Month: September 2013

Fancy yourself as a sourcing Master Black Belt?

HfS' Governance Proficiency Certification Program is designed to help today's sourcing executives approach service provider relationships and governance strategy with a sophisticated and pragmatic approach that will help them advance their careers, their skills and their experienceRead More

Was this the first ever song about outsourcing?

Was this the first ever song about outsourcing?Read More

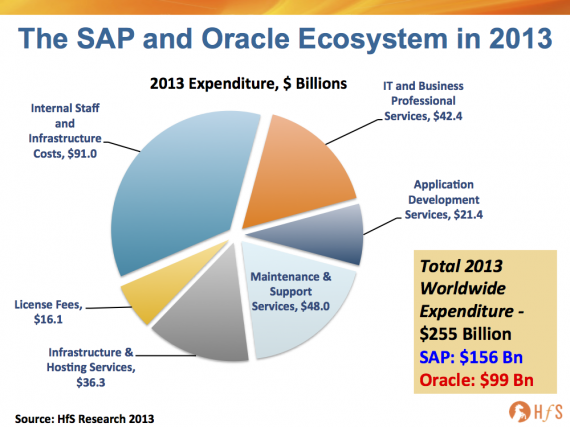

Can Salesforce and Workday’s hook-up genuinely hurt the SAP and Oracle empire?

With a quarter-of-a-trillion dollars a year being plowed into integrating and managing SAP and Oracle, are the SaaS upstarts truly ready to integrate multiple cloud apps at this type of scale to challenge the status quo?Read More

Time to help those poor Americans understand those British niceties…

It's nearly 10 years since I ventured back to these shores, and to celebrate, I decided it was time to reveal to the many unsuspecting Americans what we British really mean when you think we're being nice and polite...Read More

Prince Charles of Sutherland joins HfS to lead BPO strategy

Charles Sutherland will be playing a key role in helping us lead many of our strategic BPO assignments across traditional horizontals, such as F&A and Procurement, in addition to driving new coverage in growth areas such as Supply Chain Management and Robotization.Read More

Pankaj ponders, postulates and problem-solves: meet Genpact’s analytics guru

HfS talks to Genpact's Pankaj Kulshreshtha, whose analytics group has exploded from 10 to 6000 people under his guidance Read More

Are you “crowding it” in NYC this week? HfS has some free tickets…

We got some face time with flamboyant Massolution CEO, Carl Esposti (and founder of the Crowdsourcing.org community platform) about next week's first-ever crowdsourcing & crowdfunding conferenceRead More

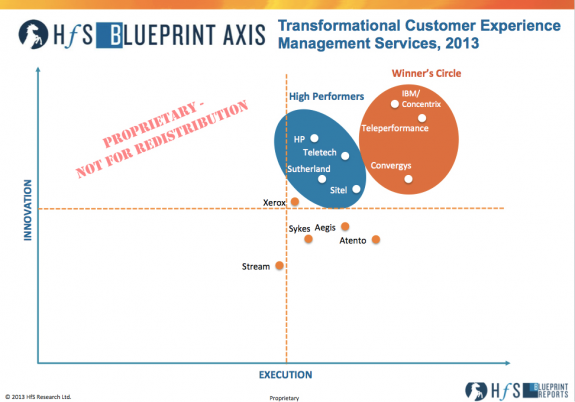

Concentrix buys its way into the customer experience management Winner’s Circle

Concentrix's investors, SYNNEX, were clearly so impressed with IBM's performance to reach the Winners Circle for customer experience management, they wanted a piece of the action for themselvesRead More

Teleperformance, IBM/Concentrix and Convergys make the Winner’s Circle for transforming the customer experience

We are proud to reveal our first Blueprint report that has gone deep into the innovation and execution capabilities of today's leading service providers in the customer experience management industryRead More

Welcome to the Lechner lectures: Why partnering strategies matter

Meet the man tasked with formulating a sourcing strategy for the IBM: Rich LechnerRead More