Month: January 2019

Time to tune in to Tapati!

Tapati Bandopadhyay joins HFS research to lead our India research operations and expand coverage of AI and IT servicesRead More

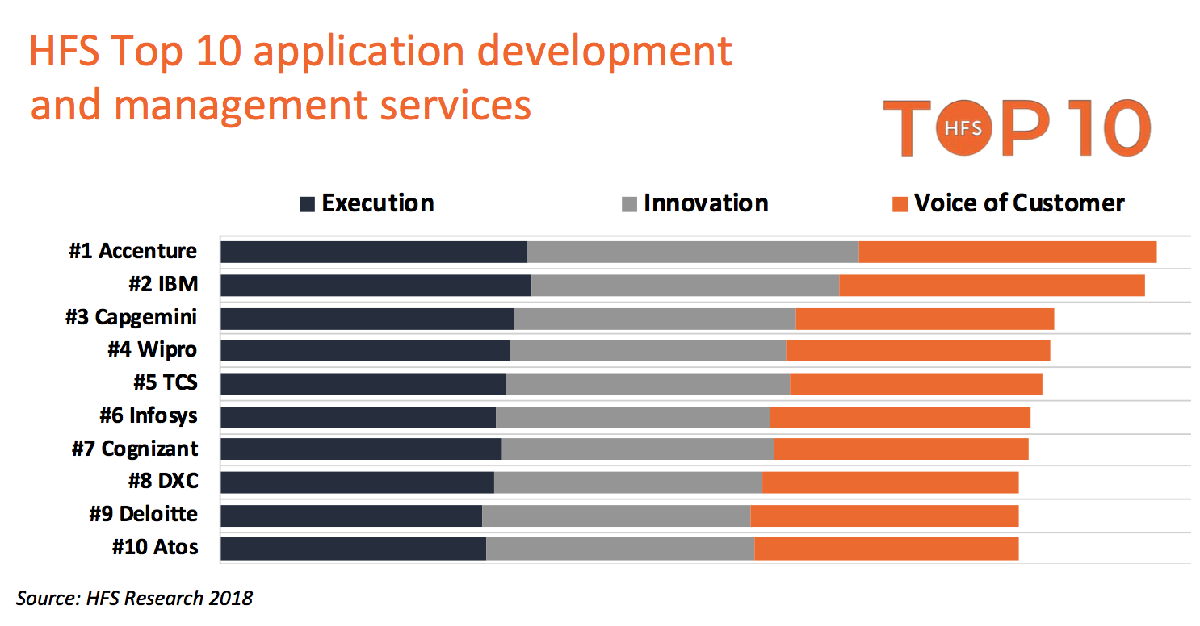

Accenture, IBM, Capgemini and Wipro lead the first application services Top 10

This Top 10 research is based on interviews with 300 enterprise clients of IT services from the Global 2000Read More