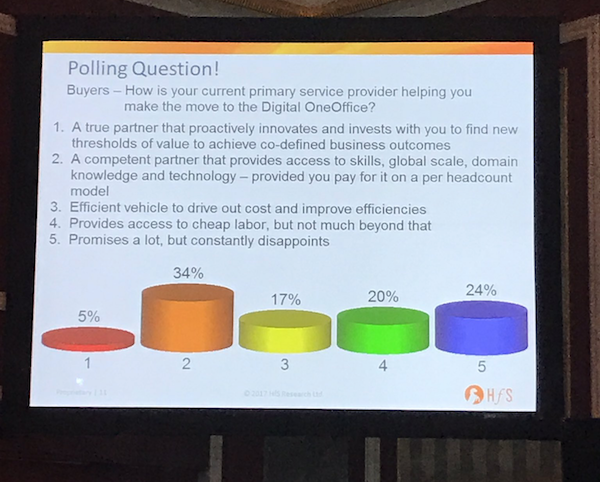

Oh dear – here are the private views of about 60 outsourcing clients we polled today at the HfS Summit in New York. Close to half the room are either feeling let down by their provider over-promising, or merely feel they are only really getting cheap labor from their relationship. Moreover, barely a third of them actually believe their provider can come up with the goods, provided they pay for them via the legacy FTE pricing model. Now, these buyers are highly experienced and sophisticated, so this data is particularly hard for the outsourcing industry to digest.

So a few simple takeaways from this:

Service providers have to stop the over-promising and start over-delivering. Over-promising may result in some short-term wins, but the implications of long-term damage caused by missing client expectations are much more hazardous. Sadly, investor pressures to sustain unrealistic growth is forcing several service providers to over-sell without the talent resources to deliver anything beyond low grade offshore delivery.

Many providers are proving their competency, but failing as proactive co-innovators. As we recently revealed, a third of senior management does see real potential in their service providers to become genuine co-innovation partners, but there is a stark difference between fantasy and reality. Providers need to prove they are willing to share risks, really roll up their sleeves with their clients – and clients need to work harder to create an environment of trust that they’ll stick with their providers, provided they are willing to co-invest with them. Design Thinking anyone? Maybe it’s time to get in a room together and figure this whole thing out.

Bottom-line: We’re going to see a lot of chopping and changing of service providers in this volatile environment.

Several buyers cited they felt their providers were too comfortable with them and were not worried they would get ejected from long-term outsourcing relationships. However, with advisors, competitive providers and RPA vendors all touting the magic 40% of cost savings through automation, the leadership layers are exerting unprecedented pressures on outsourcing governance leads to demand change. In many cases, buyers are simply bringing in advisors and RPA tools vendors themselves and running their own pilots, but eventually, they are likely to put their existing deals out for rebid to find providers willing to guarantee the RPA savings. And that is where the market is going – lots of cut-throat rebids, higher degrees of risk-taking to win business and more clients being over-promised. We’re in a vicious cycle where desperation is trumping good, pragmatic partnerships where both buyers and providers can figure out how to work together in trusted, risk/reward sharing environments.

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services

I’m not surprised with those results Phil. Over the past 18 months the Sourcing Industry Group (SIG) has periodically polled its Members/Guests on the topic of value. Two-thirds (2/3) of the respondents selected responses 3 & 4, see below. Lots of opportunity to improve value realization with an enormous amount of money being left on the table….

“Are you getting the business value you either originally contracted for or need today from your enterprise’s portfolio of sourcing relationships?”

1.) Absolutely, we’re getting the value we need across all of our relationships. 2.) In some of our relationships, especially the most critical.

3.) Only in a few of our relationships, we could do much better.

4.) I’m unsure or no!

The net…. there’s lots of opportunity to improve value realization with an enormous amount of money being left on the table….

Matt

This is pretty much expected as the major India based outsourcers are not able to come out of a mindset of labor arbitrage based value proposition. Most of the outcome based conversation is more vapor and sales ware than actual implementable solutions.

Phil – There is also a flip side here – clients also need to be receptive and eager to open their doors for new innovations which BPM providers are suggesting. Providers are willing to creep into a cost savings based “risk model” but Not always everyone is open to grab that..this has to be agreed from both the sides in a real manner..where both the parties commit to a gain share model wrapped by a committed volume projections…

I think the survey should also attempt to capture the efforts taken by customer in engaging the service providers in a strategic manner. Customers typically have T&M contracts with suppliers and micro-manage at task level. Most leading IT companies in India have invested in Digital and other R&D capabilities globally. There are some interesting output coming of these partnerships and investments as well. However, the customer should not engage in staff-augmentation model and expect to hear thought leadership from these suppliers.