Month: January 2022

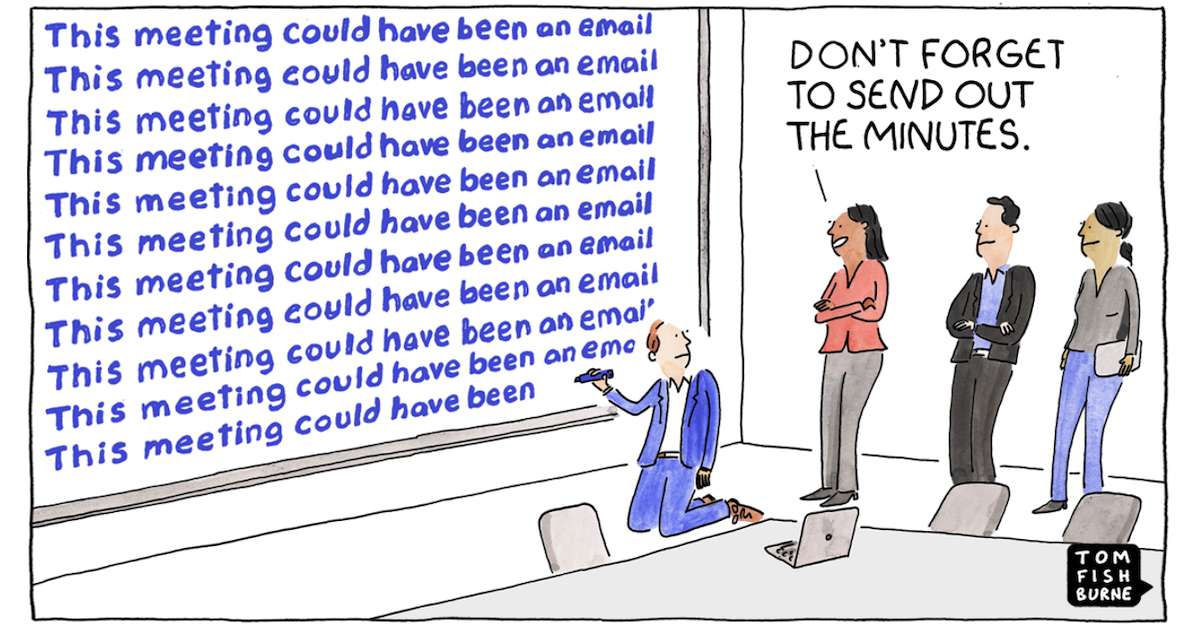

You must adapt for the future of work, folks

The future of work is right here!Read More

Accenture, Infosys, TCS, Wipro, and LTI electrify the HFS Energy Top 10

I sat down with Josh Matthews, Practice Leader and the author of this report, to learn about the experiences and insights he gained working on the 2021 HFS Energy Top 10.Read More

One must-have New Year’s Resolution…

It's 2022... let's not repeat 2021!Read More