We’ve been talking about the legacy model of butts-on-seats “mess for less” outsourcing fizzling out for years, but somehow the same old candidates have clung on grimly to the same old model, relying on clients that still find a modicum of comfort negotiating rate cards down to the lowest common denominator, content to hobble along with average service delivery that just about keeps everyone paid… and somehow relevant.

As we’ve bemoaned the decreasing growth rates across almost all traditional areas of business and IT services, no one’s pressed the panic button to do anything wildly different. In fact, many have used the recent stagnant times to merge with each other to eke out a bit more revenue growth and rationalize costs wherever possible.

Meanwhile, all the providers have slapped the lovely “digital” tag on pretty much ever new client dollar that wasn’t obviously a help desk deal or some server consolidation. Yes, people, even good old app testing today has managed to be magically reformulated as a “digital” service by some.

The balance of power sits firmly with the enterprise clients, and many have no choice but to jump ship from the old model

Being realistic, the IT and business services business is no different than it was five years ago, except there is a lot more cloud… and a lot more window dressing. But that is all changing, and our new research reveals a new services economy is upon us.

But, finally, many enterprise clients are wising up to the reality they now wield a lot more power over service providers as the market flattens to a state of hyper-commoditization and negligible-to-pathetic growth. Many are, finally, awakening to a new dawn that service providers can (and most are) able to takeout delivery cost through better deployment of cloud, less costly SaaS apps, and applying robotic process automation to reduce manual workarounds and augment people delivery.

Simply put, if your long-time service provider is failing to deliver you any of these benefits to your business, or at least is making some strides to incorporate pricing that is tied to successful service execution and not only people effort, then it’s time to cut bait before you get fired yourself for perpetuating a legacy model that is depriving your firm from finding new thresholds of value your smarter competitors are already enjoying.

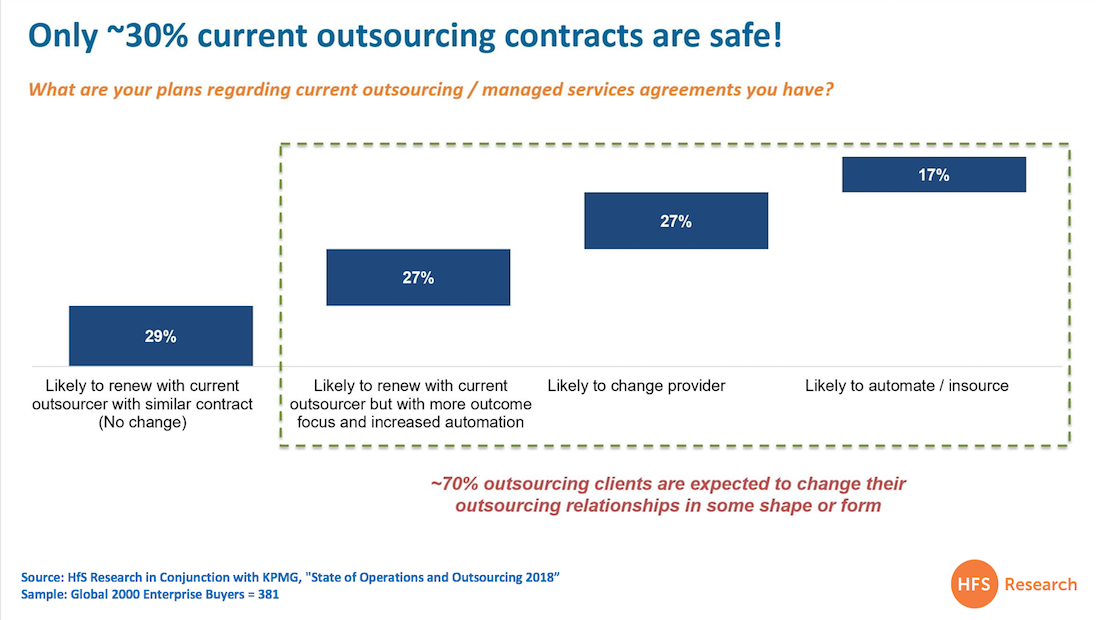

As this year’s State of Operations and Outsourcing study of 381 enterprise operations leaders across the Global 2000 reveals, only 30% of these relationships will continue to operate in the old model, while a similar number will stick with their service provider if they can have a shift towards business outcome pricing and a degree of automation applied. 27% have already given up on shifting the model with their current provider and have declared their attention to switch, while 17% want to end the misery and focus on bringing the work back inhouse, and look to simply automate it:

The Bottom-line: Outsourcing is finally entering the uncomfortable phase of change that’s threatened for several years, and it’s going to get ugly.

