Visa and Mastercard just escalated the war for the future of commerce—not with another app, but with autonomous AI agents that buy on your behalf.

These aren’t lab experiments. Visa’s Intelligent Commerce and Mastercard’s Agent Pay are foundational shifts designed to embed payments into AI platforms that consumers already trust.

The implications for enterprise marketing are nothing short of seismic, and the following class of applications is under threat:

- Ecommerce platforms like Adobe Commerce, Shopify, and Salesforce as AI agents bypass frontends entirely by making decisions and completing purchases autonomously.

- SaaS tools for behavioral analytics and personalized product recommendations (e.g., Dynamic Yield, Monetate, Nosto)

- SaaS Billing (e.g., Zuora, Stripe Billing), subscription, and replenishment platforms (e.g., Amazon Subscribe & Save, Olist, Recharge)

- Loyalty apps and digital wallet integrations

- Creates a serious rival to Apple Pay

Commerce Is Becoming Agentic—and SaaS Is Losing Its Grip

Visa integrates tokenized payments into agents OpenAI, Microsoft, and Anthropic developed. Mastercard is launching Agent Pay to handle secure transactions via AI, using a system of agentic tokens to verify trust and authorization. These aren’t front-end bells and whistles—they are backend rails designed to replace the shopping cart, the e-wallet, and potentially the SaaS commerce stack itself.

Forget clicking, browsing, or tapping. Tomorrow’s consumers can offload their entire shopping experience to trusted AI agents: searching, choosing, transacting.

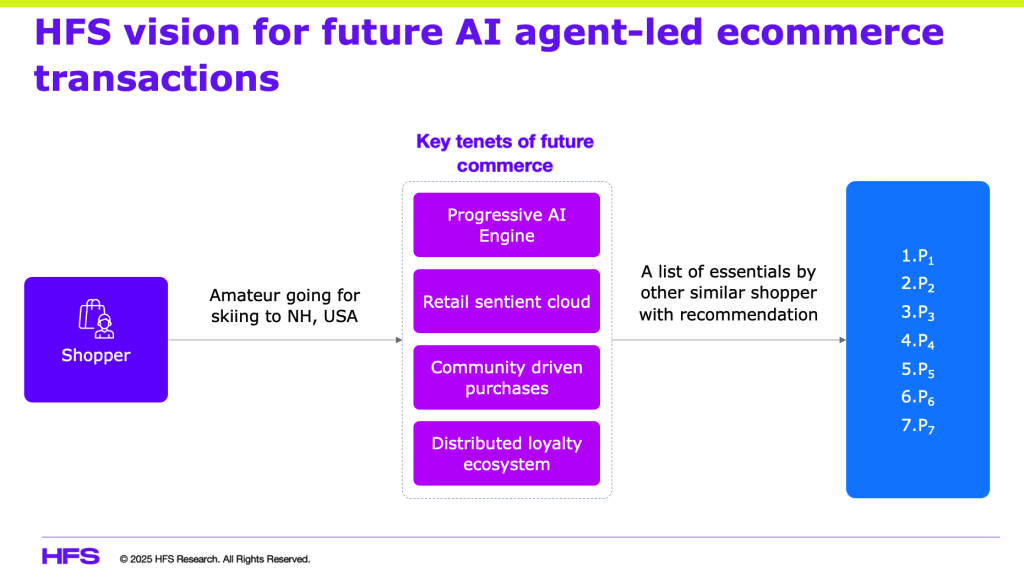

Six months ago, we at HFS outlined precisely this vision (see our previous POV, “Reimagining e-commerce with AI: the dawn of interactive commerce“), emphasizing AI-driven personalization, real-time recommendations, and autonomous purchasing as the future of digital commerce (see below). These recent moves by Visa and Mastercard directly support that bold prediction.

We’ve Been Here Before—But This Time, the Tech Can Deliver

Skepticism is warranted. We’ve seen overhyped commerce experiments flop before. Voice commerce flatlined. Chatbots collapsed under their own UX failures. Even Amazon’s Dash Buttons died quietly, abandoned by customers who preferred frictionless app-based buying.

But generative AI isn’t Alexa. Today’s GPT-class agents don’t just react—they reason, personalize, and adapt to individual behaviors in real-time. Visa and Mastercard are embedding commerce into agents consumers trust—Microsoft Copilot, OpenAI’s ChatGPT—and are not trying to build new destinations. The Apple Pay strategy is reborn but with an intelligence layer on top.

Trust Is the New Commerce Interface

Here’s the rub: none of this works if enterprises don’t aggressively confront the trust equation. Consumers will not adopt agentic commerce if transactions feel opaque or risky. Visa and Mastercard offer spending limits, granular controls, and advanced fraud protection—but enterprise leaders can’t outsource this responsibility.

Enterprise leaders must now ask:

- How do we expose our catalog, pricing, and inventory to AI agents?

- How will we audit and verify agent-led purchases?

- What is our liability if an agent misfires?

Failing to answer these questions risks marginalization. In a world where AI agents filter and finalize purchases, invisibility equals irrelevance.

Enterprise Leaders Must Act Now to Stay in the Game

Don’t wait for agentic commerce to go mainstream. The fundamental shift in how platforms manage transactions and data flows is underway. The new power brokers—Visa, Mastercard, OpenAI, Microsoft—are building commerce ecosystems where SaaS apps and digital storefronts may no longer be the primary interface.

Enterprise leaders must:

- Pilot AI-agent exposure: Experiment with exposing products to agent ecosystems (e.g., integrating with GPT plugins or Microsoft Copilot).

- Design for machine-first buying: Rethink UX, metadata, and taxonomy to serve AI agents—not humans.

- Double down on trust infrastructure: Build transparency, consent, and explainability into every touchpoint—because the agent is now the user.

Bottom Line: AI agents are not another channel—they are a new species of consumer. Enterprise commerce leaders must prepare for a world where decisions are outsourced to autonomous systems, not influenced by UX or loyalty programs.

Enterprises must build trust into every AI-agent interaction because, without transparency and control, agent-led commerce dies before it scales. The winners will be those who operationalize agentic commerce today—exposing product data, managing liability, and building trust before Visa and Mastercard become the invisible middlemen behind every transaction. Waiting means disappearing from the decision-making process entirely…

Posted in : Agentic AI, GenAI