With the paranoia of an impending Double-Dip Recession seemingly forever looming over us, what better than to help your clients get their bills paid?

With competition in Finance and Accounting Business Process Outsourcing (F&A BPO) reaching cut-throat levels (just observe some recent down-select negotiations and you’ll know what I’m talking about), what better than to acquire one of the most attractive onshore order-to-cash (OTC) specialists? With demand for comprehensive F&A BPO coming from both mid-sized, in addition to enterprise-level clients, what better than to acquire an OTC specialist with on-the-ground delivery expertise and a mid-market offering?

Our only surprise at HfS is that is took so long for one of the top tier BPOs to make this move – acquiring the 45-year old heritage accounts receivables and order-to-cash specialist, Vengroff Williams and Associates. A provider steeped in blue-chip clients at the enterprise level, such as Disney, General Electric, News Corp, Microsoft and Tyco, in addition to a raft of mid-sized clients such as Elizabeth Arden, U-Haul, Crescent Healthcare and Office Depot. A provider that has resisted the temptation to develop offshore delivery and focus on smart onshore services. A provider that has developed its own excellent SaaS proprietary order-to-cash technology platform, WebCollect. A provider with an annual client get-together called the “Billion Dollar Forum”, that you just have to go to, as its the closest thing you’ll ever get to feeling like a billionaire…

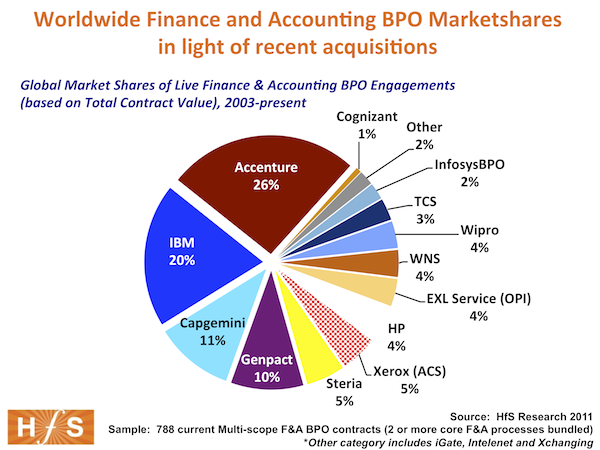

Yes, Capgemini has made a major move towards strengthening its position in the global F&A BPO market by today acquiring VWA – and leaping to third in the market share spot for F&A globally (which may change when we re-cast our data early next year, but for now they’re on podium). You can also read more about our 2011 F&A BPO market landscape and outlook by clicking here.

We believe VWA was one of the few remaining jewels that the major BPOs needed to take a serious look at to bolster their presence and capabilities in order-to-cash. Here is what they are adding to Capgemini’s global BPO business:

Positives of the acquisition

Expands Capgemini’s US onshore presence. Capgemini has traditionally been very strong as an International BPO provider – especially with its European and Asian presence, but has perennially been perceived as lagging in the US, despite having made delivery investments in regions such as Junction City, Kansas. VWA’s addition immediately solves this issue – and actually transforms the US region into a strength for the Capgemini, especially in light of its strong nearshore LatAm presence, with significant investments in countries such as Brazil and Guatemala to help service US clients;

The merger is a good cultural fit. The two firms have been working together on client engagements for some time, and know each other well. Moreover, VWA has a strong employee ownership culture and didn’t take this decision lightly – they wanted their own staff to ratify the deal. Several other potential acquirers have taken a good look at them and this “fit” was not nearly as strong;

Accounts Receivable BPO is booming and Capgemini is now firmly in the game. HfS is observing this market as topping $35bn this year and too many of the existing BPO providers have relied on subcontracting specialists (such as VWA) to provide the AR BPO services. By owning the process, Capgemini is in a significant positon of strength to price deals more aggressively and has more client exposure and capability to explore outcome pricing options. Plus, Capgemini can also go after standalone AR BPO deals and leverage its global presence to be very competitive in this market. Too many of the current crop of F&A BPO engagements have been dominated by accounts payable processes, and this added capability gives Capgemini the chops to go after deals aggressively with heavy OTC components;

VWA brings to the table a quality order-to-cash business platform called “WebCollect“. We believe WebCollect can really help both new and existing clients standardize on quality standard workflows, which our research is abundantly demonstrating is where much of the future of BPO is headed.