Judgement day is now upon the industry once known as outsourcing and this one will get pretty ugly before it eventually finds a new groove, where enterprises and service providers find real value in each other again.

History has told us time and time again that nothing in this business changes until deals are lost and the C-Suite is forced to address why this is really happening… and actually act on it. This is the fine balance in which we find ourselves today, where actions will change dramatically when 2% growth spirals into a 5-10% decline because that is what will happen to many service providers if they truly cannot pivot to deliver value beyond cheap labor.

Those providers which have the capability to make the necessary investments and adjustments will take a few hits, but rebuild for a new phase… those which think they can keep papering over the cracks, repeating to same old spin, but never fundamentally changing how they invest in solutions, talent and their clients, will quickly start moving backward (and fast) in the new services market that’s emerging.

Posted in : IT Outsourcing / IT Services

Hi Phil,

The (27+17) group, the 44% is the significant group, which whence it shifts to a 50%+ metric then perhaps a negative decline trend could be projected forward. However, this possibility has been raised many a time by analysts since 2014-15 but the industry has managed to keep growing at the famous ‘Hindu rate of growth’, happy with the compromise and not looking to rock the boat so much? Does the industry show the gut ‘….to take the few big hits’ and learn, as you mention above?

Meanwhile, have the customers experimented much beyond the old model to cause a big ripple in the pond? We have to see how the 17% is doing? This new industry model, this value beyond the (current) value? What is it? I mean in real action and predictable results, I understand about the One Office and the X-as a service outline, of-course.

Would you say that vendors have little choice (realistically) in the matter but to continue making acquisitions and continue window dressing, all the while hoping that they (and their customers) are actually making a deeper underlying shift to a new model/s, whatever that is?

Keeping Accenture out of the picture, who have recognized this as a strategy challenge much early, the only vendor that has adopted a unique market model is HCL. With it’s products and platforms business strategy (largely around legacy IP), they have generated a ‘new/safe contract stream’ with limited competitors? And the big winners in the crowd (TCS and CTS) actually continue to bank on bigger deal sizes and full service, end to end long-term outsourcing models, a hark back to earlier days albeit updated for the times? Of-course, the ‘people + assets’ takeover of weak captives or a ‘JV approach’ of sorts is also something vendors will continue to look for in complementing their clients, again nothing new?

Perhaps there is no one obvious new model emerging? Perhaps there are many, many attempts and experiments in play still WIP? Is the picture really shifting but difficult to see, to where?

Are we now in the chasm? Crossing to where, no one knows 🙂 OR are we yet to get to the chasm?

Thanks,

Manish

Even automation(of the robotic variety) is only a stop gap before nimble SaaS and specialised point solutions with machine learning capabilities take over. Will be interesting to also note portion of business clients are taking back and transforming themselves.

@Aninda:

This is why we invented the OneOffice model: all these solutions are temporary means of getting from one state to the next. When it comes to planning their operations, most do not have an ideal endstate in mind. Most struggle to define success beyond finding some shiny new activity that will get them from where they are today to a state of greater productivity and/or lower operating cost. Their real goals are to get better data to drive their businesses forward while aligning their operations to their business goals. Tech solutions are enablers to achieve these goals, they provide a means, but they do not provide the outcome, which is where so many enterprises are going wrong these days.

Even with offshore outsourcing, the endstate was rarely defined – it was simply to meet the next set of metrics. Were companies really envisaging running their operations in a similar way as before, merely with lower cost resources and some standardization of processes? But at least outsourcing was relatively predictable – it was defining how much work to move to the service provider and how many staff were needed to keep the operation ticking along to meet a desired set of metrics.

With automation, entirely new metrics are in play, and it’s currently a random crapshoot how most companies are dealing with this. From manhours per year eliminated, to processing time reductions, to actual headcounts being removed, and even improvements in compliance and data accuracy, the “new metrics” that enterprises are toying with to find that next piece of “success” are becoming foggier than ever to decipher… and trust. And if you can’t trust the metrics, the whole thing starts to fall apart.

