The energy industry is experiencing multiple competing fundamental transitions and market forces that threaten to cannibalize many energy providers out of existence:

The political mandates (or attempted mandates) to move more aggressively from fossil fuels to renewable energy, to have broader sustainability across value chains;

The adoption of digital capabilities to connect organizations and pubic sector bodies across energy ecosystems to stay relevant;

The economic double-shock effects of the pandemic and the oil price crash forcing a dual CAPEX/OPEX crisis;

M&A and divestment activity, questions over what to do with existing assets, and a continuing need to drive efficiencies throughout operations.

Technology service providers catering to the requirements of the energy industry need to balance multiple competing and interlinked priorities. One, they must have a pulse on the industry shifts. Two, they must strategically align their roadmaps to align to these shifts and solve the business challenges that stem from the global context. Three, they should focus on solutions, services, and innovations throughout the value chain—working with the wider partnership ecosystems of providers.

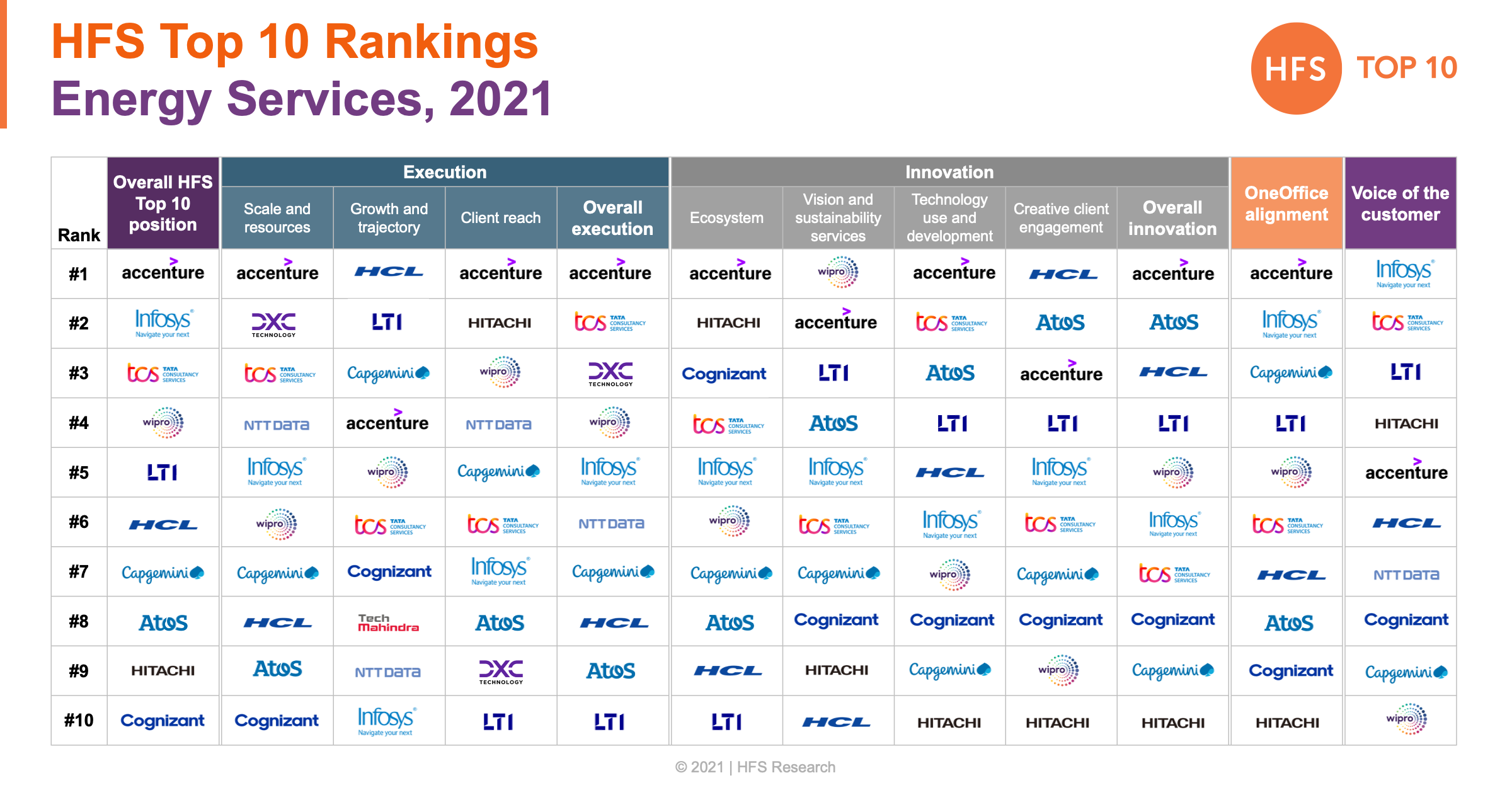

To this end, it’s been exciting for us to publish the 2021 HFS Energy Top 10 to provide a comprehensive assessment of the energy industry and its leading business and technology service providers across execution, innovation, and client feedback.

I sat down with Josh Matthews, our Practice Leader for sustainability and energy strategies – and recently returned from COP26 – to learn about the experiences and insights he gained working on the new research.

To download a copy of the report, please click here.

Phil Fersht, CEO and Chief Analyst, HFS Research: The 2021 HFS Energy Top 10 provides a comprehensive look at the energy industry services value chain. What changes or shifts did the pandemic put in motion?

Josh Matthews, Practice Leader, HFS Research: Demand is increasing across the energy industry value chain, as are the headcounts, revenues, and sustainability services capabilities of the providers in this report.

The fastest growth in demand is for upstream (exploration and production), refining, and retail and marketing services. There is standout growth for upstream asset and data management, refining emissions management, refining process control tech, and market repositioning strategy from oil and gas to energy. This mirrors the overwhelming dominance of the energy transition throughout this study; however, the competing industry demands are borne out in an increase in demand across the value chain for technology and business process services.

Phil: What were your biggest learnings from this research, Josh?

Josh: Both energy firms and their service providers need to balance the energy transition and the multiple, competing, interlinked transitions. They must meticulously align their roadmaps to outcomes, solving business challenges that stem from the global context. Underpinning these outcomes must be focused services and technology throughout the value chain—working with providers’ partnership ecosystems.

