If there was one corner of the services market which got severely disrupted overnight by lockdowns and unpredictable customer demand, it was customer engagement. For example, when Philippine’s President Duterte locked down the world’s call center capital Manila with 24 hours’ notice, there was an almighty scramble from the CX service providers to shift their agents to other locations, such as nearby Cebu, or to work at home agents in the United States or other locations. As the pandemic dragged on it became clearer than ever that this industry was in dire need of a long-overdue transformation from legacy people-heavy models to smarter use of automation and AI tools.

One thing I always struggled to understand was why several of the leading IT service providers turned their backs on the customer engagement market, such as when IBM sold off its CX division to Concentrix in 2013 and Capgemini exited the market. When the full value of automation and AI is realized in the revenue-generating processes driving customer engagement and predicting spending patterns, then the need to couple customer experience services and digital transformation is critical. This is why Infosys acquired Eishtec in 2019 (1400 seats in Ireland) and Tech Mahindra’s Business Process services has risen to number 5 in the rankings this year with 30%+ growth – these firms are able to manage the intersection between traditional BPO delivery and digital capability. This is also why the number one ranked call center provider, Teleperformance, is known to be exploring an IT services acquisition to supplement its global CX business. Simply acquiring more call center is no longer reaping exponential dividends as non-linear growth is only possible when embracing AI, automaton and digital workers.

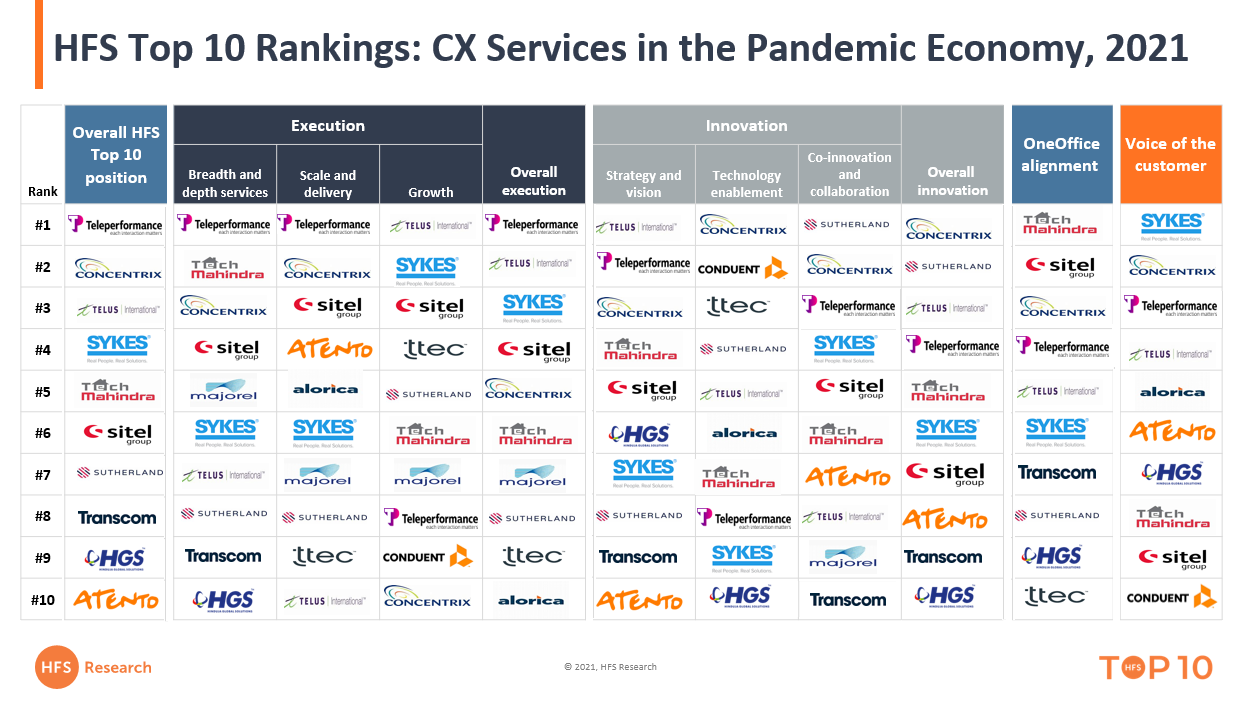

So let’s check out the 2021 rankings (download report here), which clearly show which providers kept the wheels of customer services moving throughout the Pandemic and get the insights from the report’s lead analyst, Melissa O’Brien…

