The pendulum is swinging back. Over the past year, we’ve seen the increasing focus from India-based service providers to invest in building on-shore presence and capability in the U.S. While spurred on by H-1B visa limitations and in-flight policies regarding minimum wage and the politics of “protectionism,” the long and short of it is that the U.S. citizens should benefit from local investments. U.S. governments and economic development entities are offering incentives for partnering with these service providers as they seek out “hubs” central to current and potential clients. Two recent examples are Indianapolis, Indiana with Infosys and Jacksonville, Florida with Genpact, where the cities offer tax incentives and colleges and universities can provide a talent pool.

It used to be “too expensive” for service providers to set up on-shore service delivery centers, but with the increasingly integrated and intelligent use of robotic process automation and cognitive computing and the motivation of politics and protectionism, this argument is fading. What is also relevant is when the partnership changes focus from outsourcing a task or point solution such as “collections” to business outcomes such as providing a better patient experience and increasing upfront payment (thereby reducing the need for collections), the service provider needs to be more integrated into the end-to-end process and business operation. That means having a local presence and interaction to provide relevance and create meaning and insight. (See “Recasting the patient billing experience” as an example).

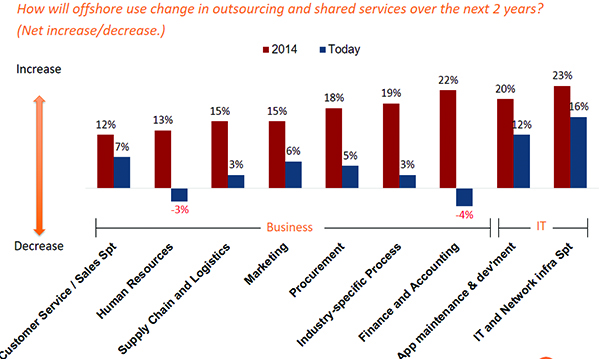

Our research (see Exhibit) shows the there is a significant drop across the board in the move to “offshore” business and IT work – finance and accounting and HR, in particular. Case in point, we recently heard from a client about how Sutherland helped set up and recruit into a local service center for F&A services in a matter of a few months for a company that was separating from its parent.

Exhibit: Changing use of offshoring – shared services and outsourcing

Source: HfS Research in Conjunction with KPMG, “State of Operations and Outsourcing 2017” Sample: n=454 Enterprise Buyers

How service providers are expanding local, U.S.-based presence

Investments by service providers in having short- and long-term U.S-based capability for clients include local service delivery centers and increasing co-location delivery teams as well as work-from-home options; education support through curriculum development in local colleges and universities as well as programs for K-12 to “entice” and enable interest in STEM (e.g., code.org and Girls Who Code) to create the workforce of the future; and transitioning workforces from clients to their own organizations.

Examples include:

- Genpact: In July, Genpact will add to its network of 12 U.S.-based service support and delivery centers by opening one in Jacksonville, Florida. This one will focus first on mortgage service support with processing, underwriting, and closing services for residential mortgage loans for a leading financial services institution

- Infosys: A new entry into this discussion, Infosys has far outstripped other service providers in pursuing H-1B visas to date and is now refocusing on building local presence and brand recognition. Infosys intends to develop four locations in the U.S., centered in “client clusters” and focused on particular capability areas such as artificial intelligence, user experience, and enterprise cloud. Its approach is to partner with local colleges and universities and offer incentives such as investing in student tuition and curriculum development. Infosys is also preparing for more long-term needs by looking at ways to entice a broader interest in STEM. The first partnership in this effort is in Indianapolis, Indiana, the heart of the U.S.

- Cognizant: Its recent acquisition of Health Care Services Corporation’s TMG Group adds Medicaid and Medicare support in offices in Texas and Pennsylvania. This move provides its clients access to more local resources – people with knowledge and depth in government health as well as infrastructure.

Bottom line: Indian-based service providers have been building near-shore and onshore presence for a few years now, but it takes on new meaning and significance now as the context changes – politics, the impact of technology, objectives for partnering, and changing priorities around the skill sets that are needed. As a service buyer or government, university or economic development organization, be creative and also take a long-term view as to how these service providers can funnel the investments they are increasingly willing to take to have value locally to grow their businesses.

Posted in : Uncategorized