Some providers have inherent advantages by being part of enormous conglomerates with deep history and operating expertise in the energy (and utilities) industry; however, independent providers are countering this with their own vast ecosystems. Access to capability is less of a barrier; rather, it’s how clearly you position your unique capability in a market that at times can sound very monotone.

Phil: So, Josh, which service providers are at the top of the list, and why are they there?

Josh: Accenture, Infosys, TCS, Wipro, and LTI top the overall list. The ability to execute and capability with emerging technologies are now just licenses to play. These providers have a vision for balancing all the competing industry demands I highlighted, with sustainability services in particular, and they have standout ambition and scale. A few other notable mentions are Atos and HCL’s innovation initiatives and client engagement, Hitachi Vantara’s ecosystem and voice of the customer, and Capgemini’s growth and alignment with the HFS OneOffice™ vision.

- #1 Accenture is unmatched in terms of the resources it has for execution and innovation. It backs up its resources with an exceptional voice of the customer and OneOffice alignment—overcoming some of its past challenges to be a frontrunner across all categories. It is leading in the sustainability services ecosystem, which, combined with a meticulous industry focus, means Accenture is well-placed to set the pace as the energy industry transitions away from oil and gas.

- #2 Infosys’ customers blew us away (frequently). Its historical brand image of delivery is complemented by consulting, innovation, and sustainability capability, as proven in its case studies and reference clients. Every corner of the market may not know it yet—but Infosys will be one of the frontrunners in the sustainability services charge over the coming years, both in the energy industry where it has a deep history and further afield.

- #3 TCS plays with the best in terms of scale, innovation, and R&D investments. Its combination of engineering and proprietary solutions with a vast range of emerging technologies fits well with impressive internal talent initiatives and all-around industry expertise. Like many “delivery powerhouse” providers, TCS is proving that it has integrated consulting and sustainability capability across the company.

- #4 Wipro’s narrative and clarity of focus give new life to its strengths in IT services and industry-specific capability—in some part built on a new operating model that gives it fresh alignment across the company and with the HFS OneOffice vision. Sustainability outcomes are embedded in many of its engagements, and Wipro knows exactly what its role is in the energy transition, but at the same time, it has a broad range of capabilities across the whole value chain.

