling us why they need a multi-vendor approach to the address the requirements/promises of RPA, but they know that for complex unattended people intensive processes, desktop tools will never deliver. Too much of this debate is on "which one is the best" and not enough thought on "which vendor can deliver the outcome we need". For me this is about establishing the market, and it is good news as we no longer need to invest time and energy in explaining why people should look to do this. At Redwood we are far from packing our bags and moving on because these guys have "won the war", we thank them for educating the market about what their tools can do, and more importantly about what they cannot. That gives us our own space to thrive with code free standard robots, that integrate with standard enterprise application and that address entire high level process groups. This market isn’t just about volume, number of customers or numbers of bots, or number of processes supported, number of input types handled. Not every "RPA" vendor is the same, or wants to be the fourth leg on that particular stool. We see ourselves as complementary to those solutions, not really competitive as if we compete, one of us is in the wrong place. If you want the shortest time to value, the lowest lifecycle TCO and the highest automation levels then my advice is to broaden your horizons beyond the usual suspects.

As ever the challenge is not the specifics of the software, all have merits and capabilities, rather it is the capability and the capacity of the organization to operationalise the solutions that determines the outcomes. To that challenge, the evidence from history of results from BPO, ERP, paperless office etc etc is well reported and depressing .. 80% of projects fail to meet their business case outcomes. A small difference in capacity to exploit technology matters FAR more than debating or choosing between once functional point or another. The reality for too many companies is they are approaching RPA as a technological magic bullet that will avoid having to get their messy, poorly instrumented operations into shape. What they’re finding like so many before them is you have to be sufficiently in control to exploit the gains and RPA requires a whole new level of control to be effective. The winners will be those who best operationalise and exploit the investments they make, rather than the size of cheque or the choices of technologies.

@Neil @Francis:

All pertinent comments. The biggest issue I am seeing is CoEs being set up, trying to train their business lines to understand how to use this software and getting IT to roll it out. Many CoEs will fail if they cannot drive adoption and get their units to learn how to manage these tools themselves effectively. Never mind scale, just getting enterprises to approach this the right way is the challenge, understand what they really need (per your comment Neil “for complex unattended people-intensive processes, desktop tools will never deliver”)

Regarding scale, at our last summit, we had one provider showcasing a client which had only 30 “bots” on UIPath – and that is supposed to be “scale”. Finding real scale is hard when you dig into these actual deployments, versus how many licenses were purchased.

We just have to endure enterprises figuring this out and learning from those which have got past the bullsh*t.

This industry is nascent. Lots of room to grow and many opportunities for solutions going beyond basic RPA. However, for basic RDA and RPA, these 3 will dominate the narrative for some time. The game-changer may be when one gets acquired, which could happen soon if some rumors have credence,

PF

Hi Phil

Great article and very detailed in its outline and overview. I would be interested to know if you have any opinions of the discussion around attended and unattended RPA and how the three main protagonists feature in this area.

Is unattended versus attended even a valid differentiator in terms of functionality and future benefit and use?