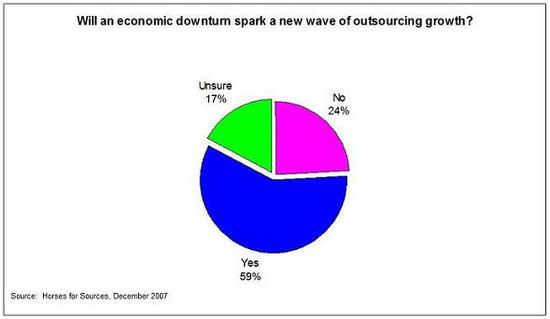

The recent post "Will an economic downturn spark a new wave of outsourcing growth" provoked several differing views on how outsourcing will be impacted by a potential economic downturn:

My good friend David Sheinfeld, who wrote a great piece here back in May, has contributed some very forthright views regarding how an economic downturn will impact the BPO industry and the fact that cost reduction is not the only medicine many companies need in these times… take it away David:

So much has been made of the downturn in the economy and the credit crunch that it is hard to believe that any industry stands to gain over the short term let alone the BPO market. But as they say with every downturn, an opportunity is created. The traditional story line sounds something like this; the company’s outlook is bleak and its financial model is flawed.

Credit is hard to come by and even though many companies may have financing in place, the covenants and other requirements make it difficult to access those funds. The key executives are looking for areas to save money so the company can ride out the storm. Where do they go? Sure they can cut labor where possible but that may not be enough. Then they can look to cut capital expenditures. One of the areas that could experience this cut is enterprise spending. These are some of the questions being raised every day. Furthermore, the outlook for enterprise and other technology spending is bleak for 2008. This will undoubtedly affect many of the decisions companies will make in its business strategy going forward. While the cut in enterprise spending may help the BPO industry since many companies may turn to spending on projects that help them reduce costs and be more efficient I wouldn’t count on it being the reason to see a surge in BPO business.

I have no doubt that in the process of cutting costs that the BPO market should see an increase in the number of companies looking to outsource as a way to control or cut internal costs. But the reduction in costs is not the only medicine many companies need in these times. The company should be concerned about how to get its business back on the right foot rather than just looking to cut costs. In this time of scarce credit most companies will not be inclined to spend any considerable amount of money on systems or anything related to its infrastructure. If they are interested in outsourcing they will leave that to the BPO provider to provide whatever is needed as part of their proposal. The client will still require the provider to prove it can deliver cost improvement and quality processes all the while by reducing any measurable risk associated with outsourcing. And while the labor component may get the BPO provider invited to the party it may not be enough to land additional business even in this market. Assuming they even get invited to the party they will be up against an onslaught of many other BPO companies who are trying to feed their infrastructure and existing labor pool. The BPO provider should also be careful during negotiations with the client so as not to put itself in the position of affecting margins to the point of jeopardizing profitability. So what should the BPO provider do to take advantage of this downturn in the economy? For one, it needs to understand the markets it is going after. Certain markets are still in their infancy as far as utilizing outsourcing and hold great potential in the future. Second, the BPO provider needs to be innovative and offer more than just what comes with labor arbitrage. While labor was the main component that carried the day in the past it is clearly not the only reason to consider outsourcing even in these times. The provider needs to be able to deploy its own solutions to either compliment what the client has or to provide a solution that the client might consider when deciding to outsource. Third, with margins continuing to be under pressure the provider needs to make sure that its delivery model and infrastructure is efficient and can in fact withstand the pressures of competitive pricing from the market.

‘So while the economic downturn presents an opportunity for Outsourcing in the future it is by no means the only reason to believe that outsourcing will see growth. Like everything else there still needs to be value creation for the recipient of those services.

David Sheinfeld is a consultant and a Managing Director of Horizon Business Advisors, LLC which provides strategy, management and merchant banking services and can be contacted at [email protected] or [email protected]

Posted in : Captives and Shared Services Strategies

Mr Sheinfeld,

Excellent comments – outsourcing is providing a cost-reduction option for firms in financial distress, but isn’t the only solution for them. With the weak Dollar and appreciating Rupee, they must focus on how to make outsourcing efficient – and not just a labor arbitrage exercise, which leads to whether they truly understand the outsourcing provider model well enough. Providers that sell on cost-reduction alone must he heavily scrutinized in the evaluation process. Use an advisor to help!

ARJ