The reality is, once certain productivity measures have been achieved, the focus from the C-Suite quickly shifts to the next set of initiatives to achieve an entirely new level of productivity metrics. This is why the emergence of automation has been so significant – it is providing that next stage of productivity improvement that C-Suites are craving, and why RPA is now the leading investment focus to reduce costs in 2018 among Global 2000 firms.

The Digital OneOffice Framework is where the organization’s people, intelligence, processes and infrastructure come together as one integrated unit, with one set of unified business outcomes tied to exceeding customer expectations. OneOffice is where teams function autonomously across front, middle and back office functions to promote broader processes with real-time data flows that support rapid decision making, based on meeting these defined outcomes. Hence, emerging technologies like automation and AI are significant enablers in helping enterprises meet their ultimate goals, where front, middle and back offices will cease to exist.

The real key is to define where you want to be, and create a path to get there. In most cases, this endstate is all about enterprises becoming conduits of the data they need to satisfy their customers’ needs in realtime, with a team of smart people who know how to manage these data flows and make smart decisions to keep ahead of the competition. The broader processes become between the customer and the enabling operations, the faster companies can satisfy their needs, and stay ahead of the game. The future is all about simplifying data complexity and having talent that can make creative and intelligent decisions, based on the availability of this data and understanding the customer.

This is the very essence of OneOffice – simplifying data flows, bringing the customer and the operation together and aligning your talent with achieving defined outcomes that keep you ahead of your competition.

PF

The 70% looking to change are safer than the third looking to stay same. Safety is not about hashtag#outsourcing deal or contract. It is about the business relevance of what is outsourced over a period of time.

And this is true for the provider as much as the individual/company who is outsourcing any part of their operations. An outdated outsourcing contract for a vendor can be just as risky when the company goes under or starts declining in their ability to spend. Your point about window-dressing legacy engagements is as much attributable to vendor marketing as it is to companies renewing their legacy deals from a position of denial.

MyPOV: Time to figure out how to design outsourcing deals for the unknown & unpredictable? Let’s bring some hashtag#designthinking to how these deals are put together and not just as a line item inside those deals. And for that, am glad you did put those three options you offered to survey respondents in a box. We need some out-of-box thinking here as those three options are not going to help with “safe” outsourcing deals.

@Sunder – “Safe” from change… outsourcers will leave legacy deals untouched (if they can get away with it) if they deliver their required margins. If the client has zero interest in changing the model, then the decision is simple, keep it as maintenance business, or risk upsetting the client. It’s a simple game of “ring fencing profitable legacy” while investing in the new. Btw legacy isn’t always necessary terrible – it usually “does the job” and that maybe it’s all that is required sometimes… all about ROI and focusing on the right things,

PF

Amen, Phil.

At Bue Prism, we’re working with major clients to enable versions of the OneOffice vision. It does involve large-scale automation in a “BPO 2.0” approach, but the objective is much larger than that. The “end state” is actually a programmatic re-thinking of the business with defined, phased end-states delivering specific value streams to the client and provider in an agreed-to schedule.

Further, the technical, business, functional and commercial constructs need to reflect this new operating model, using risk- and gainshare components to minimize relative risk and maximize speed to value while creating a common, acceptable deal permission structure for all parties.

All this requires sophisticated design thinking, business and decisioning agility, and an ecosystem of partners that can work together and pivot successfully when – not if – the game radically changes, as is depressingly common.

Hi Phil: Your article is timely and we are already seeing this shift occurring. C-suite executives that I interact with are seeing Digital (which includes technologies like RPA, Cloud, IOT, Blockchain and AI) to deliver the new S-curve for improving productivity, CX and major cost takeouts. But we all know from other technology shifts in the past 3-4 decades (mainframe to client server to Internet) that it isn’t the shiny new technology that will make this shift happen but rather the ability of service providers to come together to create the right Context and Orchestrate the right Outcomes that will create new value. And the trick is to do this while not degrading quality, service levels and customer experiences so you don’t lose existing revenues and profits. This game will be won by joint ownership taken by bold leaders both on the client and provider side. If it’s not a win-win construct one of the parties won’t participate fully and that’s when customers will look to switch providers.