Day: May 1, 2010

As Healthcare payors face up to seismic change, can outsourcing provide answers?

Unlike medical product manufacturers and pharmaceutical companies’ industries, healthcare reform will absolutely transform the healthcare payor industry. Mandated medical loss ratios, state-run insurance exchanges, guaranteed coverage, and required purchase requirements will restructure the payor’s business models. The trickle-down impact on operations will be significant, shifting priorities in a manner that will eventually impact outsourcing priorities.Read More

Do you know how good or bad your processes are?

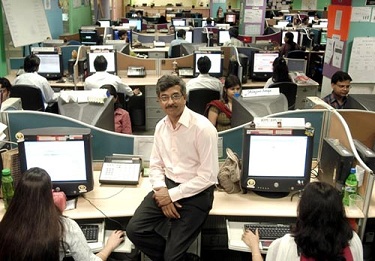

As I deconstruct the recording of our interview with Genpact's President and CEO Pramod Bhasin, one factor keeps springing out of the discussion, that makes me realize how far today's organizations have to go, before they can truly claim they are satisfied that they are maximizing their potential: Most companies can’t tell you how good or bad their business processes are. Read More