- #5 LTI talks in a level of depth about the energy industry like no other provider (I’ve worked there myself—LTI will have no trouble engaging with management or plant operators). LTI simultaneously has an impressive partnership portfolio and a clear view of how its parent company, L&T, has expertise LTI can leverage. A focus in part on carbon capture and storage solutions puts LTI apart from most participants in this study.

Phil: Josh, was there anything that surprised you in this study?

Josh: The extent to which sustainability is becoming embedded in energy industry engagements across the value chain—but to say there’s more to do is an understatement, Phil!

There are still frightening amounts of money being thrown into coal, oil, and gas; there needs to be urgency in everything that touches climate change, and the transition can’t happen without energy firms on board. Trust needs to be re-established by the material action of oil and gas firms. They need to be clear on the good and the bad if they’ll ever re-earn the trust of the public and politicians.

Bad actions don’t cancel out the good of renewables investments, but there’s work to do when those investments are still a small fraction of fossil fuel investments. There are global disparities in attitudes to the energy transition, and regardless of what happens at COP26 this November or whether the general optimism about the Biden administration proves valid, there will be a disparity for some time.

Phil: Are there any interesting trends you spotted in your conversations with customers?

Josh: Global differences in oil and gas firms’ narratives to the energy transition (investments aren’t always exactly matched) present a fundamental split.

One group presents a narrative that fossil fuels’ time is more limited (with regulation and customer perceptions shifting), and those firms are transitioning more quickly toward renewable energy. The second group pitches an acceptance of the role of fossil fuels in the global economy for decades to come and is transitioning more heavily to natural gas, banking on carbon capture, storage, and utilization (CCSU) with some level of renewables investments now and planned in the future.

But I suppose, at the very least, to have every firm talking about the transition as if it’s a given is a small step compared to where we have been very recently. But also, I’m nowhere near giving any of these energy firms a gold star.

Phil: How do you think the energy market will evolve over the next 12 to 18 months?

Josh: The pressure on energy firms to disclose their transition plans away from fossil fuels will only increase—as will scrutiny of their actions that do not align with what we all know needs to happen. It remains to be seen how much COP26 will drive this. I did leave Glasgow with both optimism and the bitter aftertaste that we’re already way too late in transitioning and dealing with climate change for so many.

Phil: How did the recent gas crisis in the UK occur, Josh, and can we expect similar crises to impact global markets in the coming months as we deal with this fractured business environment?

Josh: A classic case of it being a number of factors, Phil: Demand for energy is booming as economies restart “post”-pandemic; less-than-ideal weather conditions for renewable energies like low winds and droughts (hampering wind and hydropower) is highlighting the lack of sufficient investment in renewable energy (especially to meet net-zero targets); low levels of European gas storage and supply crunch from Russia add to the problem. Wholesale prices have skyrocketed – at times roughly doubling – which has seen many firms (mainly smaller firms) go out of business in the UK due in part to a government price cap meaning they cannot account by raising the cost to the end consumer – despite that price cap rising. This is not going away anytime soon and is affecting every industry. Put this alongside supply chain chaos (and prices, for example, the cost of shipping container space) that doesn’t have an end in sight (although some out there with a microscope apparently see signs of improvement), and high (relatively to times over the past few years) oil prices at around $80 for a barrel of Brent. Governments and firms across sectors need to secure themselves against such shocks, diversify supply chains and build stores, and ensure their roadmaps layout the journey from here to net-zero and beyond. One sentence makes it seem rather simplistic, doesn’t it…

Phil: What are you looking forward to in terms of developments in the energy industry for 2022?

Josh: I really hope to maintain my optimism that the industry can change and be a part of the global effort against climate change. The more current behavior persists, the harder that will be—even with the investments currently going into the transition.

Part of my optimism lies with the service providers in this Top 10 report. I look forward to working with them in both energy and sustainability contexts to help them help their energy clients make some desperately needed strides forward.

Phil: Well let’s pray your optimism for the sector stays true during these unpredictable and uncertain times, Josh! Thanks for your time

HFS premium subscribers can click here to download our new Top 10 Report: The 2021 HFS Energy Top 10

Posted in : Digital Transformation, Energy