Melissa – what on earth happened to the CX services industry over the last year and a half? Was it pandemonium? What worked and what didn’t?

There has been a considerable boom in CX services in the past 18 months. This market was already in the midst of a significant revolution, and the pandemic forced a lot of changes and accelerated decision-making that had stagnated. As with every other industry, the most significant change was the end of resistance to work from home. The contact center providers we covered in this report largely succeeded in the shift to work from home and made it work really well, much to many of their clients’ surprise. What made the difference is that WFH was an already established and fast-growing business model in CX services, representing almost a quarter of FTEs in January 2020. A year and a half into almost entirely remote work, many enterprises say they’ll never go back to brick-and-mortar — in fact, most we spoke to said they don’t care whether agents go back to the office and will leave that decision up to the BPOs.

But there are dynamics at play in the contact center that will even out the WFH balance over the next year. The CX services providers have long known that employee experience (EX) is king, and employee engagement does not work the same in a remote environment, especially for particular demographics and geographies. Service providers reported lower attrition and absenteeism levels in the early stages of remote work. These have gradually increased as people lose patience and crave the engagement of working in the center (many of which were explicitly designed to attract and delight employees.) So while we don’t expect office staffing to go back to pre-pandemic levels (on average, providers said that 2022 will be a 50/50 split), the agent engagement aspect, which ultimately drives customer service excellence, will end up dragging a lot of operations back to the center.

The other big change was an acceleration of the adoption of digital tools – with all the disruptions in staffing and unpredictable volume fluctuations, digital associates (i.e., intelligent chatbots and IVRs) also had their burning platform in the past year and a half. But we also saw this interesting paradox: while volume volatility significantly increased the adoption of digital assistants, there was also a tremendous demand for traditional voice (human-based) interaction. The CX services industry now has an increasingly difficult challenge of balancing the right blend of digital and human interactions in a volatile pandemic environment. Enterprises now rely on their service provider partners more than ever to help them find the right balance and differentiate through a dual focus on employee and customer experience.

So who came out on top – and were there any specific examples of heroism/failure along the way?

On the execution side we see the “usual suspects,” the big boys like Teleperformance and Concentrix flexing their brawn with the global scale and breadth of services that many of the other providers can’t hold a candle. They are tops as far as robust global operations models, sheer breadth of delivery locations, and process consistency. So while shuffling work around and getting capacity sorted out was by no means an easy task, these guys are the ultimate pros.

Then you have the innovation leaders. As in the past, we were struck with Sutherland’s co-innovation and design capabilities but this time they were utilized to help clients get through this difficult time. We were impressed with how much proprietary technology Conduent is using in its service delivery, including a COVID-19 outbreak management tool. We also have new criteria for OneOffice alignment where Tech Mahindra and Sitel came out on top, demonstrating the pillars of OneOffice, including collaboration and internal transformation.

“Voice of the customer” was a tight category because virtually all the customers we spoke to were really pleased with their providers, particularly their ability to shift to remote work with minimal disruption. The pandemic separated the haves from the have nots in this market. Those that were just making their foray into work from home grappled with the shift. But firms that had made significant investments significant prior, particularly in the cloud, security, and remote employee engagement, were able to mobilize the work from home environment faster. SYKES stood on the tremendous foundation that is 2016 Alpine Access (a pure-play work from home platform) afforded it as an advantage of being WFH experts.

