We’ve been having, let’s say, some “interesting” interactions with folks, when we asked them to talk about their innovative experiences with finance and accounting BPO.

I'll show you some innovation…

What’s been a tad disturbing, is how many have tried to pass up any mild form of progress as “innovation”. Our lieutenant entrusted with plowing through these case studies is Bruce McCracken, who shares some of his recent experiences with us, when trying to explain what innovation actually entails. Over to you Dr Bruce…

Innovation?*!@?#!?

Ask six people what represents innovation and you will get half a dozen answers. Three people discussing innovation will consist of a couple of people talking about two different things while the eyes of the third glaze over. Innovation is a term that epitomizes the semantic differential. But regardless of how it is interpreted, it is a very important element for potential buyers of BPO services.

Innovation is the cornerstone of our forthcoming report, “Reaching New Performance Thresholds with Managed Finance Services: Real-world Experiences”. As we progress, our contacts with providers have shown considerable variance in the perceptions of what innovation entails.

Some providers feel that if a solution is new for a particular client, then it is innovative. But what is new to that buyer may not be new to the industry. An example would be digitizing documents utilizing OCR technology to move from a paper-based system. A late adopting client may see this change as transformational (which it is) and the greatest thing since sliced bread. But others in the industry may view it as being as old as sliced bread. In point of fact, I had OCR software on my Macintosh home computer in the early nineties.

The American Heritage Dictionary defines innovation as something newly introduced. Innovation has many synonyms: change, alteration, revolution, upheaval, transformation, metamorphosis, breakthrough; new measures, new methods, modernization, novelty, newness; creativity, originality, ingenuity, inspiration, inventiveness; informal – a shake up.

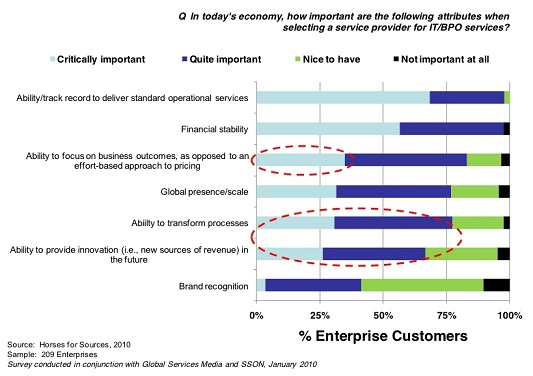

Irrespective of how it is defined, innovation is high on the priority lists of potential buyers, when it comes to selecting a future service provider, as shown in our March 2010 report, The IT and Business Process Outsourcing Industry Landscape in 2010:

When evaluating vendors, financial stability and operational excellence are the table-stakes. Business transformation capabilities are the differentiators

While on the surface, it may appear that transformation and innovation are only secondary considerations, when it comes to selecting a service provider. However, when you take into account that most service providers are offering similar solutions at similar prices, it is the providers’ proven ability to provide an innovative outsourcing experience that is fast-becoming a major decision-swayer.

So how are we defining it?

Innovation involves going beyond cost savings and transactional work to create added value to the client for business advantage, by deploying new and creative methods. There are many forms it can take, including:

- Creating revenue streams and/or increasing cash flow

- Reducing processing time to close accounts

- Increasing process efficiencies and data accuracy

- Improving workflow to reduce the workload of buyer’s internal staff

- Increasing buyer’s visibility through business intelligence to identify inefficiencies and revenue leakages

- Unifying disparate systems across business units, product lines, geographies, and stakeholders

- Creating global finance/account processes to support global operations and decision-making

As an example, the worldwide recession spurred a need for organizations to be nimble with the resources available to rapidly seize opportunities for expansion or soften the blow. Many companies and/or business lines were either diners or dinner. In the areas of mergers and acquisitions as well as divestitures, the agility of the service provider in producing innovative solutions to new challenges was critical as many companies would have been caught flat footed otherwise.

A major global financial institution saw a need to offload some business lines entirely and exit certain geographies in others. Their F&A BPO provider was able to take on much of the heavy lifting in transitioning processes to the new owners thereby sweetening the value proposition for the acquiring organization.

Conversely, a global communications provider was able to exploit the opportunities afforded in the dynamic marketplace with seven acquisitions. The F&A BPO provider was able to consolidate the disparate accounting systems into the ERP through extensive experience to significantly enhance efficiency in a reduced timeframe. The client did not have the internal capacity or expertise to do this.

Another aspect of innovation involves doing things differently or creatively within the engagement. A major global IT enterprise teamed with its provider to change the fundamental governance and relationship structure to adapt to potential changes in the business environment. Empowered dedicated teams manage the relationship that involves gain share mechanisms to encourage innovation. The SLA of the seven-year deal is reset annually to provide flexibility in adapting to changes in marketplace and the client’s business needs.

These examples will be chronicled in detail, as will others, in our forthcoming report, “Reaching New Performance Thresholds with Managed Finance Services: Real-world Experiences”.

When it comes to innovation, it isn’t a matter of whether the bread is sliced, but rather if it is fresh, nutritious and tasty.

Posted in : Business Process Outsourcing (BPO), Finance and Accounting

Interesting post, Bruce.

Innovation means many things to many people. To the C-suite it’s blue-sky creative thinking. To a financial controller, it may simply be eliminating steps in the cash-flow cycle.

I do think you touch on the heart of the issue here, Bruce, in that it’s about doing things differently by trying new methods. Good luck with the report!

Stephen

Another great post on how to define innovation can be found here, includes disruptive, incremental, and everything in-between: http://blog.brightidea.com/innovation_work/2009/04/innovation-essentials-10-basic-principles-of-innovation-that-everyone-should-know.html