This October, the Affordable Care Act is poised to disrupt the healthcare industry in seismic fashion, whereupon the entire world of the healthcare payers will be turned on its head:

*The traditional B2B model is switching to a B2C model: Payers now now have to cater for millions of individuals, in addition to thousands of companies with “cookie-cutter” solutions. In effect, they now have to sell to, market to and manage consumers, in addition to their traditional corporate clients.

*Health plans must now being priced very, very differently differently: The only variable inputs will be age, geography, family size, and tobacco use, while past history will and pre-existing conditions will no longer be taken into account. Millions of new people will be entering the health insurance market, with vastly increased regulation on how payers ‘ revenues can be allocated.

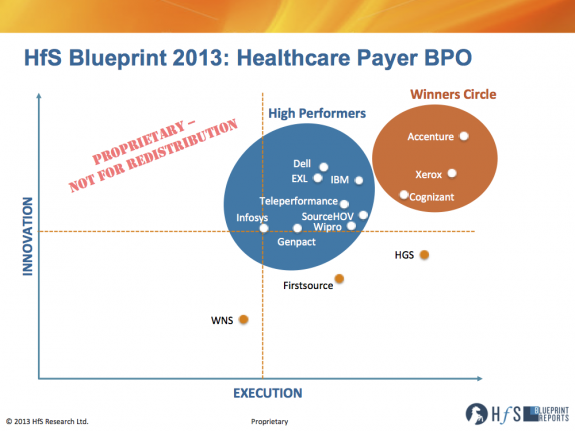

This will matter for everyone – service providers, buyers, and pretty much anyone living in the United States. These reforms will affect the healthcare payers the most, as they seek to cope with the monumental challenges needed to improve product operations, engage with the customer differently, optimize processes, and contain not only administrative costs, but medical costs too. The three service providers that we found best placed currently to service the healthcare payers are Accenture, Xerox, and Cognizant:

The Healthcare Payer Blueprint utilizes our Blueprint Methodology, which measures both execution and innovation against a set of crowdsourced criteria derived from the State of the Outsourcing Survey 2013. We assessed data from over 155 live multi-process healthcare payor BPO engagements to ascertain provider market shares, depth of client base, breath of execution and geographic scope of delivery. We examined the healthcare payer value chain (claims, service, marketing and sales, medical management, etc.) and interlaced what we know will be important to Healthcare Payers in the dramatically evolving healthcare industry with the capabilities and vision of the service providers in our assessment.

Our analyst team conducted exhaustive interviews with multiple buyers and market advisors to help score providers against each other across all the sub-categories of the Blueprint using ExpertChoice, an advanced statistical analytics platform. We also received a tremendous amount of cooperation from (almost) all of the providers above, as we went through this exhaustive process to understand their concrete plans for the future, get really deep with their current client relationships, their overall vision and their appetite to evolve and invest into higher-value areas of Healthcare Payer BPO.

HfS Subscribers can download their full copy of the 2013 Healthcare Payer Competitive Analysis Blueprint

Posted in : Business Process Outsourcing (BPO), Healthcare and Outsourcing, HfS Blueprint Results, HfSResearch.com Homepage

Adam,

This is a great overview of the providers. Credit to you and the HfS team for a timely piece of work,

Don

Good analysis. Agree with these positions.

Paul McDonough

Interesting methodology. Can you elaborate on the constituents of “innovation” and “execution”?

John Gibson

Agree with John.

Adam, interesting point of view. Would love to understand the same.

Hi John and Tomas,

Sure, we breakdown execution and innovation in the following way:

Execution:

1. Quality of Customer Relationships

2. Real World Delivery of Solutions and Delivery of Each Sub-Process

3. Geographic Footprint and Scale

4. Usefulness of Services to Specific Clients Needs

5. Flexibility in Pricing

Innovation:

1. Vision for End-to-End Process Lifecycle

2. Vision for Industry Specific Solutions

3. Ability to Leverage External Value Drivers

We then compare and contrast the different vendors against the above criteria to determine the scoring / positioning for the HfS Blueprint.

Hope that helps! If you have any other questions, please feel free to contact me at: [email protected]

Best,

Adam