Of course, there were hiccups along the way which the providers largely were quick to course correct. Poor call quality as a result of inconsistent connectivity in certain geographies was the most frequent issue we heard from customers and was often resolved by pivoting calls to chats and sometimes by sending out 5G devices to augment agents’ internet. Analytics and engagement tools played a huge role in ensuring process adherence but, more importantly employee health and well-being. There were some examples of heroism for sure, particularly as these firms empowered employees to deliver on CX in spaces directly impacted by the pandemic – think of all the interactions fraught with real customer distress and anxiety in industries like healthcare and financial services during a global public health and humanitarian crisis.

We’re now seeing a lot of consolidation in the space, and while we expect the usual “just buy more call center” attitude from some, I am hearing that we may see some actual consolidation across the IT services / CX services space. Does this make sense to you? I thought the IT services firms were eager to offload their call ctr business in the past?

Yes, many IT services firms were eager to offload or de-emphasize these capabilities in the past due to their reputation as low-margin services anchored by labor arbitrage and mired in low-value interactions. But now, there’s a paradigm shift reversing this trend. As enterprises increasingly adopt a OneOffice mindset, barriers are breaking down between IT and business with ‘experience’ as a common goal. The leading and most serious CX services firms have known for a long while that having a holistic and technology-enabled capability including design, software development, etc. is required to have a value proposition beyond commoditized contact center services, even if it meant cannibalization of traditional business process revenues. Providers’ investment and focus have been very real and largely organic, but adoption from clients is still tepid – and it’s very hard for these firms to differentiate when literally each of them has a flavor of “digital contact center” offering. Close to 3/4 of the 50+ enterprises we spoke to as references for this study said they are not using their CX service provider for any technology or innovative solutions, opting for pure operations delivery. One CX executive put it well: “It’s not that the CX partners don’t have the capabilities, it’s that the enterprises are not open to using them. The number one problem is perception… I can’t convince my CTO to look at (a CX services provider) the same way she looks at a technology services provider or vendor.”

So, as much as we’ve seen some IT services firms bulking up their CX capability for a more holistic value proposition, I think we’ll see it happening on the other side too with the serious CX services firms buying their way into the IT side of the house — for example, Telus International’s acquisition of IT services firm Xavient. These kinds of moves will help to bridge both the perception and capability gap.

In your view, Melissa, what should CX leaders do to be effective in this hybrid work / business environment?

Firstly, have a relentless and continuously evolving focus on EX. The top providers know very well how important EX is to delivering quality CX services. The required expertise will inevitably change hybrid remote and WFH emerges, and as automation and self-service continue to take a bigger piece of the customer interaction pie. Well-designed CX and well-trained customer service agents are always going to be a part of the equation. Plus, the labor market is changing. There are pockets of staffing shortages, employee expectations have shifted, and gig work is going to be an even bigger part of the workforce of the future; all this demands an ongoing re-evaluation of how to recruit, onboard, train, retain and motivate people.

My second piece of advice is related to the first because people today care a lot about the values and philosophy of the companies they choose to work for. “Profit with a purpose” is becoming a mantra in our business environment, and it’s more than paying lip service to ‘feel good’ causes; so be very clear about what you stand for as a firm and take bold action to ensure you live these values. CX Services providers traditionally have awesome CSR programs that involve employees from the bottom-up; allowing employees to choose what programs to donate time and money to has been a staple of the top providers’ strategy to attract and retain talent. But this is becoming a bigger part of retaining and winning new business also. CX buyers have always cared about how their partners approached ESG efforts but are now devising ways to measure and assess potential providers in the RFP process. Diversity and inclusion are at the very top of the list, and sustainability is catching up. We saw some awesome examples of how CX services companies and clients are partnering to jointly address ESG initiatives. Bottom line, CX executives will not buy from firms that don’t share their core values beyond revenues and profit, and act upon them.

Posted in : Business Process Outsourcing (BPO), Customer-Engagement, customer-experience-management, OneOffice