Month: July 2018

The Cambridge University FORA Summit recap…

Impressions from the HFS FORA Summit in CambridgeRead More

It’s time to give these poor Millennials a break

HfS analyst Ollie O'Donoghue, a proud representative of the Millennial race, lets loose with a staunch defense of his speciesRead More

Clear communication to leadership has never been more critical in today’s business environment

Clear communication to leadership has never been more critical in today's business environmentRead More

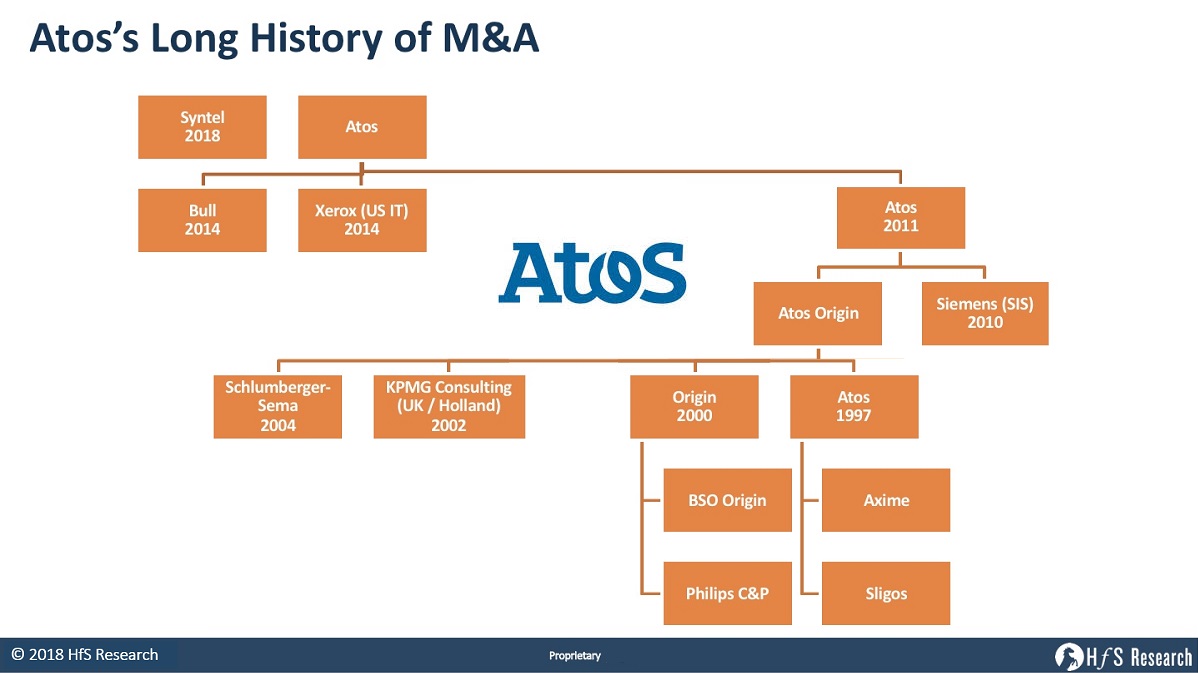

Is Syntel worth $3.4bn? And does this bring Atos to the adult’s table?

HFS analysts Phil Fersht, Jamie Snowdon and Ollie O'Donoghue lift the lid of why Atos paid $3.4bn for SyntelRead More

HfS slam dunks with Stevie!

HfS is delighted to welcome Steve Dunkerley to lead the FORA leadership roundtables and summitsRead More

Why AA’s investment windfall locks up the RPA market for the Big Three

There are three established leaders at the front of the RPA market and investors are convinced that RPA is the start of something much bigger for enterprisesRead More