Month: October 2018

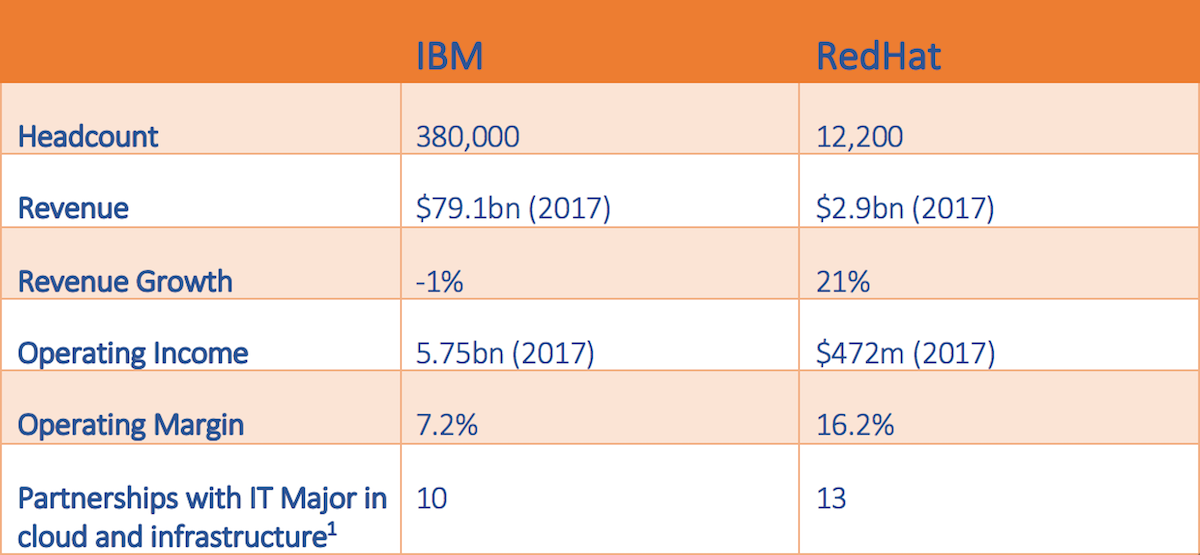

IBM / RedHat: A grand play at out-sharing Microsoft’s open source economy

This is more than the cloud, this is all about open sourceRead More

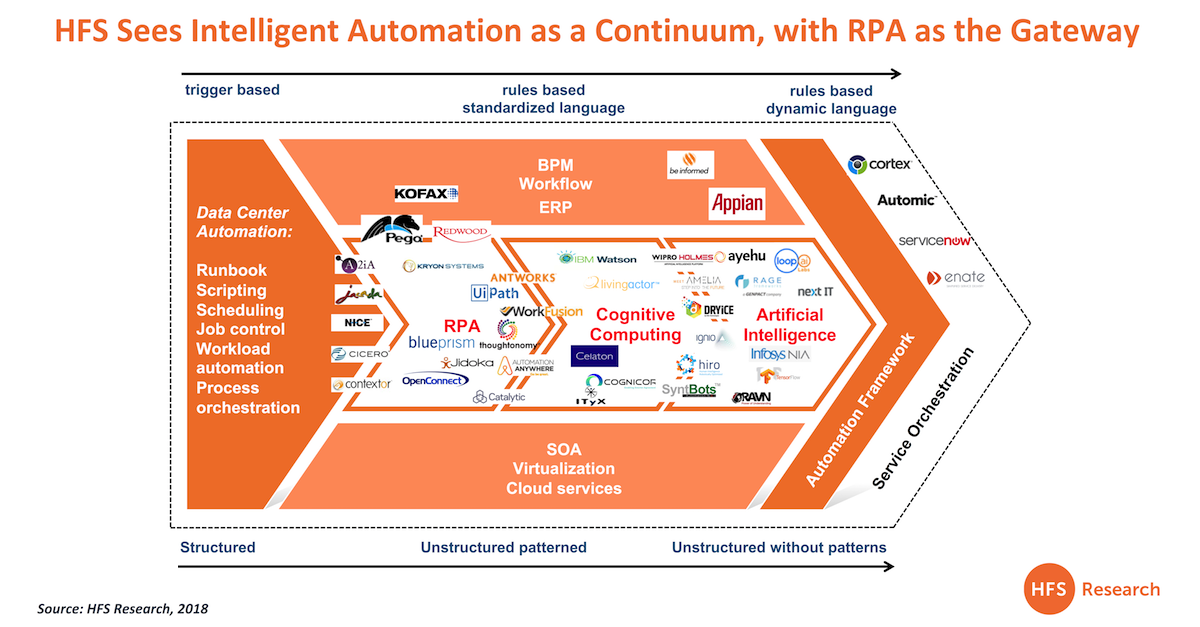

RPA is a gateway drug – and magically these guys agree too! Don’t you just love coincidences..

Our now-infamous headline 'RPA is the gateway drug. AI is the drug' has now magically appeared on the Forbes website in an article entitled 'Robotic Process Automation: A Gateway Drug to AI and Digital Transformation"Read More

SYKES acquires Symphony becoming the first call center provider with significant automation capability

Call center provider SYKES disrupts the BPO industryRead More

Mihir Shukla and Alastair Bathgate in the Battle for the Robotic Billions… only at HFS FORA

The CEOs of the leading two RPA firms, Automation Anywhere (Mihir Shukla) and Blue Prism (Alastair Bathgate) a chance to face/off on stage to thrash out why their firms' valuations are on such an exciting trajectoryRead More

RPA is the gateway drug. AI is the drug…

Enjoy that RPA high a bit longer before you graduate onto the harder stuff...Read More

Tiger burns even brighter as Genpact makes its instinctive move

Phil Fersht interviews Genpact CEO Tiger TyagarajanRead More