VWA’s business takes Capgemini into the middle-market. With saturation occuring at the high-end of the market, attention is turning to the middle-market (the $500m-$3 billion segment), where clients are frequently seeking “bigger-bang” and more comprehensive deals that the top tier providers can comfortably cater. Our recent State of Outsourcing industry study shows the increasing relevance of the middle-market to BPO services areas such as F&A.

This year, Capgemini has BPO as a top-tier service line which will help it capitalize on the acquisition. Rather than submerging BPO as a secondary service line under ITO, which some other service providers persist in doing, Capgemini’s BPO division now enjoys status as a major front-line services category in its own right. While this brings increased financial scrutiny from the board, it also empowers the division to get access to similar sales, marketing and development funds as those enjoyed by other top-line services divisions, such as consulting and IT services. This added marketing muscle will be critical for branding the VWA capabilities, as they are fully merged into the broader BPO division.

Potential challenges posed by the acquisition

Capgemini’s brand in the US. With all roads traditionally leading to Paris, this has been somewhat of a perennial weakness for Capgemini, when competing for US-centric BPO deals. However, major client wins in recent years, such as Coca Cola Enterprises and Avon Products have done a lot to increase awareness and exposure in the US market. Capgemini needs to leverage VWA carefully to improve further the awareness of its significant onshore US presence and brand awareness as an F&A BPO provider.

Too much focus on horizontals versus verticals. With Capgemini’s increasing strengths in F&A, procurement, supply chain and customer management BPO, the firm does run the risk of losing focus in some of the emerging vertical BPO markets, for example banking, insurance, life sciences, healthcare and energy. Capgemini needs to figure out how to develop and position its vertical strengths effectively and not become overly submerged in a horizontal play.

Potential conflicts with existing engagements. VWA is present as primary OTC “subcontractor” on engagements where Capgemini’s competitors are the primary F&A BPO supplier. This could create some contentious issues with regarding to working relationships and contract renewals. However, it could also put Capgemini in the unique position of potentially edging out some of its primary BPO competitors, so this could ultimately provide more opportunities than headaches.

The Bottom-line: this is a very smart acquisition by Capgemini

VWA fills many of the needs Capgemini has as an emerging F&A BPO powerhouse. There aren’t too many BPO acquisitions that appear to be as solid a fit as VWA into Capgemini, and the market for AR BPO is critical for future growth in this space. The next challenge for all BPOs is going to be creating more utility in the market to take on more clients, and the WebCollect platform has great potential to provide a platform this growth. HfS would like to see Capgemini embrace WebCollect and develop it over time to cater for clients with specific vertical requirements, for example in the retail space versus hi-tech and media.

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Finance and Accounting, Procurement and Supply Chain, SaaS, PaaS, IaaS and BPaaS

Excellent article! This is a very good move by Capgemini. Vengroff is a respected brand and their Webcollect tool will add a lot of value to Capgemini’s clients moving forward,

Kieran

Phil,

Do you expect more acquisitions like this in F&A, as a reaction this?

Len Travis

Len,

I’d be surprised if we see anything immediate. Most of the BPOs are looking to acquire vertical platforms and industry capabilities, as opposed to horizontal capabilities. I believe we’ll see them looking to invest in large clients engagements that give them added scale, platform and process flow than make outright acquisitions of other providers (such as the recent TCS/Friends Life deal). Why? because it’s far, far cheaper to “buy” client deals at low margin, that pay the multiples on expensive providers, which may not bring much to the table beyond a lot more location and people scale.

PF

[…] OPI, Genpact with Headstrong, Accenture with Ariba services, Cognizant with CoreLogic and Capgemini with VWA). Given the greater stickiness of relationships on the BPO side, this will be a critical component […]

[…] Capgemini is increasing its overall global footprint. For example, last month Capgemini acquired Vengroff Williams and Associates to expand both its US presence and its share of the finance and accounting outsourcing market. […]

[…] saw through this and acquired IBX to bolster its procurement capability – and more recently VWA in accounting. Other Procurement BPO service providers white label their technology to keep their […]

[…] saw through this and acquired IBX to bolster its procurement capability – and more recently VWA in accounting. Other Procurement BPO service providers white label their technology to keep their […]

[…] compared to its competitors in the BPO arena, Xerox has slipped further from the top tier into the middle of the bunch since the Xerox buy-out. Accenture and Infosys’ recent quarters featured increases of at least […]

[…] are adding platform capability in process niches, such as Accenture/Octagon, Genpact/Jawood, Capgemini/VWA and Infosys/McCamish, we’re yet to see any of them really attack the mid-market with […]